Ah, dear reader! You have stumbled upon the US Morning Briefing—your trusty vessel navigating the tempestuous seas of crypto news.

Pour yourself a warm brew as we unravel the audacious predictions of Standard Chartered, professing that XRP may soon leap over Ethereum like a fanciful hare outpacing a slumbering tortoise. Not to forget the grand metamorphosis of Tether as it flirts with institutional players, all while titans like BlackRock and the Federal Reserve bluff and bluster—a drama waiting to unfold!

Standard Chartered Proclaims: XRP on the Cusp of Greatness, Ethereum Beware by 2028

In the grand theatre of global trade tensions, Standard Chartered discerns a glimmer for crypto investors, beckoning them to gaze at the horizon for long-term victors amidst the chaos.

“Oh, the cacophony of tariffs opens a portal for those with a discerning eye to uncover lasting value in the Digital Assets landscape! Today, we shall crown XRP among our champions (while BTC and AVAX bask in glory, ETH receives the dubious title of the unlucky). XRP, in its splendid role as a global currency ambassador, is experiencing volumes that rise as if blessed by the gods. By the year 2028, behold! XRP’s market cap shall surpass that of Ethereum, securing its place as the second mightiest non-stablecoin asset. A call to arms for HODLers!” quoth Geoff Kendrick, a sage voice from Standard Chartered.

Our soothsayer Kendrick points to Bitcoin’s endurance as an omen of the market’s future escapades.

“The turbulent tariff tempest shall soon settle, and Bitcoin’s courageous performance amid the bedlam heralds a grand ascent for the crypto realm.”

Furthermore, he elaborates upon XRP’s recent triumphs:

“XRP soared six-fold in the two months following Trump’s entrance to the political arena, a stunning dance among the top fifteen crypto performers. Market expectations swirled, anticipating the SEC’s retreat from its legal skirmish with Ripple, while dreams of XRP ETFs emerged under fresh regulatory winds.”

And let us not overlook Ripple’s bold purchase of Hidden Road, a fleeting $1.25 billion love affair to enhance institutional services.

Yet, Kendrick insists that these gains stem not from mere political whims, but from solid fundamental shifts driving XRP forward.

“These burgeoning successes are here to stay, not solely due to SEC shuffles but thanks to XRP’s unique position as the digital asset facilitating efficient cross-border transactions. A similarity emerges! XRPL stands shoulder to shoulder with stablecoins like Tether, both embodying the growing need for financial transactions powered by the blockchain—unlike the slow-footed TradFi giants. This stablecoin dance has waltzed 50% higher each year for the last two, and we forecast a tenfold increase in stablecoin transactions by the dawn of the next four years. A joyous sign for XRPL’s throughput!”

Tether’s Daring Gambit: A Stablecoin for the Stalwart US Market

As the march of institutional adoption gains momentum, Tether’s audacious strategy to unveil a stablecoin tailored for the US market could mark a pivotal moment for these digital assets—and propel cryptos into the mainstream!

Charles Wayn, co-founder of the mystifying Web3 super-app Galxe, exclaimed to BeInCrypto:

“The revelation of Tether’s institutional-grade stablecoin for the US market is nothing short of splendid for our crypto universe! Tether, having birthed the stablecoin phenomenon eons ago in 2014, now sees its beloved USDT, the third-largest cryptocurrency in existence. Despite USDT’s checkered history with audits—a persistent enigma—it remains the crown jewel among stablecoins, boasting a mighty market cap of over $144 billion, dwarfing USDC’s modest $60 billion.”

Wayn believes this move, alongside Tether’s quest for transparency, positions the company as a future beacon of institutional crypto adoption.

“Thus, this strategic maneuver, coupled with Tether’s aspiration for an audit by a Big Four firm, indicates a willingness to embrace compliance and ascend as a leader on the institutional front. While USDT faced a rebuff under the EU’s MiCA, we anticipate this new creation will comply with upcoming US regulations.”

He further asserts that the swelling tide of institutional momentum—bolstered by titans like BlackRock—presents a defining juncture for stablecoins and the broader market.

“One cannot doubt that USDT will toil diligently to launch its innovation in good time. As we witness colossal entities like BlackRock joyfully diving deeper into the crypto pool, with a recent Bitcoin buy worth $66 million, the surge in institutional participation is undeniable!”

