Nearly 19,300 Bitcoin option agreements are due for settlement this coming Friday, January 10th, which collectively represent approximately $1.8 billion in potential value.

This upcoming week’s occurrence resembles last week’s, and it didn’t influence the live markets at all. Over the past several days, Bitcoin has been on a decline after reaching numbers in the six figures for the first time.

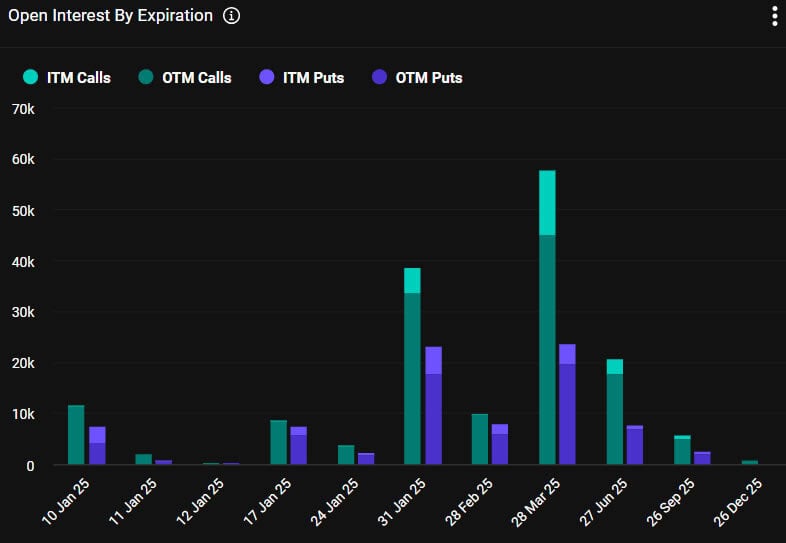

Bitcoin Options Expiry

This week’s batch of Bitcoin options is showing a higher number of long (call) contracts compared to short (put) contracts. The put/call ratio is currently 0.65, indicating this imbalance.

The most significant amount of open contracts for options expiration, currently standing at approximately $1.48 billion, is concentrated around the $120,000 strike price on Deribit. Additionally, there’s more than a billion dollars in open interest (OI) at both the $100,000 and $110,000 strike prices. It appears that speculators are generally optimistic, as they continue to maintain a bullish stance.

According to Greeks Live, a cryptocurrency derivatives provider, the short-term implied volatilities (IVs) showed a minor recovery but stayed at reduced rates this week. The market is currently predicting that future volatility will stay the same.

According to Deribit’s recent report, there isn’t as much enthusiasm in high-risk Bitcoin investments, compared to the early times when it surpassed the significant 6-figure threshold. The report also notes that trading futures is currently beneficial for those who anticipate a decrease in Bitcoin value (short positions or puts). However, it seems that more traders are still opting for options that predict an increase in Bitcoin’s value (calls).

140,000 Ethereum contracts are set to expire today, with a total worth of approximately $455 million. The put/call ratio for these contracts is 0.47. With the Bitcoin options expiring today added in, the total value of crypto options expiring on Friday will be roughly $2.2 billion.

Crypto Market Correction Deepens

The overall value of all cryptocurrencies has dropped by 4.4% today, currently standing at approximately $3.37 trillion. This decline might be due to speculation about the U.S. government potentially selling billions in Bitcoin. However, Bitcoin continues to stay within its established price range.

During early Asian trading hours on Friday, Bitcoin dropped as low as $91,250 but subsequently regained the $93,000 mark. Despite this recovery, it has experienced a further 2% decline over the last day and has decreased by approximately 9% since reaching over $100,000 on January 7.

The value is nearing the bottom limits of a flat trendline that started around mid-November, and it must maintain this position to avoid a significant drop on the downward side.

#BTC

Bitcoin has dwindled to pretty much the very bottom of its $91000-$101165 range

As a researcher studying cryptocurrency markets, I find it crucial to uphold the $91k level as a key support for Bitcoin (BTC), to prevent any additional decline and potentially extending this ongoing correction phase. #Crypto #Bitcoin

— Rekt Capital (@rektcapital) January 9, 2025

This Friday morning, Ethereum and various other cryptocurrencies experienced a drop in value as the downward trend due to concerns about U.S. inflation and uncertainty over possible sell-offs continued to intensify.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-10 09:52