In a universe where bullish headlines are as common as Vogon poetry, XRP finds itself in a rather sticky situation. Despite the optimistic chatter, the token has plummeted nearly 5% in the last 24 hours and a staggering 8.5% over the past week. It seems that multiple EMA death crosses have decided to throw a party, and guess who’s not invited? That’s right, the price!

Even with a $300 million investment from a Chinese AI firm (because who doesn’t want a robot managing their money?) and a $121 million treasury raise led by the ever-mysterious Saudi-linked VivoPower, the technicals are waving a big red flag, suggesting that sellers are firmly in control. It’s like watching a game of intergalactic chess where the pawns are winning.

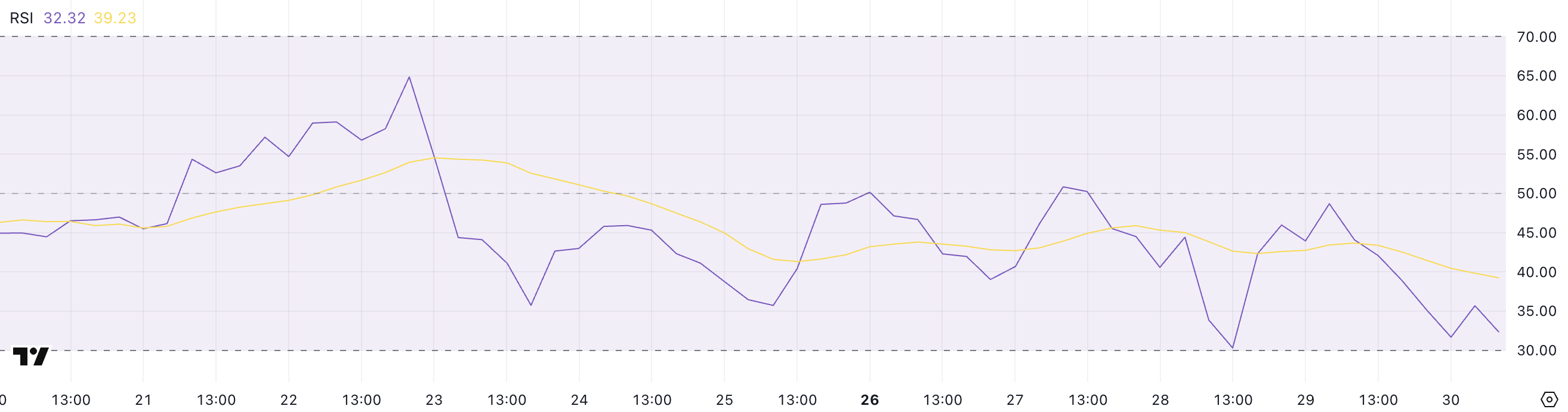

XRP Enters Oversold Territory

XRP’s Relative Strength Index (RSI) has taken a nosedive to 32.32, down from a more respectable 48.68 just a day earlier—talk about a dramatic decline! This sharp drop reflects a selling frenzy that’s pushing XRP dangerously close to the oversold threshold, but not quite crossing it. It’s like being on the edge of a cliff but deciding to take a selfie instead.

Interestingly, XRP’s RSI hasn’t dipped below 30 since April 7, which means while the recent corrections have been sharper than a Pan Galactic Gargle Blaster, they haven’t yet triggered the kind of oversold conditions that would make even the most stoic trader weep.

The current reading near 30 suggests that XRP is nearing a potential exhaustion point in its downward spiral. If buyers decide to show up (perhaps they’re stuck in traffic?), the price could stabilize or even attempt a rebound. But let’s not hold our breath!

And all this bad momentum comes even after a Chinese AI company announced its grand plan to invest up to $300 million in XRP, and VivoPower raised $121 million for the XRP Treasury, backed by a Saudi Royal. It’s like throwing a lavish party and no one shows up!

The RSI is a widely used momentum indicator that ranges from 0 to 100, designed to measure the speed and magnitude of price movements. Readings above 70 typically indicate overbought conditions (cue the panic!), while readings below 30 signal oversold conditions and possible price recovery.

With XRP hovering just above that oversold threshold, the market is at a crossroads: further downside could push RSI below 30, attracting attention from technical traders who are always on the lookout for a bounce. Meanwhile, stabilization at current levels could prevent deeper losses, but let’s be honest, it’s a bit like trying to stop a runaway spaceship with a rubber band.

Given that XRP hasn’t broken below 30 in nearly two months, a dip below that level now could trigger renewed volatility—either drawing in bargain hunters or accelerating bearish momentum if support levels fail to hold. It’s a thrilling game of financial chicken!

