“Why Blockchain Can Solve the Buy-Side Blues 🎩✨”

Ah, tokenization—what a splendidly modern contraption! Its ultimate aims include crafting robust trading markets for private assets, skipping jauntily into the DeFi ecosystem, and tossing the keys of investment accessibility to the unwashed masses. Naturally, one might trot out the question: Why hasn’t the buy-side taken to blockchain like ducks to the proverbial pond? 😏

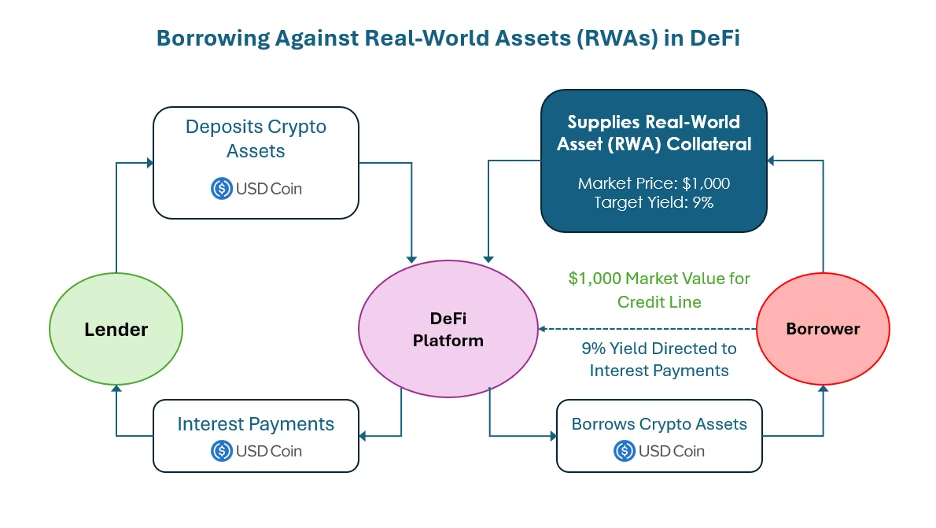

The hitch in the giddy-up, as it were, lies in tethering those stodgy legacy assets—think portfolios tied up in Cupid-like bonds—onto the vibrant, overly caffeinated blockchain dance floor. It’s not child’s play, mind you, dragging old-world assets into the land where Moonwell, Aave, and Morpho are the belles of the DeFi ball. Ideal solutions, as shown below in Blue Water’s ambitious “Opportunities” report, require more than just a stiff upper lip.

You’ve stumbled upon Crypto Long & Short, the newsletter equivalent of Jeeves whispering sweet financial nothings into the ears of investors. Sign up for the weekly installment—no ration cards required. 📰

Now, let us get down to brass tacks, or should we say blockchain ledgers. The stiff-necked traditionalists marking their ledgers quarterly (or on a leisurely semi-annual basis) are about as suited for crypto speed as a snail is for NASCAR. To win the hearts, minds, and wallets of DeFi enthusiasts, transparency and real-time operations must become as natural as breathing—or at least as easy as boiling an egg. 🍳

Here are the pearls of wisdom one must grasp if they’re to charm the blockchain crowd:

1. Transparency is King: Metrics—whether they’re holding, state, or authorization—are the gospel truth in DeFi realms. Anything less would be like trying to sell a car without revealing the mileage. 🚗

2. Speed is Queen: Crypto markets run 24/7, so dragging your heels with manual updates is like attempting to race a greyhound while wearing cement boots. Suffice to say, it’s not fetching. ⚡

3. Holistic Monitoring: The blockchain’s old hands want real-time data, not spreadsheets balancing precariously on the edge of 1997. They expect everything from trades to tokens to zip along faster than a well-bred dachshund. 🐕🦺

For instance, Inveniam’s operating system (displayed below with the grace of a prima ballerina) provides a bridge for private assets into a sprightly ecosystem that previously turned its nose up at such old-world contrivances.

Newcomers like Tradable’s hefty $1.7 billion in loans or Figure’s $10+ billion in HELOCs might set a fine example, having begun their blockchain lives in the cradle. But those tackling the Everest that is legacy assets—trillions of dollars worth, mind you—must ditch their Excel-ridden ways. Instead, they need an operating system to credential and broadcast asset data faster than Jeeves can pour a martini. 🍸

Platforms like Inveniam and Accountable, along with blockchain stalwarts Chainlink and Pyth, are proffering delectable low-hanging fruit for those eager to schmooze their way onto blockchain rails. It appears the buy-side is one stiff drink and a good nudge away from embracing this brave new world. Cheers to that! 🥂

Note: The witticisms presented in this text reflect the author’s musings and not necessarily those of CoinDesk, Inc. or its affiliates. Any grievances can be addressed politely over tea. ☕

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lottery apologizes after thousands mistakenly told they won millions

- Umamusume: Pretty Derby Support Card Tier List [Release]

- KPop Demon Hunters: Real Ages Revealed?!

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-02-19 19:34