In the swirling vortex of economic speculation, one might be inclined to pause for breath, to consider the very essence of existence itself, particularly as it pertains to the digital alchemy known as Bitcoin. Our modern-day seers, Harvey and Clemente III, have gathered, perhaps in a dimly lit tavern, to conjure a vision that prophecies Bitcoin soaring to the lofty heights of $160,000 by the end of the year 2025. Ah, but let us not be dazzled too easily, for this ascent is tethered by the fragile threads of a hypothesis: the capital structure supporting these estimable Bitcoin Treasury Companies (BTC-TCs) must remain unscathed, like a maiden’s reputation amid a raucous ball. 🎭

The opening line of their treatise is nothing short of a revelation, indicating that these BTC-TCs have amassed a staggering 725,000 BTC—3.64% of the entire Bitcoin universe! How delightful it is to think of these titans, Strategy in particular, hoarding coins like a miser clutching at his last copper! Yet, in the company of other ambitious souls like Marathon Digital, we find a plethora of players whose grand ambitions may mirror our own, though perhaps with significantly less fortune. This merry band’s cumulative exposure does indeed outpace the holdings of US spot-ETFs, as if to mock conventional wisdom.

The Impact Of Bitcoin Treasury Firms

Yet, dear reader, the wisdom encapsulated within this enlightening report comes wrapped in the delicate tissue of conditionality. Like a torturous philosophical debate, Keyrock provides us with a thirty-percent chance that liquidity flows freely, institutional yearnings multiply, and our dear Bitcoin achieves an honor so lofty as to surpass its current halcyon days by fifty percent: a dizzying notion, indeed! But can you feel the weight of responsibility as BTC-TC equities—those whimsical constructs—continue to trade at a 73% premium? It’s as if they are asking us to believe in their Faustian bargain with the very essence of financial gravity. 💰

Take heed of Strategy, our protagonist in this narrative of boom and possible doom. The illustrious Michael Saylor, in a fervor perhaps bordering on obsession, has managed to elevate Bitcoin-per-share (BPS) by an exhilarating eleven-fold since the summer of 2020—indeed, how intoxicating! Yet, let not this triumph shadow the reality of fragility, for if the tide of sentiment shifts, we may find ourselves drowning in a sea of regret. Equities may transform from avaricious to punitive at the drop of a hat—a grim reminder of our own existential dilemmas.

Further compounding our trepidations are the looming debts, those monstrous giants who lay in wait. BTC-TCs, it seems, are poised upon a precipice with convertible notes due in 2027-28. With Strategy alone carrying a burden of $8.2 billion, one cannot help but ponder—what might the gods of fortune decree? The heavy specter of debt casts a shadow over this so-called prosperity, perhaps leading to a tragic downfall reminiscent of our favorite tragic heroes.

And thus, we come to the report’s dismal classifications: those fortunate enough to generate cash flow, and those doomed to dependence on capital like moths fluttering toward a flame. Should premiums fade like a lover’s affection, these companies may find themselves ensnared in a web of dilution—an ironic twist indeed, for selling Bitcoin undermines the very thesis that grants them breath.

The Base Case

Their base case, a funereal contemplation of possibility, posits Bitcoin at a more humble $135,000 by the end of 2025, as NAV premiums cool to a temperate thirty-to-sixty percent. In such a world, our trusted treasuries may still rise, albeit with far less glamour, while the excitement of leverage decays into mediocrity. A bear scenario lurks like the polluted air of the city, a bitter breath of twenty percent decline masked by the foul stench of over-saturation of new treasury listings — what a cacophony! 🎈

Our esteemed analysts, after much deliberation in this moral landscape, do not cast aside the BTC-TC model. Instead, they brand it as an audacious venture that amplifies both prospects and risks—the quintessential duality of man! Saylor’s theory of “Bitcoin yield,” a most daring act of financial gymnastics, rests upon the precarious balance of bullish optimism and meticulous execution. The NAV premium is deemed pivotal, hinging on the notion that these TC entities resemble specters in need of sunlight—without operational stability, they risk allowing the darkness of insolvency to envelop them.

