So here’s the tea: 52.8% of all Bitcoin is just chilling in the wallets of regular folks. That’s right—no fat cats at banks, hedge funds, or even the flashy crypto exchanges grabbing the lion’s share. It’s like your mate down the pub owns more Bitcoin than Wall Street’s finest. 🍻

This glorious chaos—that is, decentralization—is basically Bitcoin’s middle finger to the old-money establishment.

Axel Adler Jr. (sounds like a guy who definitely knows his stuff) dug into some juicy numbers from CryptoQuant, SaniExp, and TimeChainIndex and found that everyday users actually control most of the Bitcoin supply. Unlike traditional finance, where a tiny cabal of banksters hog all the goodies, Bitcoin’s money is more like a group chat where everyone actually owns a share.

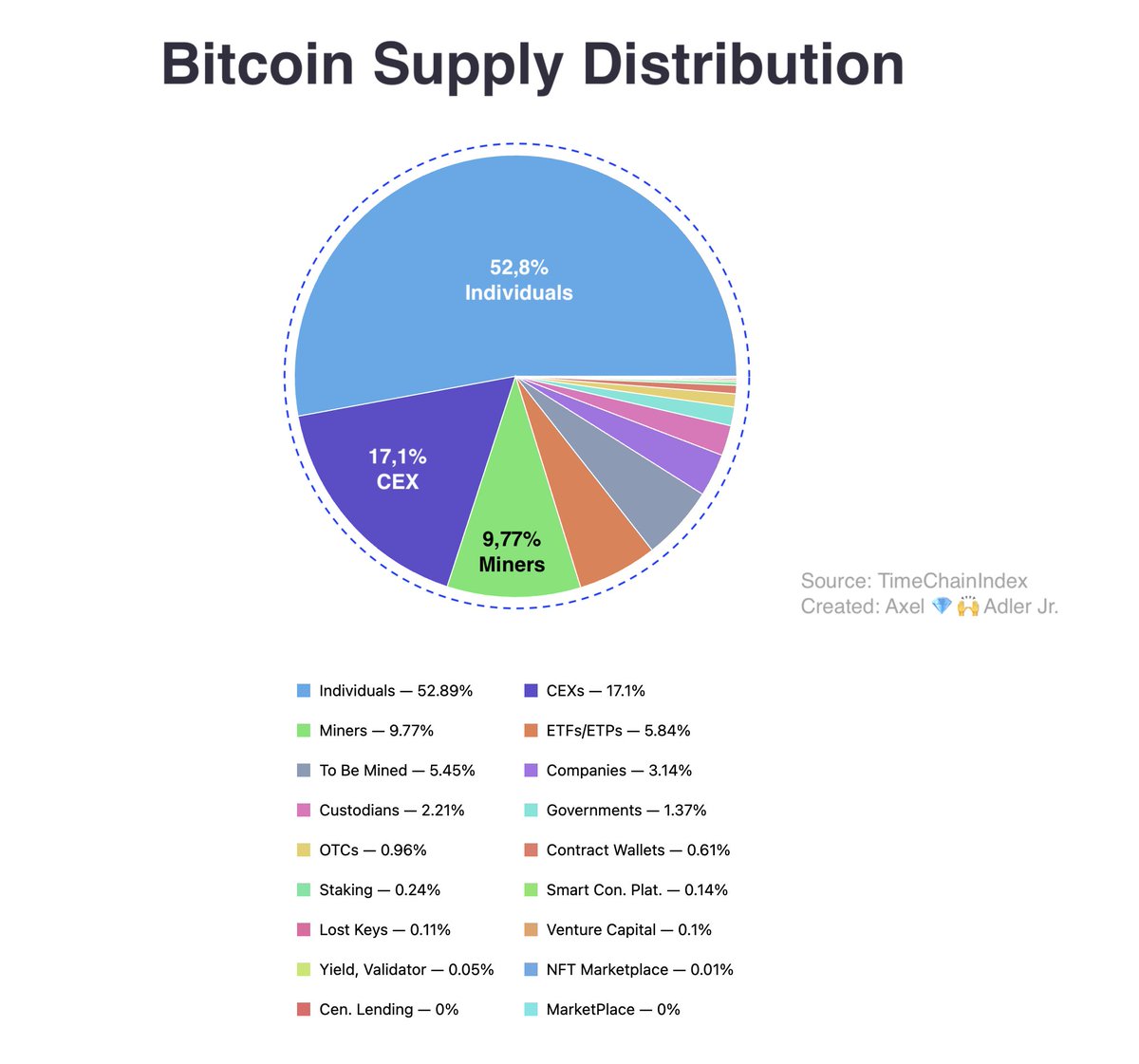

Here’s the Bitcoin owner spreadsheet you never asked for but totally need:

- Individuals: 52.89% (aka the cool kids)

- Centralized Exchanges (CEXs): 17.1% (the middlemen who still wanna play)

- Miners: 9.77% (the digital gold diggers)

- ETFs and ETPs: 5.84% (the Wall Street wannabes)

All the other characters—companies, governments, custodians, OTC desks—are basically sitting in the back, doing very little.

Oh, and let’s not forget the 5.45% of Bitcoin that’s still waiting to be mined—like a treasure chest under the digital sea. There’s also teeny tiny slices scattered across lost keys, staking gigs, smart contracts, venture capital, and NFT nonsense. But honestly, those are just the crumbs on the table.

Why This Actually Matters (And No, It’s Not Just Crypto Fanboi Hype)

The whole point of Bitcoin was to chuck the traditional financial gatekeepers out and let people call their own shots with their money. Seeing that over half of Bitcoin is still in everyday hands means Bitcoin’s grand plan of “financial freedom” isn’t some pipe dream whispered about in geeky forums; it’s alive and kicking.

This spread-out ownership makes Bitcoin as stubbornly resilient as that one friend who refuses to leave the party, no matter how many times you hint it’s bedtime. No one single power-player can just snap their fingers and take control. It’s money democratised — no borders, no permissions, just you and your digital dosh.

And let’s be real, in a world where “decentralized” sometimes just means “still owned by a bunch of posh tech bros,” Bitcoin’s owner chart is a refreshing slap in the face to anyone who thinks centralization is inevitable.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- How to watch the South Park Donald Trump PSA free online

2025-04-27 18:43