As someone who has been immersed in the world of cryptocurrencies for several years now, I must admit that Hyperliquid has caught my attention. With its unique blend of CeFi and DeFi elements, it offers an unparalleled trading experience that’s both high-performance and user-friendly.

Having witnessed the rise and fall of numerous DEXes in the past, I can confidently say that Hyperliquid stands out from the crowd with its innovative features such as scale orders, pre-launch token trading, decentralized order books, and more. These features not only reduce slippage but also enhance price efficiency, making it a go-to platform for traders who value speed and liquidity.

Moreover, as someone who has always appreciated the power of democratization in finance, I’m particularly impressed with Hyperliquid’s approach to market making through liquidity vaults. This allows everyday investors like myself to participate in the creation of financial products and potentially earn returns on their investments.

However, it’s important to remember that no platform is without its risks. Recent security concerns surrounding DPRK hackers testing Hyperliquid’s trading platform have raised eyebrows, and the reliance on a small number of validators for transaction approval could be a potential vulnerability. But so far, the platform has managed to avoid any exploits or attacks.

All in all, I believe that Hyperliquid is a promising DEX that’s worth keeping an eye on. Its commitment to innovation and its user-centric approach make it an exciting addition to the perpetuals trading ecosystem. And who knows, maybe one day we’ll see Hyperliquid become as synonymous with futures trading as Binance is with spot trading.

Oh, and let me tell you a little joke: Why did the trader cross the road? To get to the other side of the chart! (Yes, I know it’s corny, but it made me chuckle.)

Swiftly rising to fame, Hyperliquid now stands as one of the most favored decentralized platforms for crypto trading. Its user-friendly design, combined with traditional trading functionalities and the inherent advantages of decentralization, has earned it widespread appeal among numerous traders.

Let’s explore how Hyperliquid sets itself apart from current options, examining its design, economic model, and other key aspects in this overview.

Quick Navigation

- What is Hyperliquid?

- Exploring Hyperliquid’s Features

- Hyperliquid: Technicals

- HyperEVM: Full Ethereum Compatibility

- HyperBFT: Hyperliquid’s Consensus Algorithm

- The HYPE Tokenomics

- HYPE Token Allocation

- Hyperliquid Airdrop

- How Safe is Hyperliquid?

- What Makes Hyperliquid Unique?

- Low Slippage with Decentralized Orderbooks

- Cross-Chain Bridging Capabilities

- Founders of Hyperliquid

- Hyperliquid Main Competitors

- GMX

- dYdX

- Jupiter Perps

- Frequently Asked Questions

- What is Hyperliquid and how does it work?

- What makes Hyperliquid different from other decentralized exchanges?

- Is Hyperliquid safe?

- Final Thoughts

What is Hyperliquid?

Hyperliquid is a unique decentralized exchange, as it operates on its self-developed blockchain, setting it apart from many other platforms in the market. This platform allows users to trade crypto-based perpetual futures contracts, much like centralized exchanges, without requiring ownership of the underlying assets.

One of the key attractions of Hyperliquid lies in its advanced yet easy-to-use trading platform, which boasts lightning-fast speeds, rich features, low latency, and a seamless user experience. It’s unique in that it harmoniously blends aspects of traditional finance (Centralized Finance or CeFi) with the innovative world of decentralized finance (DeFi).

This platform accommodates numerous types of digital currencies including Bitcoin, Ethereum, Avalanche, Solana, Sui – essentially any you can think of. It boasts such extensive support for cryptocurrencies that specialized data tracking platforms have entire sections dedicated to monitoring its diverse ecosystem. The market capitalization of this platform is approximately $8 billion, primarily attributed to the HYPE token.

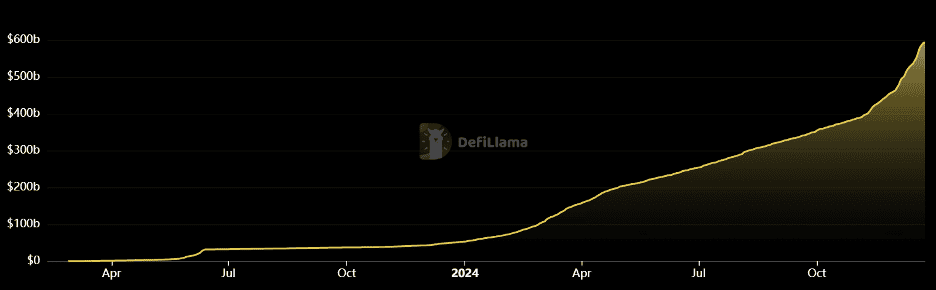

However, the project’s appeal isn’t limited to the number of coins it supports or its user-friendly interface. It provides a wealth of trading features and options that have collectively amassed a staggering perpetuals volume of over $600 billion in just under two years, as demonstrated in the following graph:

(Graph added here)

Exploring Hyperliquid’s Features

The significant increase in Hyperliquid’s Total Value Locked (TVL) and growth of its ecosystem is not merely hype; instead, it can be traced back to the consistent development and deployment of innovative features by their team. Additionally, they introduced novel, intriguing trading instruments that were largely overlooked by other Decentralized Exchanges (DEXs) at that time.