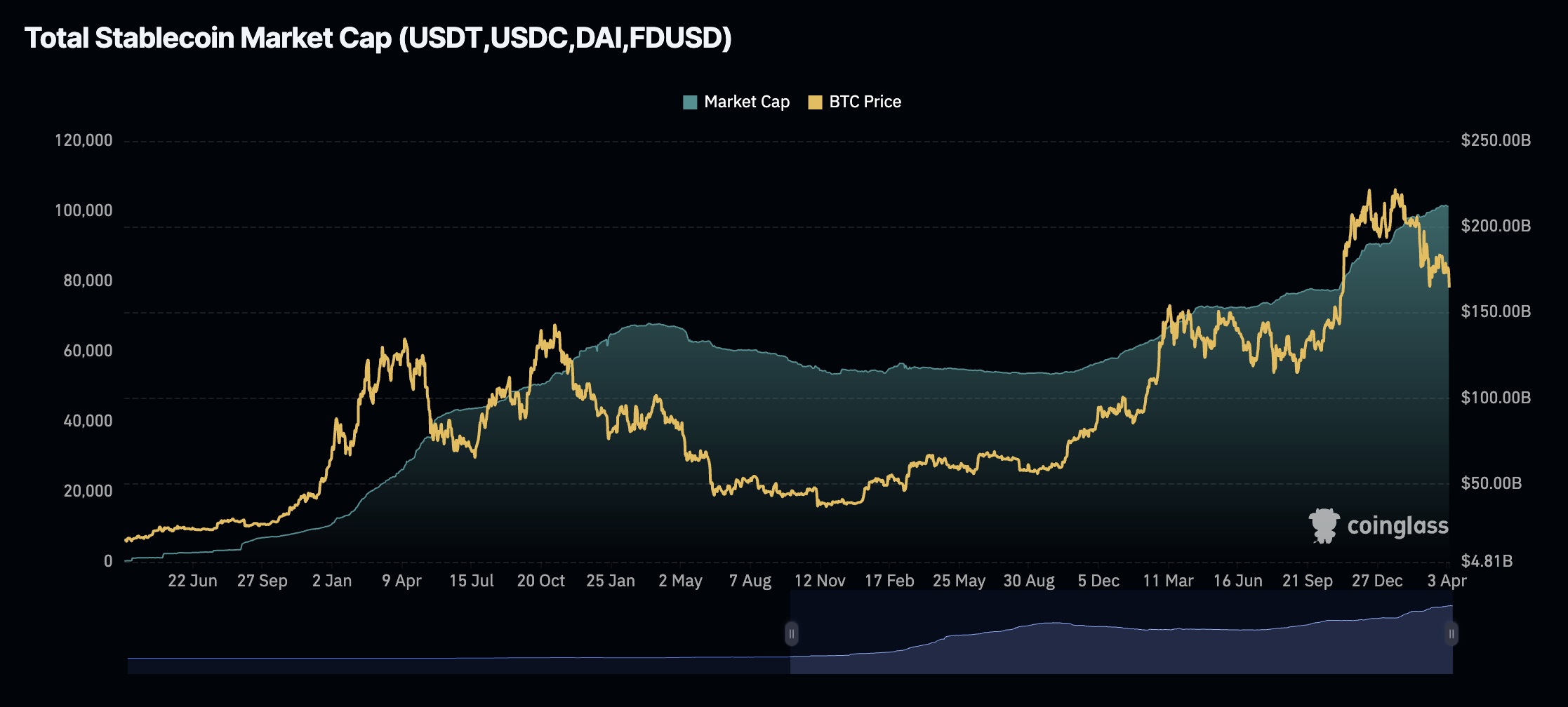

The Crypto Chart of the Day: A Symphonic Display

Ah, stablecoins currently bask in the splendid glow of their market cap, approaching another peak at $210 billion!

Bytes of Brilliant Insight

– Analysts whisper that a return to Quantitative Easing in 2025 could ignite an exuberant crypto rally, perhaps catapulting Bitcoin to the illustrious $1 million mark while altcoins twirl in glee.

– Alas! No inflows into Bitcoin ETFs and waning interest in futures signal a flicker of waning confidence, though the rise of put contracts and perky funding rates hint at a cautious optimism percolating beneath.

– Galaxy Digital has completed its dance with the SEC, securing permission to metamorphose toward a dazzling Nasdaq listing in May 2025—resurrecting confidence in crypto amidst a more agreeable US policy landscape.

– Behold! Binance Research reveals that during tariff seasons, RWA tokens boldly outperform Bitcoin, challenging its role as a stalwart diversification asset.

– MicroStrategy, in a moment of profound reflection, paused its grand Bitcoin buying spree last week, facing an impressive $5.91 billion in unrealized losses—cue the cautionary tales of liquidity and debt.

– And in a world painted by uncertainty, potential Fed rate cuts may just breathe invigorating life into the crypto expanse, while skeptics like Larry Fink linger in the shadows!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- LINK PREDICTION. LINK cryptocurrency

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

2025-04-08 18:34