Why TRX Might Just Surprise Us All (or Not) – The Crypto Soap Opera Continues!

- Whale frenzy and skyrocketing gas fees—what could go wrong? Maybe a TRX breakout, or just whales showing off their new yachts.

- Lending TVL plunges faster than your favorite brunch spot’s popularity, making everyone cautious, even if TRX looks kinda bullish—at least until it isn’t.

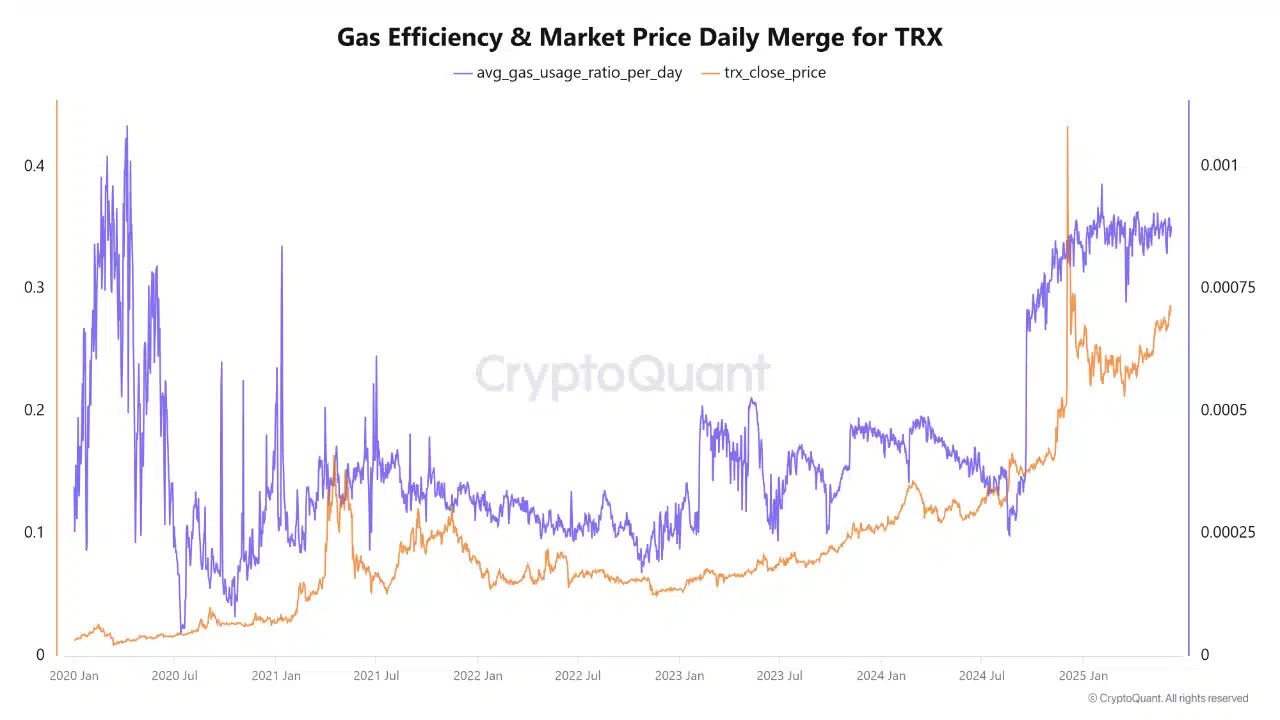

Since late 2024, TRON’s gas usage has been climbing faster than your Netflix bill after a binge weekend. This surge screams “network activity!” louder than your aunt at a family gathering. Funny thing, though—this increased hustle on-chain is mirroring TRX’s price climb, proving once again that on-chain activity and investor mood are as tightly linked as Jake and Amy.

Historically, when networks get busy and efficient, prices often rise—who knew? But hold your horses—sometimes these metrics decide to play hide and seek, leaving us questioning whether they’re actually friends or just pretending.

So, at press time, it’s like the perfect romance—until someone says, “Not so fast,” and the plot thickens. Keep your eyes peeled; this story’s far from over.

Is the lending TVL crash the thrill-seeker’s warning sign?