One captivating characteristic of Hyperliquid lies in its potential for crafting stories and occurrences, particularly in financial transactions. For example, users can engage in trading indexes, pre-launch tokens, or even the trendy meme-based coins. Notably, Hyperliquid is among the pioneering decentralized exchanges (DEXs) to offer memecoin trading on its system.

This Decentralized Exchange (DEX) is also pioneering the use of scale orders, similar to those widely used in conventional markets. Essentially, it enables users to divide a large order into multiple smaller ones. These are essentially a group of limit orders that gradually adjust their price based on whether it’s a buy or sell transaction. This incremental adjustment makes it easier for the order to execute smoothly and efficiently.

In addition to providing scale orders, Hyperliquid offers similar features you’d find on a Centralized Exchange (CEX). This includes market and limit orders, take profits, stop losses, cross-margin options, and the ability to leverage up to 50 times, depending on the asset. Distinctively, it also has Hyperps, which are unique to Hyperliquid and operate similarly to standard perpetuals. Unlike regular perps, they don’t necessitate spot or index price data from an oracle.

As a seasoned trader with years of experience under my belt, I can confidently say that many of today’s decentralized trading platforms already incorporate several of those features. However, what sets Hyperliquid apart is its impressive technical prowess. Let me explain why it has caught my attention.

Hyperliquid’s innovative approach to decentralized trading resonates with my desire for seamless, efficient, and secure transactions. Its unique blend of cutting-edge technology and user-friendly interface makes it stand out in a crowded market. I believe that Hyperliquid has the potential to revolutionize the way we trade in the digital space, and I’m eager to see how it evolves in the future.

Hyperliquid: Technicals

The team operates a blockchain under its name, which is made up of HyperEVM and HyperBFT. These two protocols enable Hyperliquid to offer smart contracts that are compatible with Ethereum, along with the speed and dependability of a self-designed layer-1 (L1). This makes it an ideal choice for rapid trading and developing DeFi projects.

HyperEVM: Full Ethereum Compatibility

HyperEVM functions as a built-in Ethereum Virtual Machine on the Hyperliquid Layer 1 (L1). Unlike separate EVM implementations, it shares the same consensus layer, HyperBFT, with which it operates.

HyperEVM has three key characteristics:

- Native Integration: HyperEVM smart contracts can interact directly with Hyperliquid’s core functionalities, including on-chain spot and perpetual futures order books, streamlining the interaction between EVM-based applications and the platform’s trading infrastructure.

- Enabled Execution Model: Hyperliquid’s execution model enables the L1 and HyperEVM to operate sequentially, so the EVM can access the state of the 1 blockchain from the previous block and submit actions for the next block. As a result, it delivers predictable and consistent operations.

- Token Standards and Liquidity: ERC20 tokens on HyperEVM are fungible with their corresponding native assets on Hyperliquid’s L1. This allows users to trade tokens with minimal fees and access deep liquidity while also using these tokens in EVM-based decentralized applications (dApps).

HyperBFT: Hyperliquid’s Consensus Algorithm

HyperBFT represents a unique consensus mechanism developed by Hyperliquid, modeled after the Hotstuff protocol. This mechanism aims to cater to the requirements of fast-paced trading activities, all while preserving system security and uniformity throughout the network.

HyperBFT is characterized by three main features.

- High Performance: Block confirmation times under one second, while median latency is 0.2 seconds, with 99th percentile latency at 0.9 seconds. This allows the platform to process over 200,000 transactions per second, with scalability potential exceeding 1 million orders per second as optimizations progress.

- Byzantine Fault Tolerance (BFT): As the name suggests, HyperBFT can tolerate up to one-third of malicious validators while maintaining consensus, ensuring robust security even in adverse conditions.

- Shared State Across Environments: Both the L1 and HyperEVM share the same state and data availability layers, maintaining consistency and synchronization throughout the ecosystem despite operating in separate execution environments.

In essence, the primary reason why traders and developers are attracted to Hyperliquid is its unique, unified ecosystem designed specifically for sophisticated financial applications and novel trading possibilities. For developers, this platform offers the advantage of Ethereum-compatible smart contracts, coupled with low latency, high data processing capacity, and substantial on-chain liquidity. This makes Hyperliquid more than just a Decentralized Exchange (DEX); instead, it appears as an efficient platform for constructing advanced trading instruments and decentralized applications, all under one roof.

