Will the Fed Ever Play Fair? Jobs, Bitcoin, and Political Chaos! 😂

Ah, the grand ballet of economic signals—may we all marvel at the subtlety of hope and despair intertwined like a bad soap opera. In May, U.S. jobs grew, but just enough to keep the Fed’s fingers twitching over the rate cuts—like a nervous gambler at a poker table, sneaking a peek at the dealer’s cards.

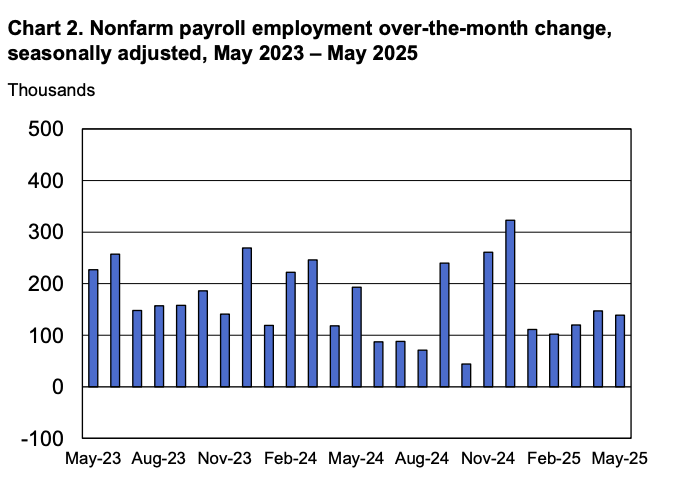

Despite the previous grand predictions, the so-called “crypto market” was more interested in watching paint dry than reacting to the numbers. On June 6, the number of new jobs added was 139,000—less than April’s 147,000, but still more than the forecasted 125,000 to 130,000. Logic? Who needs it! Meanwhile, the unemployment rate lingered at a cozy 4.2%, as if scared to drop lower and expose the nation’s fragile ego.

Interestingly, government jobs took a hit, losing 22,000—because nothing says “confidence” like firing bureaucrats! This shift might give private sector workers a moment of smug satisfaction, though it does little to excite Bitcoin bulls. If anything, these figures are about as bullish as a cat in a rainstorm, yet somehow, they didn’t cause the market to collapse into chaos—perhaps the crypto world has become immune to reality.

However, who really stole the show? The endless circus involving President Trump and Elon Musk—a tag team of chaos and memes! The political drama overshadowed employment figures like a bad sitcom. Meanwhile, the macroeconomic puppeteers continue to pull the strings behind the curtain, predicting Bitcoin’s fate like fortune-tellers with questionable crystal balls.

Bitcoin Traders Play the Waiting Game—Fed’s Next Move or Just a Bad Joke?

With the employment data fitting jeeringly into the expected box, the Federal Reserve will most likely remain cautious—probably more cautious than a cat walking across a keyboard. According to those wise sages at Bitfinex, the jobs report is a key piece of the puzzle guiding the Fed’s mysterious policy dance—more like a drunken shuffle than a waltz.

Good employment figures mean fewer reasons for the Fed to panic and cut rates faster than a politician dodges questions. Instead, they’ll focus on inflation—because what could possibly go wrong? The trade policies of Trump, Musk, and whoever else is vying for a spotlight, form the backdrop of this chaotic performance.

High interest rates might strengthen the dollar—great for those who love their greenback more than Bitcoin—while ETFs and crypto enthusiasts watch nervously, like tourists at a clown show. Still, the macro environment remains as stable as a house of cards in a hurricane, with reversals lurking behind every horizon. Perhaps even the Fed—those supposed masters of stability—are hesitant to commit to anything. Ah, the grand comedy of economic oversight! 🤡🚀

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Basketball Zero Boombox & Music ID Codes – Roblox

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- How to use a Modifier in Wuthering Waves

2025-06-06 18:10