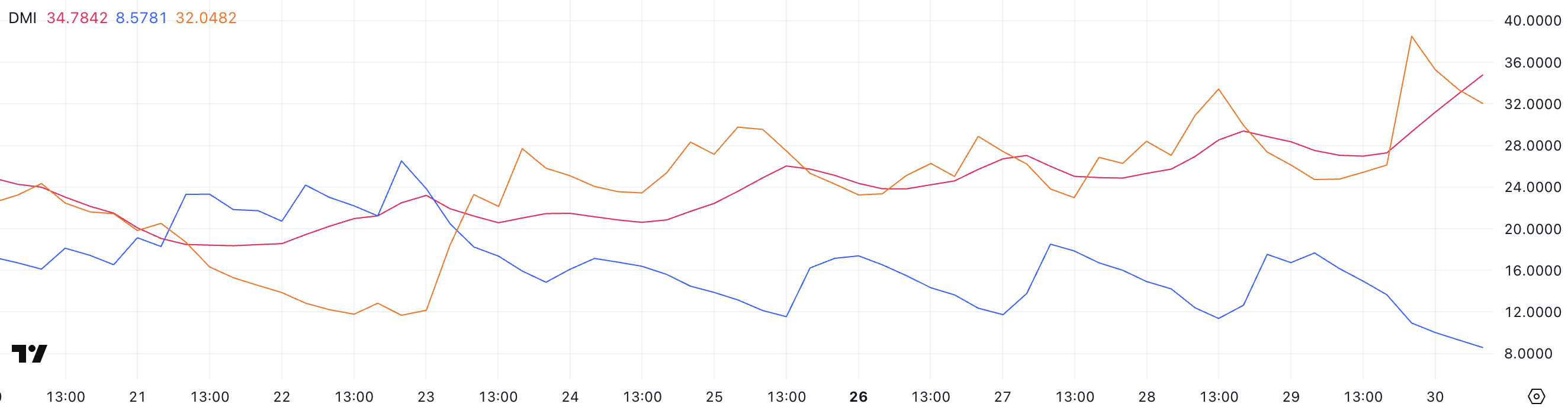

XRP DMI Signals Strong Bearish Trend as ADX Surges Above 34

XRP’s Directional Movement Index (DMI) is revealing a significant shift in trend strength and momentum, with the ADX rising to 34.78, up from 27 just a day earlier. It’s like the universe is saying, “Hold onto your towels, folks!”

The ADX, or Average Directional Index, measures the strength of a trend without indicating its direction—readings above 25 typically suggest a strong trend, and those above 30 indicate a very strong one. The sharp increase in ADX confirms that the current trend is intensifying. However, the direction of that trend is made clear by the movement of the directional indicators: +DI has plunged to 8.57, while -DI has surged to 32.

This widening gap between the directional indicators highlights a strong bearish trend in play. The falling +DI means that bullish momentum is weakening faster than a spaceship running out of fuel, while the rising -DI shows that selling pressure is accelerating.

With -DI now significantly higher than +DI and the ADX confirming the strength of this move, XRP appears to be firmly in a downtrend. Unless there’s a sudden reversal in buying interest (perhaps a miracle?), the current setup points to continued downside pressure in the near term, reinforcing what other indicators like the RSI have already signaled.

XRP Risks Dropping Below $2 as Bearish Momentum Builds

XRP’s exponential moving averages (EMAs) have flashed multiple death crosses in recent days, reflecting sustained downward pressure as the token struggles to regain traction below the $2.50 mark. It’s like watching a soap opera where the main character just can’t catch a break!

These bearish crossovers—where short-term EMAs fall below long-term EMAs—indicate a weakening trend and align with XRP’s recent inability to break back into bullish territory. If the correction deepens, XRP could retest support at $2.07, and a failure to hold that level would open the door for a drop below $2, a price not seen since April 8. This would likely confirm a broader shift in market sentiment and potentially accelerate bearish momentum.

Still, the outlook could shift if buyers regain control and XRP manages to reverse the trend. In that case, $2.26 stands out as a key resistance level; a successful breakout there could signal renewed strength and bring the next upside targets at $2.36, $2.47, and even $2.65 into focus.

These resistance levels would need to be cleared with convincing volume to invalidate the current bearish EMA structure. Until then, the multiple death crosses serve as a warning that downward pressure remains dominant unless bulls stage a strong recovery. And let’s face it, we’re all just waiting for the next plot twist in this cosmic drama!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Come and See

- Umamusume: Pretty Derby Support Card Tier List [Release]

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

2025-05-30 23:02