- In a most curious turn of events, the esteemed Tron has introduced a USD₵1 stablecoin, most notably backed by the illustrious World Liberty Financial, and intriguingly linked to none other than Mr. Trump and the ever-ambitious Justin Sun. 🎩

- Lo and behold, the market cap of this stablecoin on Tron has surged by a staggering $1.86B in the span of a mere week, now standing at a princely sum of $79.04B. 💸

- Our dear Justin Sun, having secured an invitation to Trump’s pro-crypto dinner circle in May 2025, has certainly found himself in the company of influential gentlemen. 🍽️

- Alas, the TRX appears to be exhibiting signs of waning momentum as it approaches the formidable resistance level of $0.286. 😟

- On-chain data reveals that a commendable 60.03% of holders remain in profit, thus alleviating some of the sell pressure. 📈

- Currently, TRX is consolidating around $0.275, and it is imperative for the bulls to reclaim the $0.286 threshold to regain control of the trend. 🐂

Trump-Backed Stablecoin Sparks TRX Momentum

Indeed, the price of TRX has once again captured the attention of investors following the launch of the Trump-linked USD₵1 stablecoin, which is, of course, backed by the ever-entrepreneurial Justin Sun. Minted upon the Tron, it coincides with the TRX’s audacious attempt to test the $0.286 resistance. 🧐

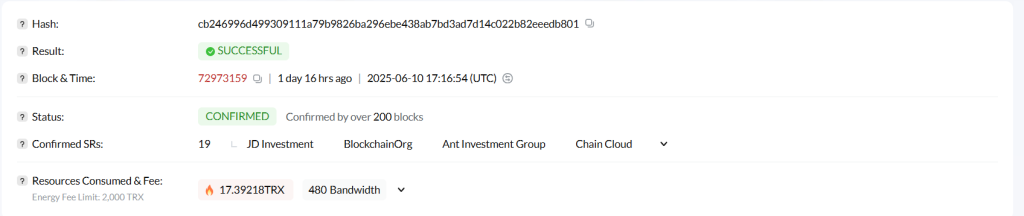

Our dear Justin Sun confirmed this launch on the platform known as X, with validation from the ever-reliable TRONSCAN. The network metrics have surged, with Tron’s stablecoin cap rising from $77.18B on June 10 to $79.04B on June 12, a remarkable increase of $1.86B in just two days, accompanied by a peak in user activity. 📊

Justin Sun, the illustrious founder of TRON cryptocurrency, was among the select few invited to Trump’s crypto dinner in May 2025, a clear indication of a deeper alignment with U.S. pro-crypto policy, thus enhancing sentiment surrounding the TRON ecosystem. 🍷

TRX/USD Loses Steam After Rejection

In comparison to the earlier days of June, when the Tron Coin was valiantly attempting a breakout above $0.286 with bullish momentum, the current situation presents a rather more cautious disposition. 😬

Previously, TRX was amidst a rally, having gained over 7.45% weekly and striving towards the psychological level of $0.30. Alas, it has now retreated to $0.274, testing the key trendline support. 📉

The failure to close above $0.286 — now a confirmed multi-test resistance — suggests a state of exhaustion rather than continuation. 😩

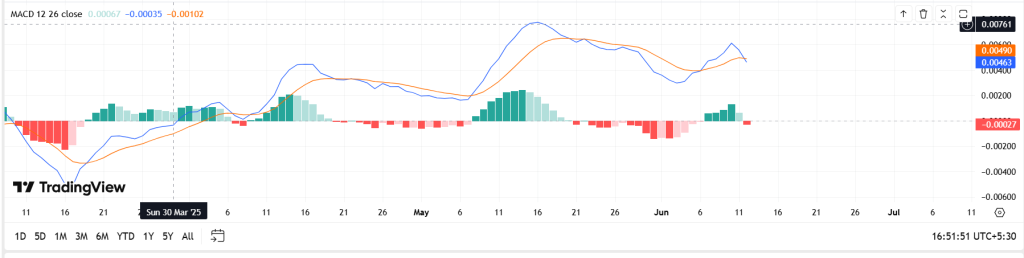

Momentum Divergence:

- RSI (14) has declined from 61.89 to 57.59, reflecting a waning bullish strength. While still above neutral, the negative slope hints at declining momentum. 📉

- Stochastic RSI is flattening after a recent bullish crossover, with the gap between 65.85 and 43.74 narrowing, indicating indecision among short-term traders. 🤔

- MACD histogram is fading, and the crossover curve has flattened — a stark contrast to the sharper positive divergence observed earlier this month. 😳

