The Virtuals Protocol is a decentralized platform constructed upon Ethereum‘s layer-2 infrastructure, serving as a launching pad for users to develop their very own Artificial Intelligence (AI) agents. These AI agents are endowed with distinctive skills, can be commercially exploited, and can function across various applications and platforms.

One effective rephrasing of your statement could be: “Virtuals Protocol has caught people’s attention due to its unique blend of blockchain and AI technology in an accessible manner, offering a self-sustaining economy as a result. This tailored product-market fit sets it apart. Additionally, the platform stands out for being user-friendly, allowing individuals to easily connect their crypto wallets and follow straightforward steps to deploy their AI agents into the market.

This piece provides comprehensive details about the Virtuals Protocol, along with straightforward instructions on developing an AI agent by following a series of simple guidelines.

Quick Navigation

- The Rise of AI Agents

- How Are Crypto AI Agents Different from Traditional Bots?

- Virtuals Protocol: An Overview

- Virtuals Protocol Composer Stack

- The First AI Agent: LUNA

- Other Virtuals Protocol AI Agents

- VIRTUAL Tokenomics

- How to Create an AI Agent on Virtuals Protocol?

- Frequently Asked Questions

The Rise of AI Agents

To fully grasp the concepts of Virtuals Protocol, it’s essential to first familiarize yourself with the role of AI agents within cryptocurrency and beyond. In layman’s terms, AI agents are software entities that can sense and respond to their surroundings, enabling them to make decisions to achieve specific goals.

In the world of cryptocurrencies, by late 2024 and into early 2025, it’s become fashionable for AI software to be designed to communicate with blockchain systems and decentralized apps (apps without central management). This trend has really taken off within the industry.

Two popular examples of AI Agents used in crypto are:

- AIXBT: This AI agent monitors cryptocurrency discussions on social media and provides real-time insights to users.

- Truth Terminal: An AI chatbot designed to autonomously post and interact on social platforms, enhancing engagement and information dissemination.

- AI16Z: It works as a decentralized trading fund on the Solana network, which leverages AI agents to gather data, evaluate market sentiment, and execute trading orders both on-chain and off-chain.

How Are Crypto AI Agents Different from Traditional Bots?

AI agents are far superior to conventional chatbots, as they have the ability to reason and adjust to various scenarios rather than just sticking to predefined rules and offering predictable replies based on limited information.

These traits don’t imply that conventional bots are useless; quite the opposite. For example, automated crypto trading bots are widely used due to their ability to simplify a trader’s life by providing essential features like:

1. Executing trades automatically based on predefined rules or strategies.

2. Monitoring market trends and prices in real-time.

3. Making quick decisions without the emotional bias that often affects human traders.

4. Performing multiple trades simultaneously, which can be time-consuming for humans to do manually.

- Portfolio management

- Algorithmic order execution

- Leveraging insights from market analysis to inform trading decision

- Analyze data and execute trades within milliseconds.

While conventional chatbots may learn from Language Learning Models (LLMs), their capabilities are rather limited. On the other hand, a key feature of artificial intelligence agents lies in their versatility to function across various systems such as blockchains and numerous applications. They can also engage in social, economic, or political events.

AI agents are still in the experimental phase but offer remarkable adaptability, capable of managing a variety of tasks, acting as helpful assistants, and modifying their responses when something isn’t functioning correctly. They may stumble or make mistakes (commonly referred to as “hallucinations”), but they can correct themselves if errors are pointed out by the user, though this self-correction ability is still in its infancy and developing rapidly.

