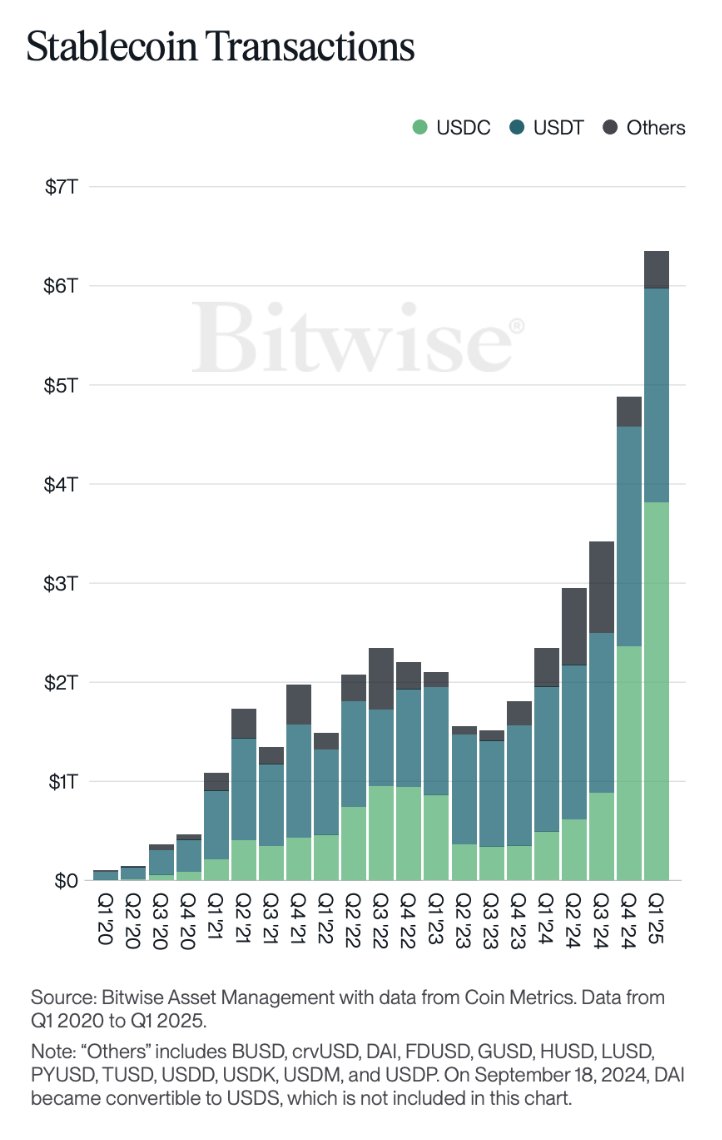

Can you believe it? Over six trillion dollars in stablecoins in just the first quarter of 2025. That’s a lot of digital noodles sloshing around. It’s like everyone’s got a virtual piggy bank and they’re just aggressively shoving cash into it — “Here, take my money, I don’t want it cluttering up my wallet!”

USDC and USDT are the big shots here. USDC’s been growing faster than my neighbor’s lawn since 2023. Now it’s basically the boss of transactions. And USDT? Still hanging in there, especially overseas, where regulations are about as welcome as a root canal during a volcanic eruption. 🌋

Then there’s this “Others” category— BUSD, FDUSD, and friends — the little siblings trying to get noticed. Not as big of a slice, but hey, they’re growing. Like that shy kid at school who suddenly becomes class president. Oh, and DAI? Gone from the data because it decided to become a USDS — like changing your name after a bad breakup.

The transaction volume? Oh, it’s climbing back up, baby. After taking a break in 2022, it’s now on a sugar high. Demand’s surging— people are not just trading for fun anymore; they’re sending remittances, doing DeFi stuff, paying bills across borders, even paying employees on-chain. Because, sure, who needs banks, right? 🙄

And as if that wasn’t enough, governments are finally waking up. The US is talking about the GENIUS Act — as brilliant as it sounds, it’s basically trying to make stablecoins legit. They’re putting on their serious faces, trying to keep up with the digital age, or at least pretend they are. 🧐

Every quarter, stablecoins are just proving that they’re here to stay — like that annoying relative you can’t get rid of. They’re not just a fad; they’re the backbone of this wild, crazy financial mess we call modern money.

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Death Stranding 2 Review – Tied Up

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-17 21:13