Ultimately, whether Bitcoin can indeed gallop towards that celestial $160,000 before the arrival of the New Year remains a question of faith, much like the existential pursuits of our own souls. Should the investors, those characters in this stage of folly, hesitate—should they fail to pay that dollar-fifty for a dollar of hope—the entire precarious structure may come tumbling down like a poorly crafted play. As the clock winds down, we are left with anticipation and dread—hold your breath, cherish the delicate line of faith, for it stretches thinner with each passing moment; one misstep could unriddle the very fabric of our digital dreams.

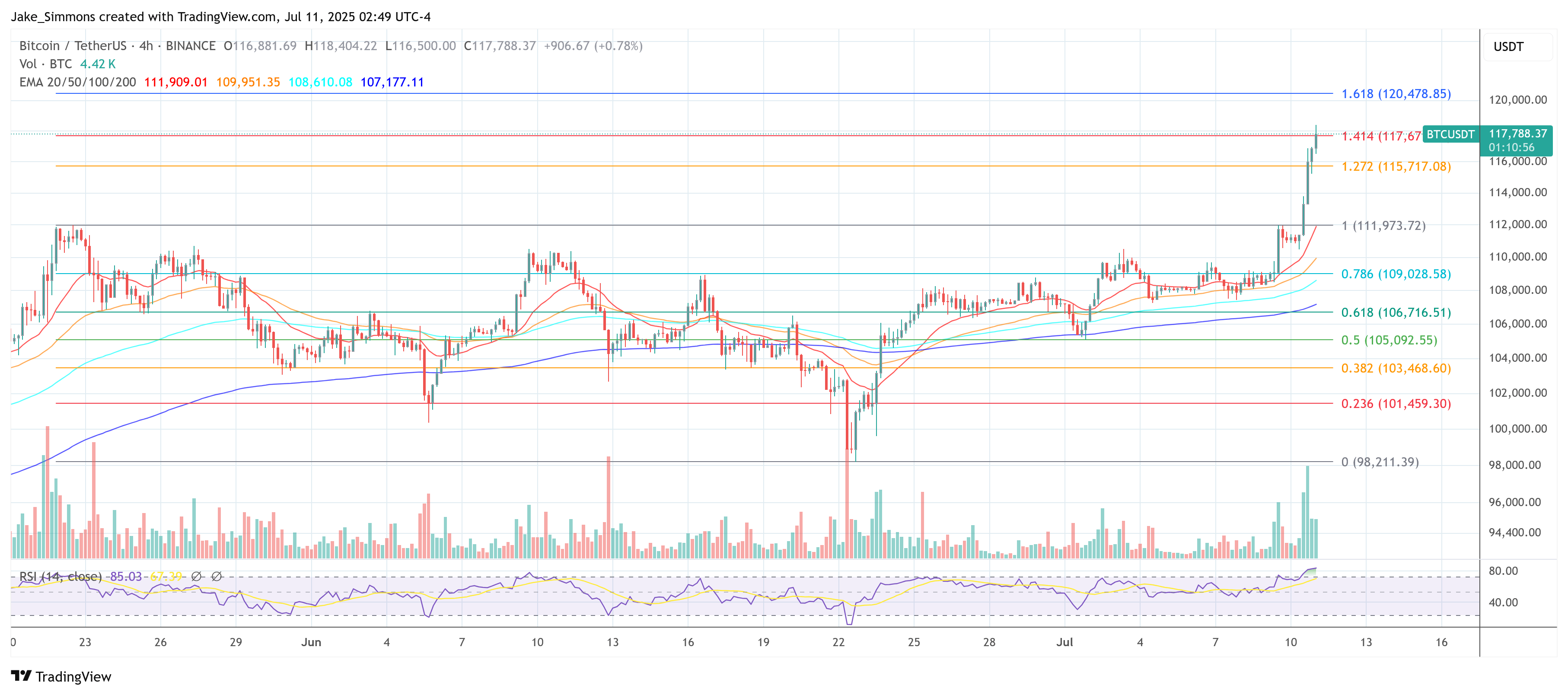

At this juncture, Bitcoin stands at $117,788—a whisper of possibility inhabiting the space between aspiration and despair.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-07-11 11:48