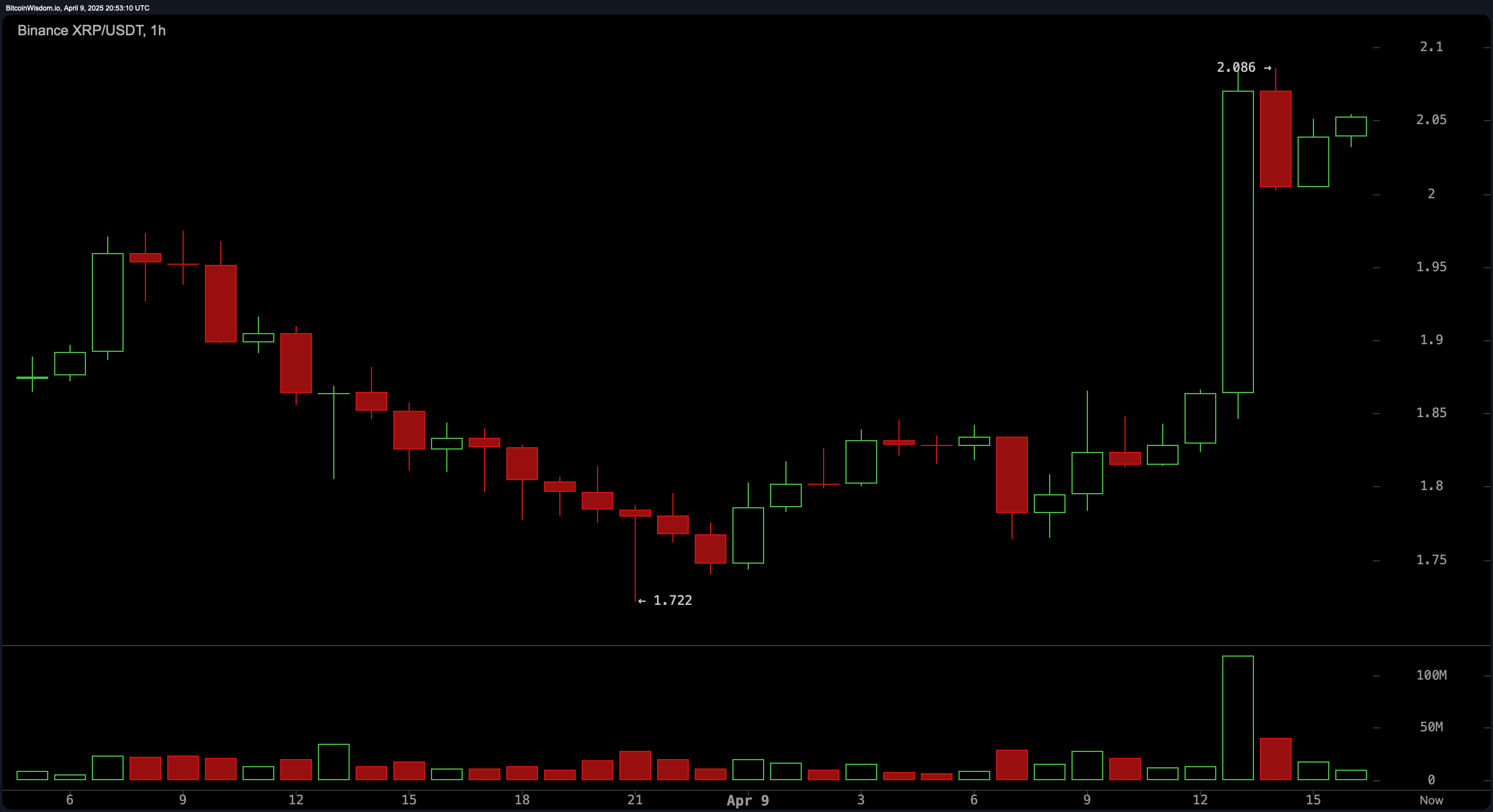

On April 9, 2025, XRP’s valuation stood at $2.07, a number that seemed to mock the chaos of the market. With a 24-hour turnover of $8.12 billion and a market cap of $121 billion, it was as if the coin itself was laughing at the traders who dared to predict its next move. The day’s oscillation between $1.73 and $2.086 was a testament to the absurdity of it all.

XRP

On the 1-hour chart, XRP’s impulsive rally was followed by a period of consolidation, as if it were catching its breath after a wild sprint. The breach above $1.85 to $2.086 was accompanied by a surge in trading activity, as if the market itself were gasping for air. The $2.00 to $2.05 range has become a battleground, with traders treating it as a temporary foothold. For those with a penchant for intraday strategies, this zone might as well be a trampoline for bullish continuation patterns—assuming XRP doesn’t trip over its own feet. The $2.15 to $2.20 resistance looms like a dark cloud, offering a tantalizing take-profit target for the brave (or foolish).

