If there’s anything more volatile than my willpower near a plate of free donuts, it’s the cryptocurrency market—specifically, in recent times, the darling disaster that is XRP. Following a market crash that made my portfolio look like a poorly managed Monopoly game, sentiment has shifted, at least according to the good folks at Santiment. BTC is sauntering cockily toward $100k, memes are flying thick and fast, and the mood has gone from despair to greed so abruptly, I half-expected the Ghost of Christmas Yet to Come to appear with some ETF prospectus under his arm.

Which brings us to XRP, the coin that can’t stop, won’t stop—unless of course you expect it to, in which case it’ll do exactly the opposite. The gossipy excitement swirling around Ripple ETFs in the US has reached fever-pitch, with traders breathlessly whispering that “all-time highs” might be just around the corner. Of course, if crypto markets were capable of listening, they’d probably nod, say “sure, mate,” and promptly nosedive for dramatic effect. 😏

XRP to New ATH? (Insert Drumroll Here)

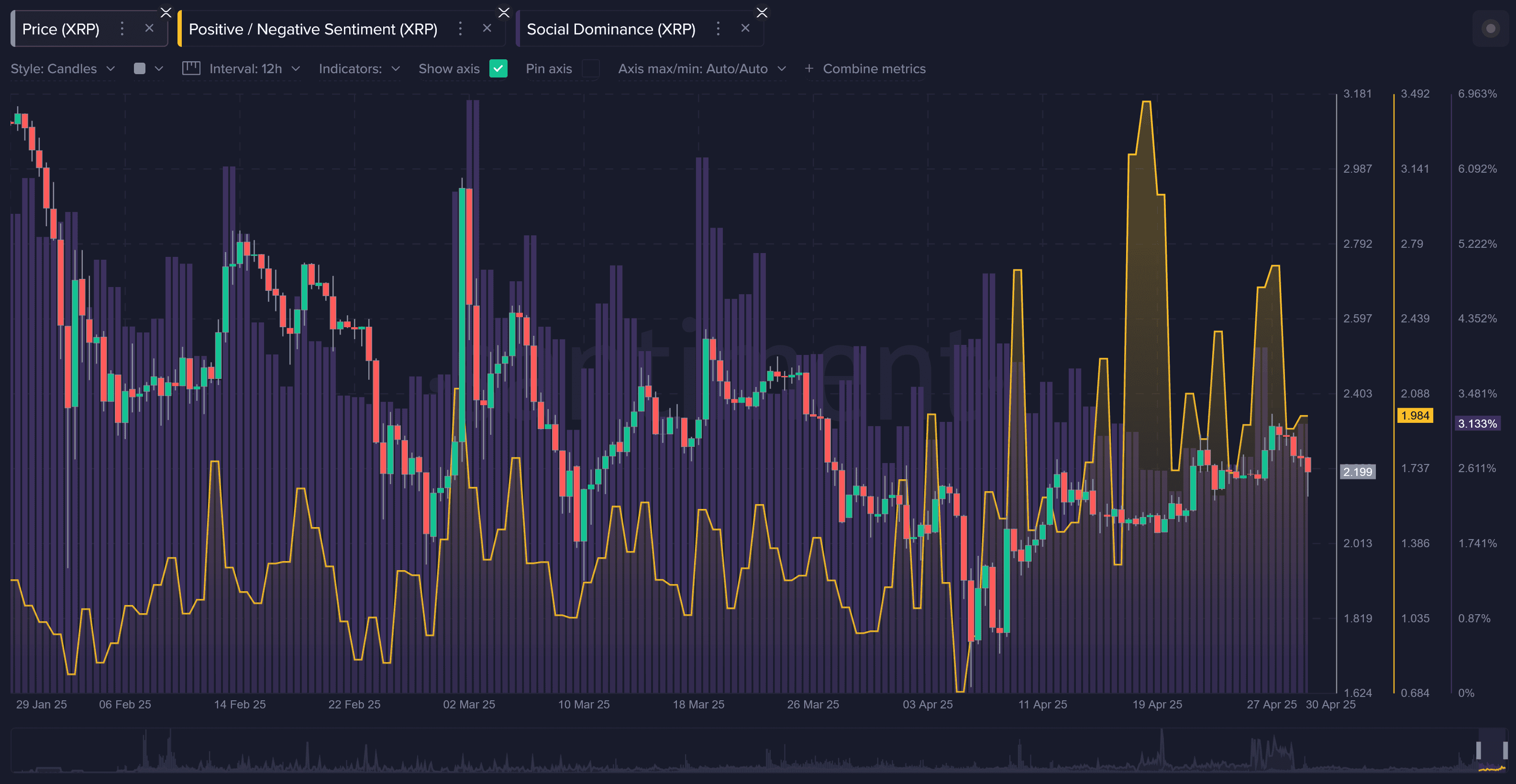

Now, post-US elections, there’s been a fresh wave of giddy optimism, mostly stemming from the belief that regulation is about to become less “ban hammer” and more “who wants an ETF?” XRP piggybacked on this joyride, surging from the basement bargain price of $0.6 up to a rather tantalizing $3.4. Cue the confetti!

Alas, even though Ripple’s CEO announced with the kind of glee usually reserved for lottery winners that their lawsuit was settled, XRP apparently decided to live in the “before” portrait of a weight-loss ad, slithering back down to just below pre-announcement levels. Sometimes, you throw a party and the guest of honor just naps through it. 🥳💤

With the lawsuit confetti now swept up, the XRP crowd has fixed their gaze on new possible gains—namely, that magical unicorn: a US-based Ripple ETF. Futures-based XRP ETFs got a thumbs up earlier, which means the crowd is now holding their collective breath (and probably several memes) for a spot ETF, rumored to be arriving any summer now. Santiment backs up this fever dream, even though the SEC seems intent on milking this cliffhanger, delaying Franklin Templeton’s ETF proposal just to add some extra spice. 🌶️

“…[T]he delay hasn’t shaken investor optimism. Many believe that, once approved, these ETFs could bring in large amounts of institutional money and push XRP into the financial mainstream.”

Still a Bullish Outlook (Seriously, They Swear)

You might imagine the XRP conversation has gone from party chatter to awkward silence, but according to Santiment, the bullish are now screaming their heads off—drowning out those few wet blanket bears muttering about fundamentals. The technical gnomes are also chiming in to say XRP is “on the edge of a major breakout,” which sounds exciting until you realize they say it about every coin, every week.

“With attention growing and more exposure on the way, many in the crypto space see XRP on the edge of a major breakout,” conclude the paper.

So, will XRP moon, or will it just take your money and run off to some quiet beach to sip piña coladas with Dogecoin? Tune in next week, reload your portfolio, and prep your next hot take—crypto never sleeps, and neither does the hype. 🚀🤷♂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- KPop Demon Hunters: Real Ages Revealed?!

2025-05-02 22:31