XRP, the cryptocurrency that has been making waves lately, is currently trading at $2.93, a 26% increase over the past week. However, on-chain data suggests that a short-term correction may be on the horizon.

A spike in whale transactions and rising exchange reserves are setting up conditions similar to past local tops, pointing to a possible 20% drop before the XRP price resumes its upward journey.

Exchange Reserves Signal Caution

XRP exchange reserves (Binance) have climbed to their highest level (2.96 billion) since January 2025, signaling potential selling pressure ahead. According to CryptoQuant, the last time reserves spiked this high was in May 2025, when XRP was priced around $2.54. That period was followed by a 20% correction, with the token falling to $2.01 over the following weeks.

Rising exchange reserves typically mean more tokens are being moved to exchanges; a setup often associated with upcoming sell-offs. The current trend mirrors that May peak, increasing the chances that a short-term cooldown in XRP price is coming.

Whale Transactions at 3-Month High

Supporting this thesis, XRP Whales making transactions over $1 million have surged to their highest level in three months. Historically, spikes in high-value transfers have preceded distribution phases and price corrections, where large holders offload their positions at local tops.

The timing of this metric aligns with the exchange reserve spike, adding weight to the bearish argument.

XRP Price Might Correct to $2.34

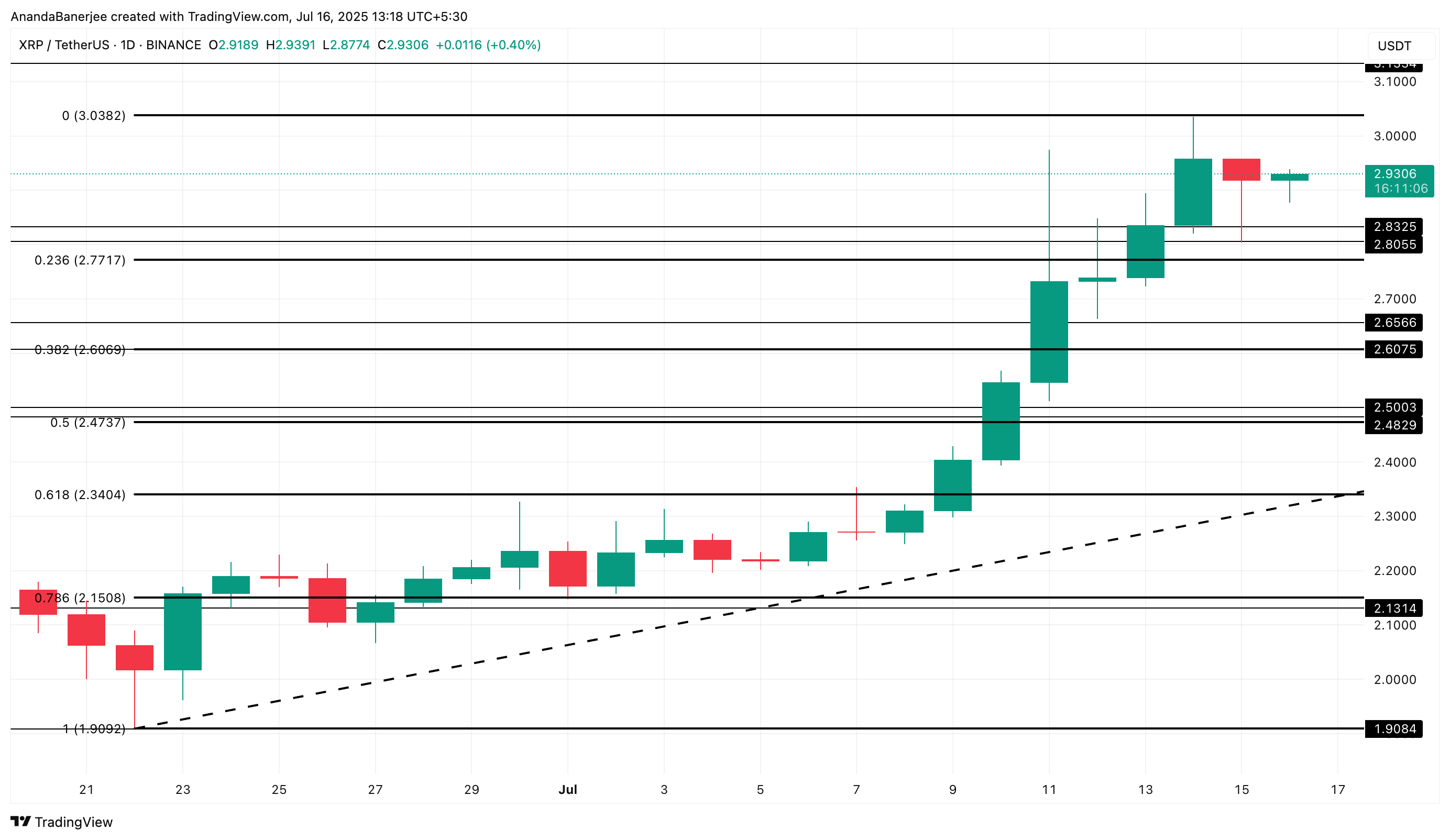

From a technical perspective, the latest move from $1.90 (swing low) to $3.03 (recent high) puts the 0.618 Fibonacci retracement level at $2.34; a critical zone that often acts as a magnet during consolidations or corrections.

A drop from the current XRP price of $2.93 to $2.34 would represent a 20% correction. This level is consistent with the May decline following a similar exchange reserve spike.

Immediate short-term support sits at $2.80 (the standard support line) and $2.77 (the 0.236 Fib level), levels which have provided footing during previous pullbacks. A break below these could accelerate downside momentum toward the $2.34 Fibonacci level.

This bearish scenario would be invalidated if XRP holds above $2.77 while exchange reserves begin to decline. This would indicate renewed accumulation rather than distribution.

If the token maintains this support and XRP Whales stop offloading, the bullish momentum could resume. And that could potentially push the XRP price back toward retesting the $3.03 level, a critical area in the ongoing XRP news cycle.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

2025-07-16 14:16