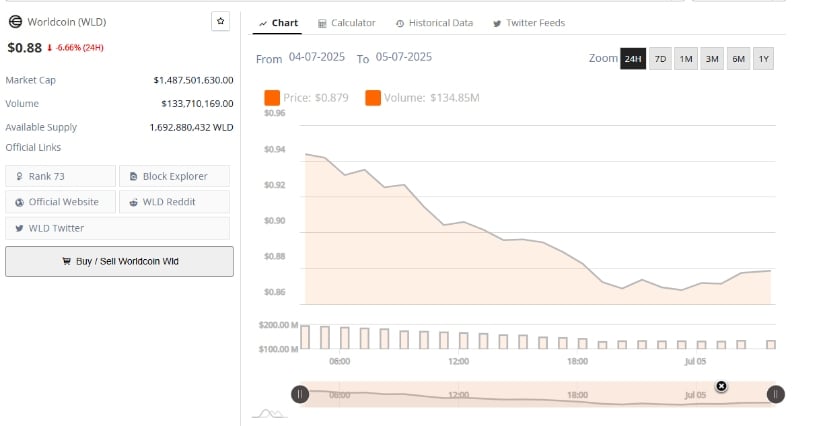

It was the best of times, it was the blurst of times, but mostly it was just short-term volatility, limp trading volume, and those momentum indicators your neighbor swears he understands but definitely doesn’t. As of July 5, 2025, Worldcoin (WLD) is performing its best impersonation of a dropped soufflé, landing with a splat at $0.88 after taking a nosedive faster than a panic-stricken Vogon faced with poetry.

Worldcoin Price Selling Pressure: Now With More Gloom! 🐻

Brave New Coin’s brave new data (possibly collected by mildly hungover robots) shows WLD plummeting 6.66% overnight, which is either apocalyptic or just market numerology at play. The price tumbled from approximately $0.94 to a low of $0.86 before wobbling back to the $0.88 mark, a move reminiscent of a drunken penguin attempting the cha-cha. Apparently, buyers were last seen peering anxiously at charts, clutching at straws, and Googling “How to stop a price slide, please help.”

Day traders coughed up $133.7 million in volume, which sounds impressive until you realize it’s shuffling awkwardly behind previous bullish periods where $150 million was the bare minimum for market enthusiasm. The low volume basically means everyone’s sitting on the fence, waiting for someone else to jump in the pool (then hoping it’s not empty). With 1.69 billion tokens floating around like ill-behaved rubber ducks, optimism is fragile, and if volume doesn’t pick up, so will the sound of sobbing from the WLD subreddit.

WLD Price Channel: As Narrow as a Bureaucrat’s Imagination 📉

If you ever wanted to watch numbers squeeze tighter than Arthur Dent’s schedule during spontaneous hyperspace jumps, the WLD/USDT daily chart is for you. The token now loiters at $0.877—awkwardly close to the Bollinger Band 20-day midline at $0.902, which is financial-speak for “it could go up, down, or just get bored and take a nap.”

Resistance sits crankily at $0.975, while support zones around $0.829 have so far told bears to “kindly bugger off.” In short, price is trapped tighter than Marvin’s social calendar, and the directional bias is as clear as a politician’s promise.

Meanwhile, the Awesome Oscillator—a name clearly chosen during a caffeinated brainstorming session—slumps at -0.080, red bars shrinking like the hope of anyone expecting a quick bullish reversal. Sellers appear to be running out of steam, but buyers seem equally uninspired. If WLD doesn’t crawl above $0.90 soon, we may see a heroic dive towards $0.829 or the ominous realms of $0.76—$0.70. Hitchhiker’s towels recommended.

Falling Wedge Breakout: Or “How I Learned to Stop Worrying and Love Chart Patterns” 📊

Crypto Joe, an analyst who likely dreams in candlesticks, uncovered a falling wedge pattern between June 10 and June 24—picture a downward-sloping tunnel out of which price wriggles like a stunned Betelgeusian worm. From $1.20 to just under $0.80, WLD squished itself into submission, then burst free—because, according to the ancient texts (and dozens of YouTube explainer videos), wedges like to break out when no one’s watching.

WLD zipped past the 50-period moving average, now standing guard around $0.896. Dynamic support, they call it, because “support that moves around a lot” doesn’t sound as cool at parties.

The celestial wedge pointed toward $1.04–$1.05, provided WLD danced above $0.90 without tripping. Crypto Joe watched the price approach $0.935 and briefly considered smiling. Bulls, however, are reminded that without enough volume and a solid defense of $0.90, the next leg up could dissolve faster than your attention span at a Vogon poetry reading.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-07-05 23:27