- Resistance: $0.286 (multi-test), $0.290 (short-term breakout), $0.30 (psychological). 🚧

- Support: $0.275 (trendline), $0.268–$0.276 (accumulation zone). 🛡️

- Momentum indicators suggest a stall. Should $0.275 fail, the downside may accelerate. ⚠️

On-Chain Metrics: Confidence Builds, But Resistance Holds

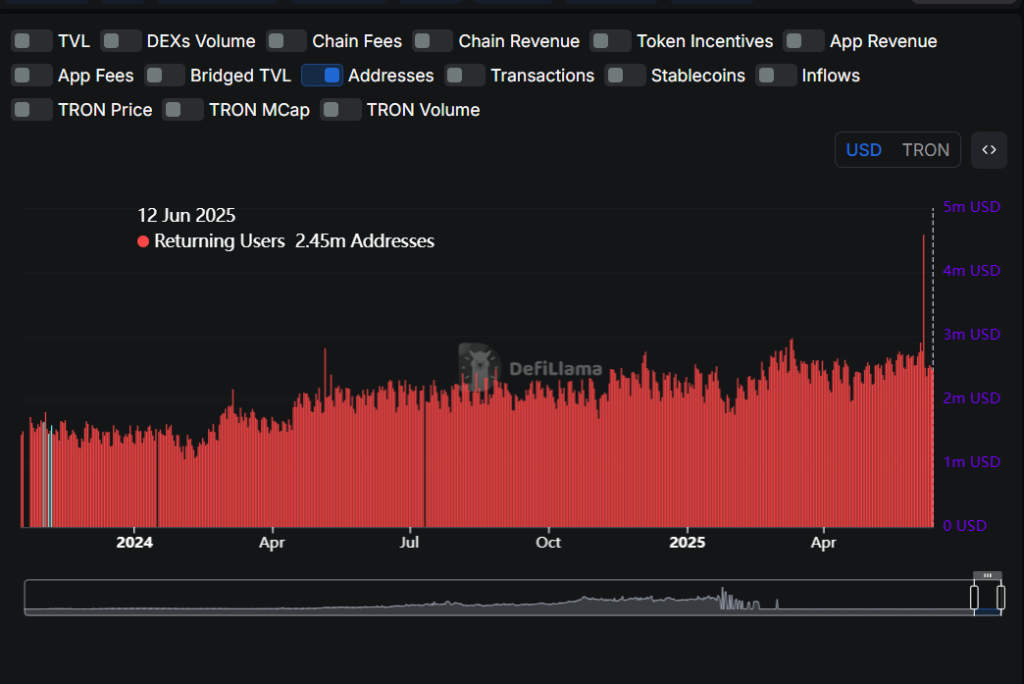

DeFiLlama shows 2.31M returning users on June 12 — slightly below the June 6 peak of 4.58M, indicating a decline in network activity. 📉

According to IntoTheBlock, a commendable 60.03% of TRX holders are currently in profit, up roughly 3% since the stablecoin news, while 32.18% are at breakeven and 7.80% remain in loss. 📊

This suggests a reduction in sell pressure from those fortunate holders, though the high concentration of breakeven wallets around $0.281–$0.290 may still act as near-term resistance unless volume and sentiment strengthen. 🧐

This indeed reduces selling pressure. However, many breakeven holders near $0.281–$0.290 reinforce resistance. 🛑

TRON’s stablecoin market cap now stands at $79.04B, having risen $1.86B in just seven days. USDT continues to dominate with a 99.01% share, confirming Tron’s relevance in the realm of stablecoin flows. 💰

TRX Outlook: Can the Rally Sustain or Is a Cool-Off Inevitable?

TRX finds itself at a pivotal juncture where technical fragility meets burgeoning on-chain strength. Should the bulls reclaim $0.286 and trigger a daily close above, momentum could swiftly accelerate towards the $0.290 and $0.30 zones, thus validating the recent breakout narrative. 🚀

Should this movement coincide with an uptick in whale activity or stablecoin inflows, one might expect broader market confidence to follow, potentially propelling the price even higher. In such a scenario, $0.32 becomes a feasible short-term extension. 🌟

However, if the price continues to linger below $0.286 without new volume or catalyst support, consolidation may extend. A breakdown below $0.275 would pave the way to $0.268, particularly if momentum metrics like MACD and RSI continue to weaken. 😬

As it stands, TRX maintains a neutral-bullish structure, yet time is of the essence for buyers to defend the trend. The forthcoming 48–72 hours shall likely dictate whether TRX rallies or succumbs to a deeper correction. ⏳

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-06-12 15:25