Ah, the eternal dance of volatility—SEI’s price action has been more unpredictable than a cat deciding whether it wants to be petted. Yet beneath this chaos lies a glimmer of hope: growing investor confidence, as if everyone suddenly realized that blockchain isn’t just for buying pixelated apes 🐒.

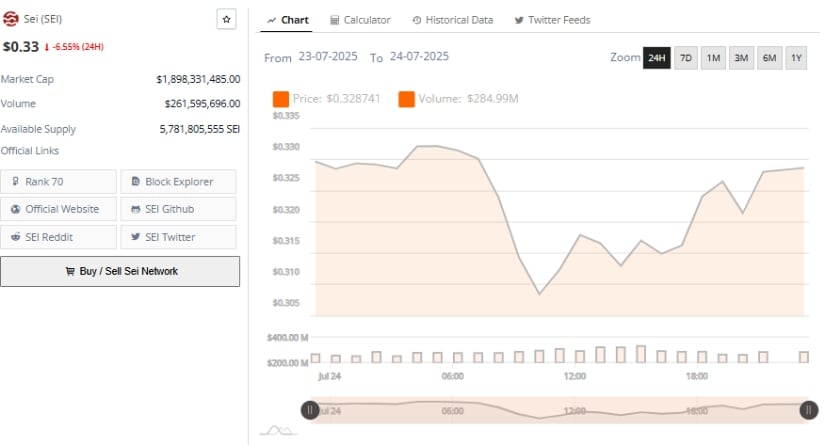

Behold! A “cup and handle” pattern is forming on the charts, signaling what some optimists call a “bullish breakout.” At the time of writing, SEI sits at $0.3273, having suffered a 6.55% daily decline. But fear not, dear reader; it continues to consolidate within an upward structure, like a stubborn climber refusing to descend from their mountain peak ⛰️.

TVL Growth: The Silent Hero of This Tale 🦸♂️

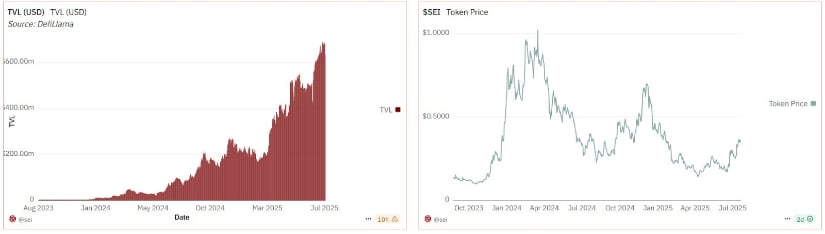

Let us now turn our gaze to Total Value Locked (TVL), which has risen dramatically—from under $20 million in early 2024 to nearly $600 million by July 2025. Analyst @DeFiDecoder_ shares a chart illustrating this ascent, making one wonder if TVL is secretly plotting world domination—or at least financial domination 💰.

This steady climb reflects long-term capital inflow and robust user engagement across DeFi protocols. It seems people are quite fond of Sei’s integration of stablecoins like USDC and USDY, along with its support for cross-chain retail payments. Who knew infrastructure could spark so much excitement? 🤔

Yet, despite these promising fundamentals, the price remains aloof, creating a bullish divergence often seen in maturing Layer 1 networks. Perhaps SEI is simply waiting for its moment in the spotlight, like an actor lingering backstage before taking a bow 🎭.

The Cup and Handle Saga: A Brewing Storm ☕➡️🍵

And now we arrive at the pièce de résistance—the cup and handle pattern. After peaking near $1.00 in early 2024, SEI embarked on a journey downward, forming a rounded base around $0.25 by mid-2025. Its recent recovery to $0.39 created the top of the “cup,” while the current retracement forms the “handle.” One can almost hear the market whispering, “Is this the calm before the storm?” 🌩️

Analysts eye the $0.33–$0.35 zone as critical. If the handle holds above $0.30 and volume picks up, prepare for fireworks—a potential rally toward $0.50. However, should the price fall below $0.30, the dream may shatter faster than a dropped porcelain teacup 🫖.

Momentum Indicators: The Voice of Reason 📉🤷♂️

At present, SEI trades at $0.3273, retreating from highs of $0.3903. The MACD (12, 26) whispers caution, crossing into negative territory with a histogram reading of -0.0036. Like a disapproving librarian, it signals fading upward momentum and hints at consolidation 📚.

Meanwhile, the Chaikin Money Flow (CMF) sits neutrally at 0.00, embodying the indecision of someone staring blankly at a restaurant menu. For a bullish breakout to materialize, CMF must rise above +0.10. Until then, SEI may wobble between $0.30 and $0.35, leaving traders to ponder whether they’re witnessing brilliance or mere mediocrity 🤷♀️.

In conclusion, SEI stands at a crossroads, much like a traveler choosing between two paths. Will it soar like an eagle or flutter like a confused pigeon? Only time—and perhaps a bit of luck—will tell 🕊️✨.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to watch the South Park Donald Trump PSA free online

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- 50 Goal Sound ID Codes for Blue Lock Rivals

2025-07-25 20:52