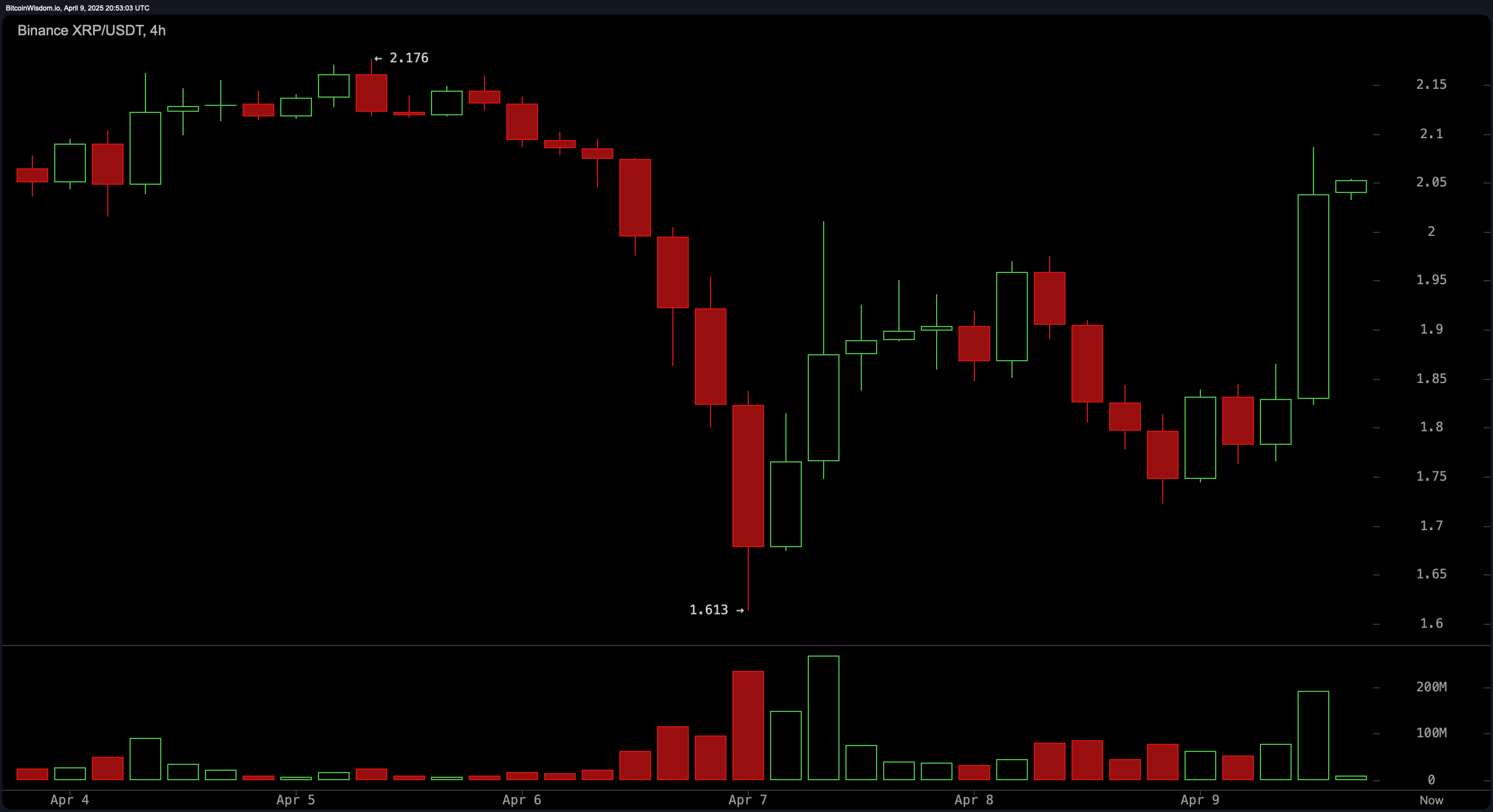

The 4-hour chart paints a broader picture of recovery, with XRP clawing its way back from the $1.61 abyss to levels above $2.05. The succession of green candlesticks and significant volume inflows suggests a shift in sentiment, as if the market were finally waking up from a long, dark slumber. The $2.18 resistance, marked by recurring upper wick rejections, remains a formidable foe. A decisive breach above $2.05 to $2.10 could open the door to the $2.20 region, while support near $1.95 offers a safety net for the cautious.

On the daily chart, XRP’s bullish reversal is as dramatic as a Dostoevsky novel. The recovery from the $1.61 low hints at a blend of short-covering and renewed buying enthusiasm, as if the market were finally finding its soul. Resistance between $2.10 and $2.20 stands like a moral dilemma, while a close beyond this range could signal a true awakening. Price objectives in the event of sustained progress could stretch into the $2.45 to $2.60 territory, though an inability to hold above $2.00 might reveal the rally as a cruel joke.

Oscillator metrics are as indecisive as a man torn between love and despair. The RSI at 44.98, the Stochastic at 36.68, the CCI at −91.57, the ADX at 23.34, and the awesome oscillator at −0.28 all suggest a phase of ambivalence. The momentum (10) indicator offers a glimmer of hope with a buy signal, but the MACD at −0.113 whispers of longer-term uncertainty.

Moving averages (MAs) are a mixed bag of hope and despair. The 10-day EMA and SMA signal buy opportunities at $2.027 and $2.024, respectively, but all subsequent moving averages from 20-day to 100-day intervals scream of negativity. The 200-day EMA at $1.948 and the 200-day SMA at $1.859 offer a flicker of optimism, as if the price has finally found its moral compass. Yet, the contrast between short-term hope and mid-term skepticism is as stark as the duality of man.

Bull Verdict:

If XRP sustains a daily close above $2.15 with continued volume support, it could confirm a bullish reversal, propelling the price toward the $2.45–$2.60 range. The confluence of short-term buying signals, a V-shaped recovery, and strong long-term moving average support highlights the potential for renewed upward momentum—or perhaps just another fleeting dream.

Bear Verdict:

Should XRP fail to break and hold above $2.15, particularly amid declining volume or repeated rejections at $2.20, the current move may be a short squeeze or bull trap. The predominance of negative signals across mid-term moving averages and neutral oscillators could point to a potential retest of the $1.95–$1.73 support zone—a descent into the abyss.

Read More

- How to use a Modifier in Wuthering Waves

- Mistfall Hunter Class Tier List

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- WIF PREDICTION. WIF cryptocurrency

- Basketball Zero Boombox & Music ID Codes – Roblox

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- SWORN Tier List – Best Weapons & Spells

2025-04-10 00:28