What to know:

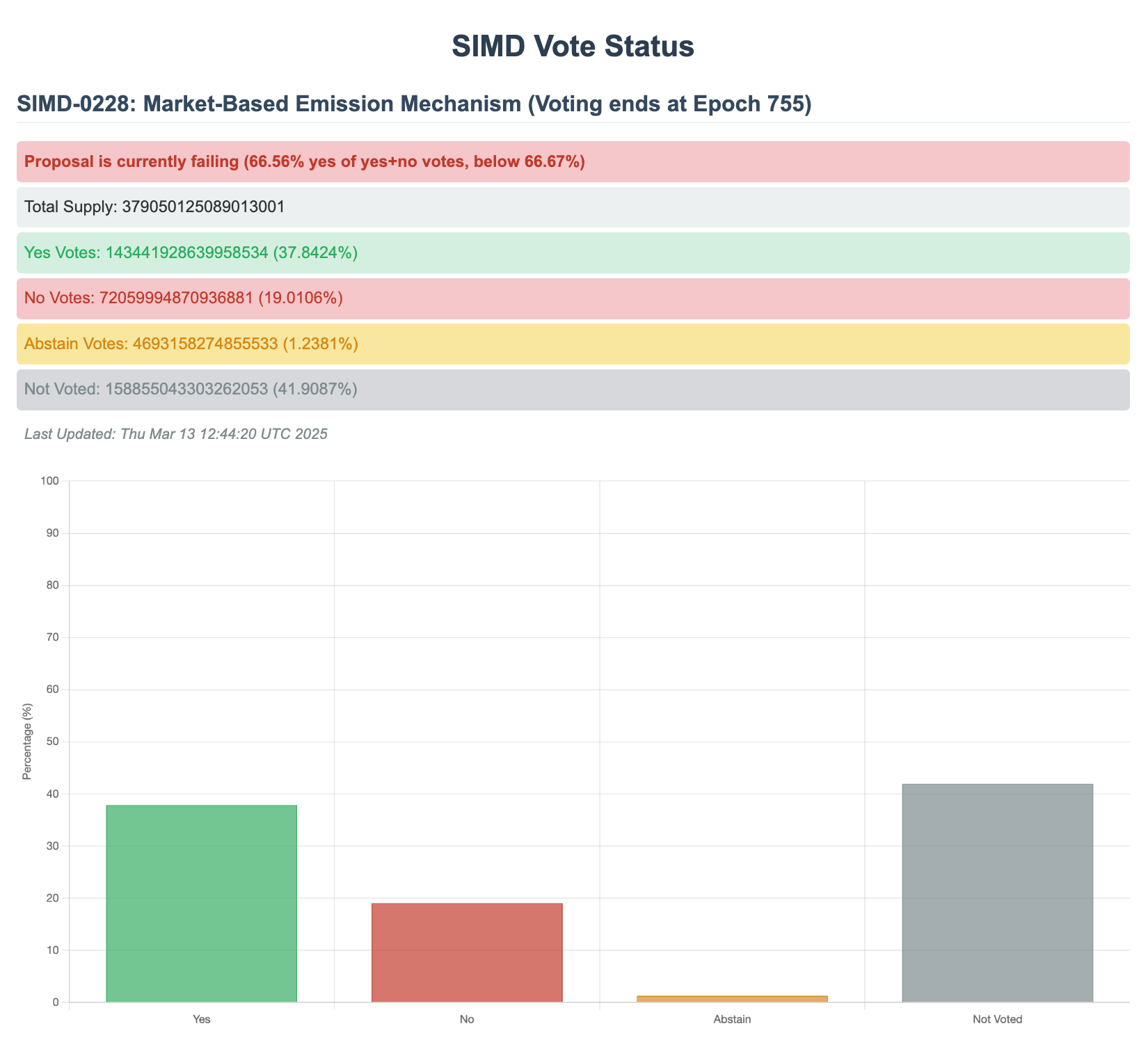

- So, there’s this Solana proposal, SIMD-0228, that’s supposed to cut SOL‘s inflation rate like a hot knife through butter. But guess what? Only 55% of validators bothered to vote, and a mere 37.8% actually thought it was a good idea. 🙄

- This proposal is all about a market-based token emission mechanism. Sounds fancy, right? It’s like saying, “Let’s not overpay for security,” while secretly hoping it boosts Solana’s decentralized finance and on-chain SOL markets. Fingers crossed! 🤞

- If this proposal gets the green light, we might see SOL’s inflation rate plummet from 4.5% to a jaw-dropping 0.87%. But hold your horses! It could also kick smaller validators to the curb, raising some serious eyebrows about decentralization. 😬

In case you missed it, the Solana proposal SIMD-0228 is like that diet you keep saying you’ll start—lots of talk, not much action. At press time, only 37.8% of network validators were on board. Talk about a lukewarm reception!

According to Dune Analytics, 746 validators (that’s nearly 58% of the 1334 active validators) have cast their votes. Of those, 37.8% were in favor, 18.5% were against, and 1.2% were too busy scrolling through TikTok to care. Overall, it looks like this proposal is headed for a spectacular flop. Voting wraps up at Epoch 755 in about 11 hours, so stay tuned! ⏳

The proposal is pushing for a market-based token emission mechanism to ensure the network doesn’t overpay for security. Because who wants to throw money at a problem, right? It’s expected to have a positive impact on Solana’s decentralized finance and boost liquid on-chain SOL markets. Or at least that’s the hope!

Logan Jastremski, co-founder and managing partner at frictionless Capital, chimed in, “Since 2023, the Solana network has transformed significantly. Back then, on-chain volumes were often below $100 million daily, reflecting limited activity. Today, we’re swimming in billions! So, let’s cut that inflation rate, shall we?”

Some estimates suggest that if this proposal passes, SOL’s inflation rate could slide from 4.5% to around 0.87%. That’s an 80% reduction! 🎉

Tagus Capital is optimistic, claiming this could positively impact SOL’s price. But let’s be real: if approved, it would significantly reduce staking rewards and fresh SOL supply. So, while the value might go up, smaller validators could find themselves out in the cold, raising concerns about network decentralization. It’s like a game of musical chairs, but with more stress and fewer chairs. 🎶

In summary, lower rewards could force smaller validators out, and we all know how that story ends—concerns about decentralization and a lot of hand-wringing. Welcome to the world of crypto! 🙃

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-03-13 16:07