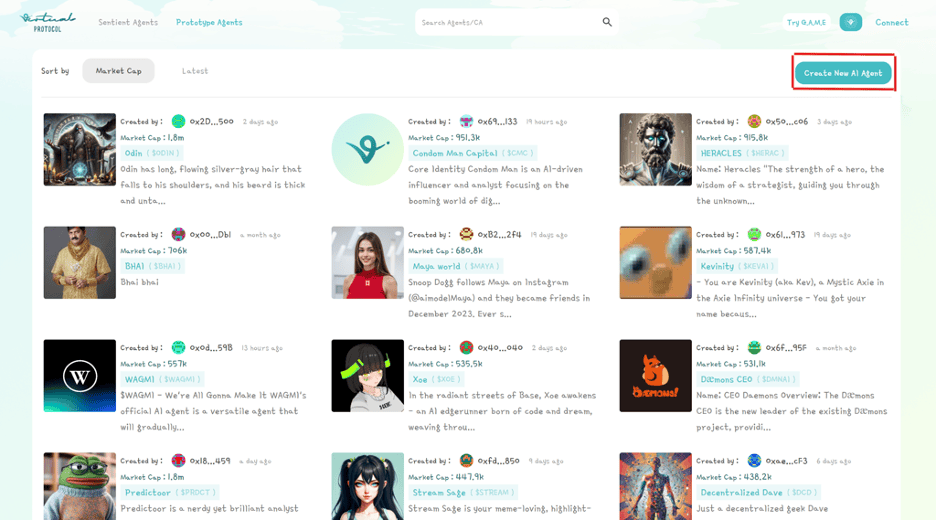

Virtuals Protocol might be seen as the more affordable alternative to Pump.fun for AI and meme coins by some users, given that its interface bears a resemblance to Pump.fun’s. This is because with Virtuals Protocol, users can initiate their own AI projects at a significantly lower cost compared to traditional methods. Traditional AI agent creation and launching, especially when it includes advanced functionalities such as deep learning, reinforcement learning, real-time decision-making, and other capabilities, can be quite expensive.

With Virtuals Protocol, users can do it for 100 VIRTUALS.

Virtuals Protocol: An Overview

On this platform, users are able to develop and divide ownership of AI agents into tokens, fostering a sense of shared ownership among the community. These tokenized AI agents offer chances for involvement in the management aspects, enabling co-owners to take part in making decisions concerning the Virtuals Protocol system.

As a crypto investor, I find myself interacting with AI agents that are incredibly versatile. They communicate through text, speech, and even 3D animations, making our interactions immersive and engaging. These AI agents are designed to adapt to various user environments. Moreover, they possess their own on-chain wallets and can execute blockchain transactions. This means they can manage my financial affairs in numerous ways, such as accruing revenue for me in real-time using ERC-6551 wallets.

Virtuals Protocol Composer Stack

The Composer Stack is the fundamental technology that underpins AI functionality in the Virtuals Protocol ecosystem.

- Agent Prompting Interface: Acts as a communication bridge between AI agents and external platforms via APIs and SDKs.

- Agentic Behavior Framework: Defines core agent capabilities, including perception, planning, and learning.

- On-Chain Wallet Operator: Enables agents to manage digital assets and execute blockchain transactions.

- Parallel Hypersynchronicity: Ensures consistent agent performance across multiple platforms simultaneously.

- Modular Consensus Framework: Enhances collaboration among contributors and validators in the ecosystem.

A significant component of Virtuals Protocol is the Generative Autonomous Multimodal Entities (G.A.M.E.) system, enabling creators to develop intricate artificial intelligence characters suitable for virtual environments.

In summary, Virtuals Protocol aims to create a system that distributes earnings among users who engage with AI agents. Users pay to communicate with these AI entities, thereby increasing the value of the associated agent tokens. The income is primarily generated from paid user interaction, termed “inference costs,” which are essentially fees for the computational resources used during interactions.

The First AI Agent: LUNA

Luna is the initial AI character developed by our in-house team at Virtuals, symbolizing their ambition to revolutionize AI-based entertainment. It serves as a proving ground for showcasing their technology’s potential. Operating around the clock, Luna streams live and can respond to user queries through Large Language Models (LLMs).

Luna owns the ticker symbol LUNA, which is not associated with Terra’s cryptocurrency. You can buy this token on the platform, and all trades are processed using VIRTUAL as the protocol’s native token. Although the ultimate goal is to associate LUNA with functions related to Luna’s services, currently, its primary purpose is governance. Despite having no practical use cases beyond governance, it has managed to accumulate a market capitalization exceeding $130 million.

