In the dusty, endless plains of market uncertainty, Bitcoin stands like a tired cowboy, eyeing the horizon where fortune and folly collide. The price, like a restless horse, might just bolt into the wild blue yonder, possibly climbing to a staggering $143,000, if the stars align and the cups and handles play their part. Folks watch nervously, whispering about a supply squeeze that could make or break the whole shebang.

As of Tuesday, Bitcoin was trading at $109,860, a good 10% above its April lows and sporting a grin that says, “Hey, I’ve seen worse.” That’s fifty percent higher than this year’s bleak April lows—like a man’s mood lifting after a barroom punch. But don’t get your hopes too high; the market’s a tricky beast, and today’s bull can be tomorrow’s bear, especially if you’re not watching closely.

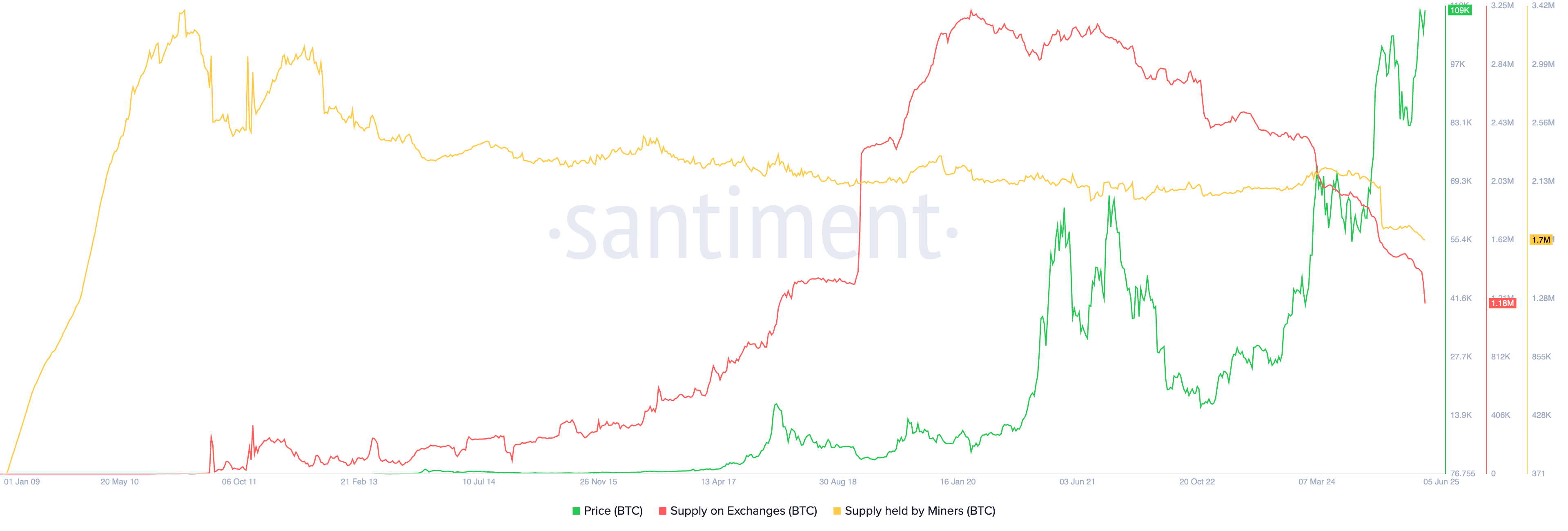

From the data of Santiment, it looks like folks are hoarding their coins tighter than a miser clutching his last penny. The amount of Bitcoin on the exchanges has plummeted to a mere 1.18 million—remember when it was 3.25 million in March 2020? Now, that’s a steep fall, ain’t it? The trail of bitcoins has been evaporating faster than dew at dawn, heading blowout levels since last year, when the number was 1.53 million at the start of January. Seems like everyone’s stuffing their coins in their own pockets, not willing to part with them, no matter what the pimps of the market say.

This quiet withdrawal indicates a shift—investors are locking their bitcoins away in self-custody, apparently convinced that the upcoming storm is worth waiting for, or maybe just too tired to sell.

Meanwhile, demand is galloping ahead of new coins being mined—roughly 450 freshly minted bitcoins a day, or about 3,150 a week, as if miners are busy churning out gold in a sleepy factory. Miners themselves have less than they did in 2010—only 1.7 million coins, like a dwindling herd in a patch of wilderness. Companies, greedy or hopeful, are buying thousands of coins every week, led by Strategy and joined by others like Metaplanet, Twenty One, KULR Technology, and MicroCloud Hologram. They’re piling in like gamblers at a dive, dreaming big.

And let’s not forget the ETFs—the stock-market’s way of pretending to hold Bitcoin while actually just counting dollars. Over $386 million poured into these in a single day, pushing the total inflow above $44 billion, with ETFs now holding Bitcoin worth $131 billion—about 6% of everything, or a tiny slice of the pie but enough to make folks nervous, or excited.

All this rising demand against the shrinking supply signals something powerful—a potential bullish blow that might send Bitcoin racing skyward. Even the wise Crypto Michael, who called the bottom at $15,300, believes that the next wave of a historic bull run is just around the bend, maybe starting this very week. He’s like the town prophet, saying, “Get ready, folks—things are about to get wild.”

The Bitcoin rally I predicted from 15k to 112k was just the test pump.

The next phase of the greatest bull market in history should begin this week.

The entire crypto market will go parabolic.

Strap in. 🚀🚀

— Crypto Michael (@MichaelXBT) June 10, 2025

Bitcoin Price Technical Analysis—Or How a Cup and Handle Might Just Be Its Ticket to Heaven

The daily chart paints a picture that’s straight out of the textbook—Bitcoin’s forming a nice, clean cup with a handle, ready to spill over into new heights. The top of the cup stands at $109,220, while the bottom dips to $74,558. It’s a classic pattern, the kind that traders dream of, hinting that the next move could be a rocket ride to the moon, targeting around $143,360 if fate allows. So, buckle up, because it looks like Bitcoin’s about to take a big sip from that cup—maybe with a little extra swirl now and then. 🍵🚀

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- Mirren Star Legends Tier List [Global Release] (May 2025)

- MrBeast removes controversial AI thumbnail tool after wave of backlash

2025-06-10 15:55