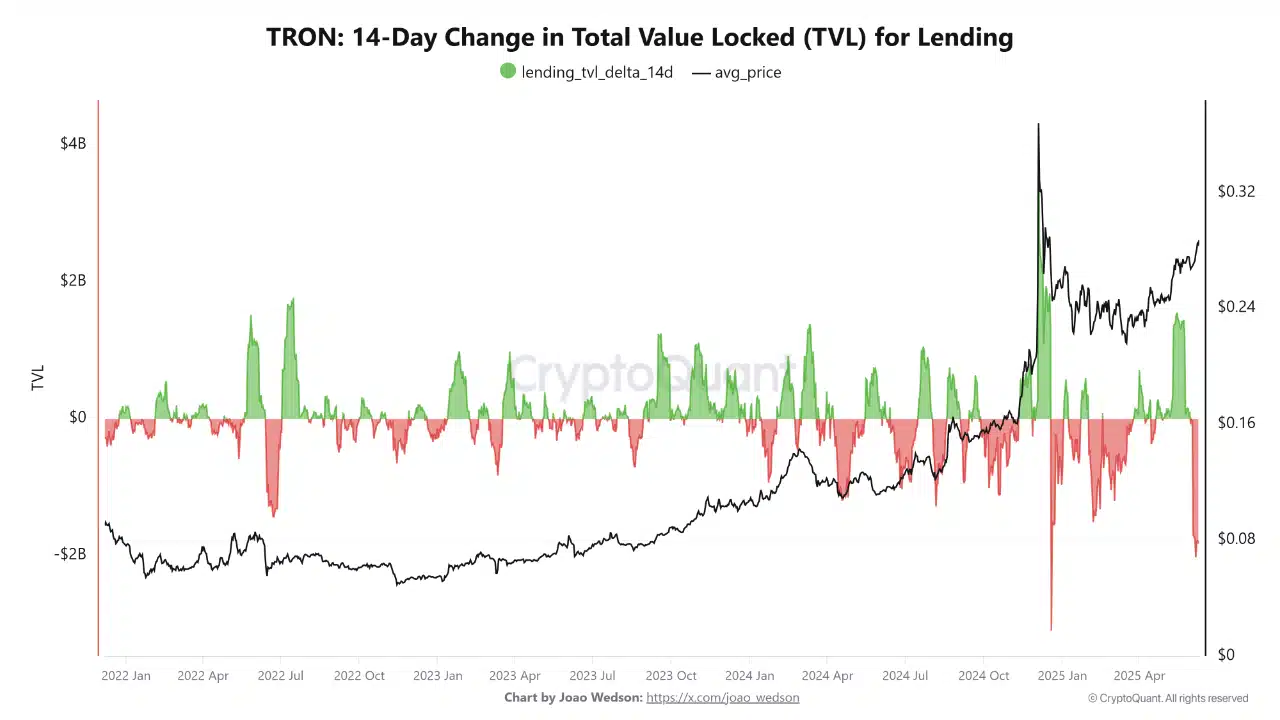

TRON’s lending scene has taken a nosedive of $2 billion (yes, billion—big boy money), putting the 14-day delta into the negative zone. If this were a rollercoaster, we’d be holding our breath on the way down. Meanwhile, TRX’s price is doing its best to stay positive—classic case of denial or just blind optimism?

This contrast feels like watching someone dance while a storm brews behind them. Historically, when TVL drops faster than your patience in a long line, it signals trouble brewing—maybe borrower’s demand is drying up or just more FOMO exit strategies. Either way, relief is unlikely until this gap shrinks or explodes.

If investors keep pulling out, don’t be surprised if volatility turns from a gentle breeze into a full-blown hurricane.

Sell pressure: The silent party pooper of TRX’s bullish dreams?

Despite TRX flirting with breakout levels, the 90-day taker volume delta (think of it as the market’s mood ring) is skewed towards sell orders. Basically, everyone’s more eager to dump than buy—such a vibe.

Historic rallies driven by passive sellers often fizzle out faster than your summer tan. Without enough aggressive buyers, this hype might turn into a short-lived fireworks display—bright but brief.

So unless the buying squad steps up, we might be looking at a rally that’s all sizzle and no steak. Keep a close eye on spot market moves; they’re the real mood swingers here.

Whales and smart money—are they planning the next big thing?

While the taker data screams “hold your horses,” on-chain whale wallets are behaving like teenagers at a concert—snatching up more tokens, up 10.17%, with mid-tier investors adding a hefty 41.19%. Meanwhile, retail investors are just… watching.

It’s like the big players are preparing a surprise birthday party—quiet, calculated, and ready for a big reveal. Rallies backed by these institutional types tend to last longer—think of them like that reliable friend who always shows up with wine.

At the moment, TRX is hanging around $0.288, with 92.39% of holders in profit—meaning most are about to do the victory dance or maybe just the ‘wait, what?’ shuffle. When everyone’s “in the money,” the gains slow down, and the risk of sell-off looms like a thundercloud.

Can TRX finally break free from its long, boring range?

For months, TRX has been playing the “range-bound” game between $0.25 and $0.29—think of it as a crypto equivalent of a “hold my drink” moment. Now, it’s testing the upper limit, with RSI bumping near 65, looking eager.

If it can punch through $0.29 with volume to spare, we might see a rekindling of the past highs—like a phoenix rising from the ashes of boredom. But if it falters, expect more of the same, with the price oscillating like a mind-numbed pendulum or, worse, bouncing back down.

//pollinations.ai/redirect-nexad/oQX76Krg?user_id=983577) could probably help with that… just kidding! (Sort of). But seriously, after all that “whale accumulation” and “gas usage ratio,” one can only assume TRX’s price will either skyrocket or plummet. It’s like deciding whether to wear Spanx on a first date – high risk, high reward. 🤔 You know, Text, Inc.’s LiveChat® might actually be useful for calming investors down when things inevitably go sideways. 😂

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-06-11 08:20