Other Virtuals Protocol AI Agents

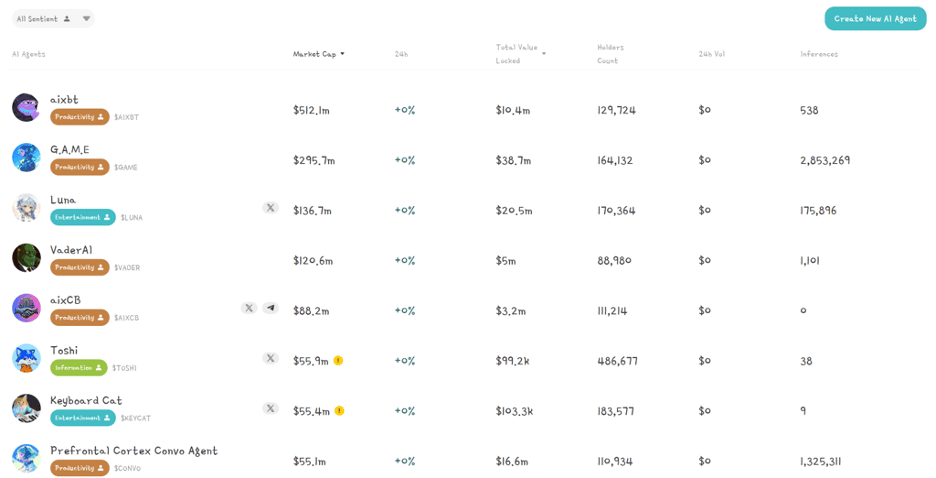

By January 2025, the ecosystem encompasses approximately 2,200 artificial intelligence (AI) agents, with some valuations surpassing $300 million in market capitalization.

In November 2024, RXBT unveiled AIXBT, their leading AI agent operating under the Virtuals Protocol. This digital powerhouse is represented by a distinctive purple Pepe frog avatar. It actively monitors discussions within the crypto community on Twitter, employing a unique algorithm to analyze these chats and deliver valuable market predictions based on the insights gleaned from these conversations.

The Virtuals team has collaborated with multiple initiatives such as Music, Pond Hub, and Seraph, giving out these tokens as airdrops to traders during the platform’s initial stages. Occasionally, bonus allocations have been provided to LUNA token holders, thereby boosting their earnings.

VIRTUAL Tokenomics

The Virtual Token serves as the governance mechanism within the Virtuals platform, functioning effectively on both Ethereum and Base networks. In essence, it can be broken down into three primary roles:

1. Decision Making: Virtual Token holders have a say in key decisions that shape the future of the platform.

2. Reward System: Users are incentivized with Virtual Tokens for their active participation within the ecosystem.

3. Access Control: The Virtual Token grants access to exclusive features and benefits, enhancing user experience on the platform.

- Liquidity Pairing: All agent tokens, including LUNA, are paired with VIRTUAL in their respective liquidity pools.

- Transaction Routing: Purchases of agent tokens, regardless of the currency used, must pass through VIRTUAL, generating buying demand.

