As an analyst with over two decades of experience in the volatile and ever-evolving world of finance, I have seen my fair share of market corrections and subsequent rebounds. The recent dip in XRP‘s price, while unsettling for short-term investors, does not deter me from maintaining a bullish outlook on its future potential.

TL;DR

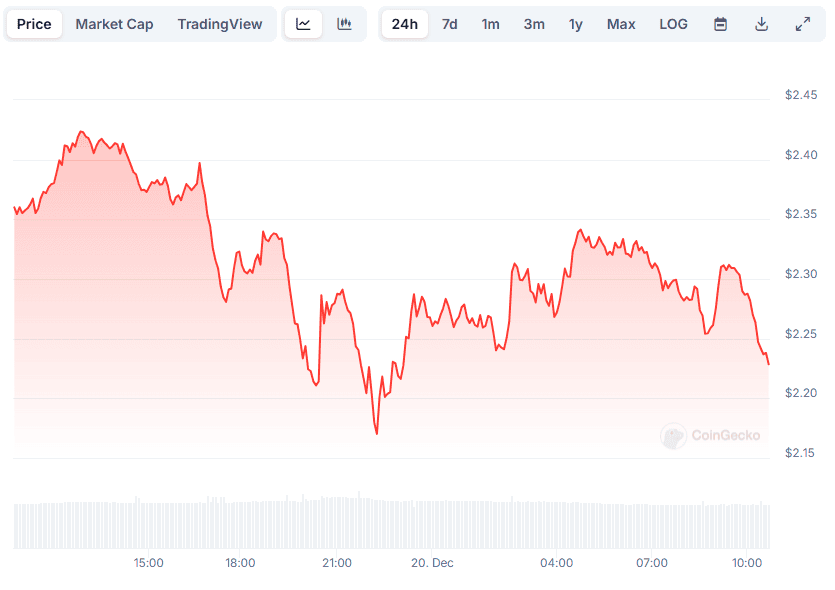

- XRP experienced a sharp decline, briefly falling below $2.20 following a broader crypto market correction.

- Despite the dip many analysts foresee the asset rebounding to targets as high as $5, with some projecting even greater peaks if a FOMO-driven rally occurs.

XRP Follows the Market Decline

Regardless of the increased market turbulence, Ripple‘s XRP has had a prosperous first half of December. At the onset of the month, its value exceeded a multi-year peak of $2.80, and at the beginning of this week, it held steadily above $2.50.

Initially, things were looking good for XRP, but unexpectedly, its value started falling. By December 18, it dropped below $2.30 and continued to dip further within the next few hours, reaching below $2.20. At the moment, XRP is hovering around $2.23 after a minor recovery, indicating a decrease of about 6% compared to its previous day’s value.

As a researcher, it appears that the recent correction across the cryptocurrency sector might be significantly influencing the token’s price. Over the past 24 hours, the global crypto market capitalization has dipped nearly 9%, currently standing at approximately $3.42 trillion (according to CoinGecko’s data).

On December 17, Bitcoin (BTC) reached a record high of more than $108,000, but its current value has dropped to around $96,000. Ethereum (ETH) fell below the $3,300 mark, while Solana (SOL), Dogecoin (DOGE), Cardano (ADA), and other cryptocurrencies have experienced double-digit declines.

The market experienced significant losses soon after the Federal Reserve announced its recent reduction of the interest rate by 0.25%. Jerome Powell suggested that next year, this policy may come to a stop because of a potential rise in the inflation rate.

Beyond that, it’s worth noting that Bitcoin ETFs experienced their largest single-day outflows ever, with a total of approximately $670 million being withdrawn in a 24-hour period. According to CryptoPotato’s report, Fidelity’s FBTC and Grayscale’s BTC were the main contributors to these withdrawals, with $208.5 million and $188.6 million removed respectively.

XRP’s Next Potential Targets

Despite the significant dip I’ve witnessed in my crypto portfolio, numerous analysts remain hopeful that XPR‘s bull run isn’t nearing its end. In fact, the well-known XRP user, Crypto Bitlord, believes that the recent correction has marked a local bottom. He predicts that post this downturn, XRP could soar as high as $5.

Other market analysts who have recently shared their insights include Dark Defender and Armando Pantoja. The first one projected short-term targets at $5.85 and $8.76, while the second believes that XRP might move towards $2.78 initially, followed by a potential rise to $3.87. Pantoja also speculated that if the price surges to $10-$12, there could be a widespread fear of missing out (FOMO), at which point things could become quite chaotic.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-20 12:26