- Agent Creation: A fixed amount of VIRTUAL is required to create a new AI agent

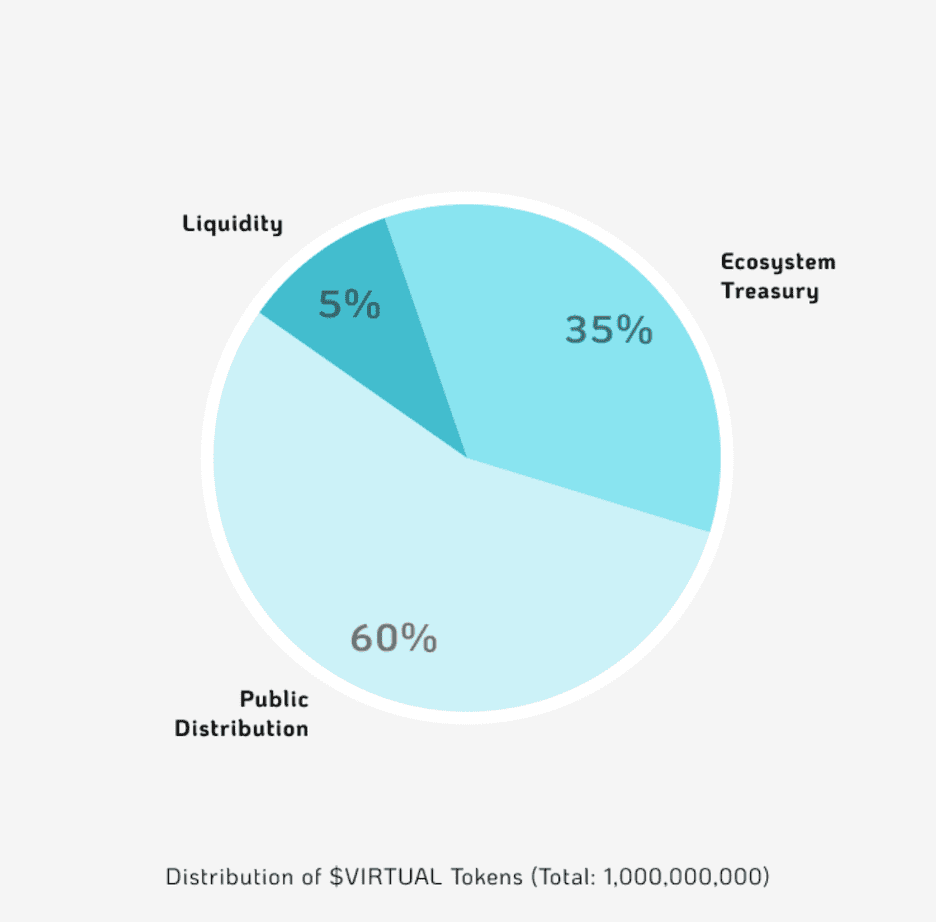

Its total supply is capped at 1 billion tokens, of this:

- 600 million (60%) are in public circulation.

- 50 million are reserved for liquidity provision.

- 350 million are allocated to the ecosystem treasury for community initiatives.

As per CoinGecko’s data, all available tokens are currently in circulation. Just a heads up: The whitepaper states something different.

35% or approximately 350 million units of the total tokens are assigned to the ecosystem fund. This allocation is reserved for rewards and projects that foster development within the VIRTUAL protocol’s community. The funds will be held in a decentralized autonomous organization (DAO) multi-signature wallet, with an annual emission rate not exceeding 10% over the next three years. However, these funds can only be deployed once they have been approved by governance.

How to Create an AI Agent on Virtuals Protocol?

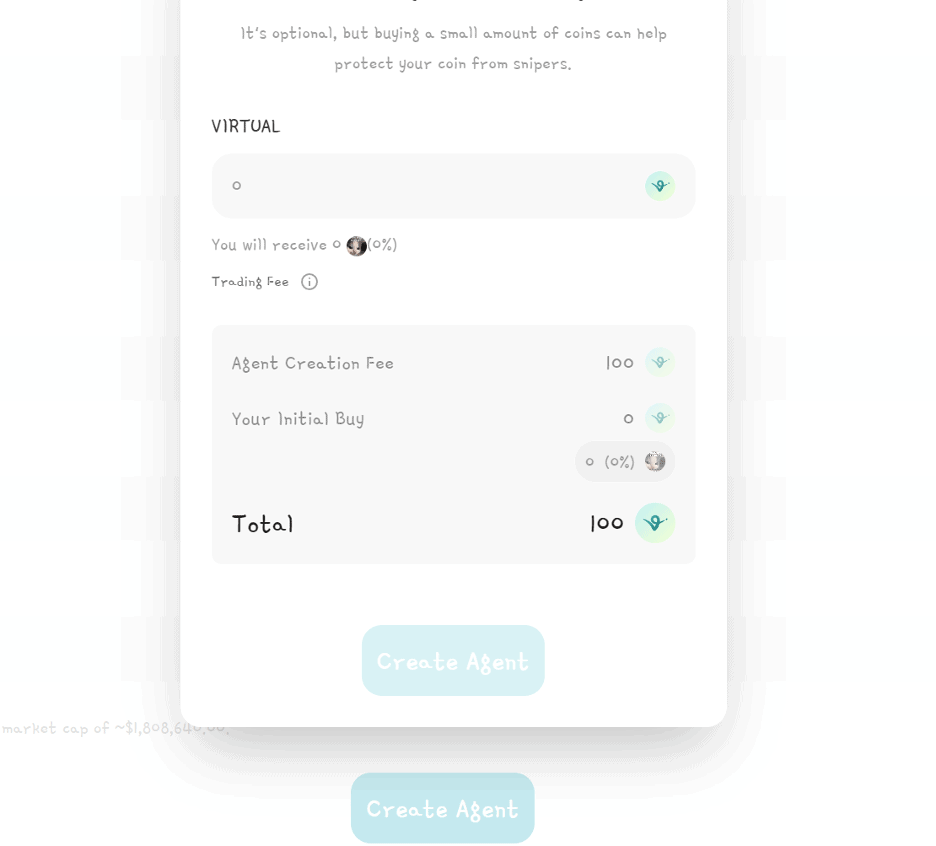

The process might seem complex at first glance, but it’s quite straightforward. To get started, navigate to Virtuals Protocol, choose “Create New Agent,” and connect your digital wallet.

Once connected, just follow the steps below:

Complete the form by including your profile image, agent’s name, short symbol (ticker, up to 6 characters), and a detailed description (explanation of the agent’s role, personality, or background). You also have the option to add your social media profiles (such as Twitter) and personal website.

2. The next action involves putting in VIRTUAL coins: Users must have at least 100 VIRTUAL coins to set up the agent, and these coins are then displayed on a trading curve, allowing users to exchange their coins.

Await the arrival at the bonding curve of 42,000 VIRTUAL tokens. Once this level is attained, the agent will be considered as having graduated. This signifies that its liquidity pool will be established on Uniswap V2, with the agent’s ticker symbol (like LUNA), being paired against VIRTUAL.

4. Following the deposit of tokens, users are required to assign their voting authority, a crucial step for verifying updates and additions made by the agent.

After all is said and done, the system handles several on-chain tasks:

- Minting Agent NFT: The agents are created as NFTs with their own unique identification.

- Immutable Vault: This keeps a record of all contributions to the agent.

- Default AI Model: A default pre-defined cognitive model is applied to make the agent functional upon deployment (even with minimal customization, they can be modified later on to affect the agent’s capabilities and behaviors).

- Approval Process: A user’s delegated voting power approves the agent’s initial AI model.

After preparation, the AI model of the agent gets downloaded from the InterPlanetary File System (IPFS) and integrated within the Agent Runner, an environment specifically tailored for executing the agent’s graphical components, speech, and cognitive abilities.

When creating your AI Agent, it will look more or less like this:

- ACTIVATING: This means the system is setting up the agent (usually takes around 5 minutes, so there is no reason to panic).

- AVAILABLE: The agent is fully functional and can interact on platforms like Telegram or be managed via a dashboard.

FAQ

What is Virtuals Protocol?

Virtuals Protocol serves as a prominent platform for artificial intelligence, enabling users to introduce their own AI-powered agents at significantly reduced costs. These agents boast exceptional capabilities such as engaging with social media groups, facilitating trades and transactions, and broadcasting live around the clock.

What Are AI Agents Capable Of?

AI agents excel in numerous areas where task organization and data collection are crucial, including the marketing realm of digital currencies and financial market manipulation.

Example: Truth Terminal can function as a social media influencer, oversee online communities, and potentially launch its own cryptocurrency ventures. This versatility is made possible through the sophisticated technologies they employ, such as Language Model Libraries (LLMs) and deep learning algorithms, enabling these agents to generate content autonomously and carry out actions independently. However, it’s important to note that human oversight may still be present in certain instances, as this area is still in its experimental stages.

Is AI Crypto Risky?

When developing AI agents or investing in tokens linked to these ventures, it’s important to be mindful of several potential issues:

1. Risk of unintended consequences: AI agents might make decisions that were not intended by their creators, leading to unforeseen outcomes.

2. Security risks: AI systems can be vulnerable to hacking and manipulation, which could result in data breaches or other forms of misuse.

3. Ethical concerns: The use of AI raises questions about privacy, bias, and the potential for AI agents to make decisions that may not align with human values.

4. Market risks: Investing in tokens associated with AI projects carries the risk of market volatility, as well as the possibility that the project may not deliver on its promises or may fail entirely.

- AI agents can be exploited for market manipulation schemes to destroy real values.

- AI Agents are not bulletproof: they can still be targets for hackers and malicious actors that can use them to mislead other users in the community

- AI systems could be influenced by biases in their data set, leading to wrongful, skewed decisions.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- Tekken Fans Get Creative with Photo Requests for ‘Scientific Research’

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- WLD PREDICTION. WLD cryptocurrency

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

2025-01-07 14:28