The previously mentioned deep liquidity within the chain operates using a mechanism the team calls “Vaults.

How do these vaults work?

- Users can deposit funds into a vault and start copy trading to earn a share of the P&L. The community can provide collateral for liquidation or market-making strategies and share in the P&L.

- Users can start their own vaults with a minimum of $100 and set their parameters. Users’ position and full trade history are public. Plus, it’s non-custodial, with withdrawals available after a determined lock-up price.

In contrast to many standard procedures, this method stands apart due to its unique distribution of characteristics, typically exclusive to exchange intermediaries or high-tier market makers. However, the risk associated with these vaults mirrors that of other vaults; should traders experience increased profitability or if the market-making strategy falters, the return will diminish accordingly.

The HYPE Token: Tokenomics

On Hyperliquid’s platform, the native cryptocurrency, HYPE, serves as the backbone, facilitating various functions within the ecosystem such as decentralized governance, economic rewards, and transaction fees. By possessing HYPE tokens, users gain the ability to engage in decision-making processes and contribute to shaping updates and modifications through governance structures.

Additionally, HYPE tokens can provide returns through staking and simultaneously enhance the network’s security. For traders, this token comes with tangible advantages such as discounted transaction fees when transacting within the platform.

HYPE Token Allocation

Hyperliquid’s distribution plan was straightforward, emphasizing its community heavily as a means to encourage lasting development: it aimed at fostering long-term growth by prioritizing the community.

- 38.88% for future emissions and community rewards

- 31% for the genesis airdrop

- 23.8% for contributors

- 6% for the Hyper foundation

- 0.3% for community grants

Hyperliquid Airdrop

On November 29, 2024, Hyperliquid distributed its native token, HYPE, to approximately 100,000 eligible users through an impressive airdrop event. Many experts in the field believe that this move set a new benchmark for future airdrops. This generous distribution represented a significant value, with each average allocation estimated to be worth between $45,000 and $50,000, making it one of the most financially rewarding airdrops ever held.

Subsequently, unlike conventional airdrop practices where large quantities of tokens are distributed to venture capitalists (VCs), Hyperliquid deviated from this pattern. Instead, they prioritized their community, with 76.2% of the total token supply allocated for user-focused projects. Moreover, team members were required to wait a year after the token generation event, which took place on November 29, 2024, before receiving their tokens. This approach was taken because Hyperliquid has no private investors.

Without a doubt, this strengthened trust and marked a fresh benchmark for community-oriented token distributions. Contrary to popular trend where tokens tend to plummet following distribution to users, HYPE bucked that trend. Instead, it skyrocketed from $4 to an impressive $35 in the ensuing weeks, while its Total Value Locked (TVL) experienced exponential growth.

Essentially, Hyperliquid opted for quality rather than mass participation when it came to their airdrop, as only about 94,000 individuals qualified. This is significantly lower than the typical range of 500,000 to over a million users that most projects aim for. Even if they had a million participants, the average allocation would still be approximately $5K, which is higher than the industry standard, demonstrating their commitment to quality distribution.

How Safe is Hyperliquid?

As a seasoned investor with over two decades of experience in the financial markets, I have seen my fair share of ups and downs. With that being said, it is crucial to approach every investment opportunity with caution, especially when dealing with decentralized finance (DeFi) platforms like Hyperliquid. While the allure of potential high returns can be tempting, it’s essential to remember that these platforms carry a non-zero risk of failure.

In late 2024, I witnessed firsthand the controversy surrounding Hyperliquid. It all started when security expert Taylor (Tay) Monahan raised concerns about suspicious wallet activity on the platform, alleging that addresses linked to North Korean hackers were being used to test the platform’s vulnerabilities. This was particularly alarming because it involved the Democratic People’s Republic of Korea (DPRK), a country notorious for its cybercrime activities.

Personally, I have always believed in transparency and accountability when it comes to financial transactions, especially those involving potential national security threats. If these allegations are true, it raises serious questions about the platform’s due diligence and security measures. It is crucial for investors like myself to carefully consider such risks before investing in any DeFi platform, no matter how promising they may seem.

In conclusion, while Hyperliquid offers an innovative approach to finance, its association with potential cyber threats should not be ignored. Investors must prioritize security and due diligence when making investment decisions, especially in the rapidly evolving world of DeFi.

The accusations led to a massive withdrawal of funds, far beyond what could be considered a significant sell-off. In just 30 hours, over $256 million was taken out from the platform, and the price of HYPE token dropped about 25%. By December 23rd, the total amount withdrawn had surpassed $502 million, showing a clear trend of investors pulling their money out.

Hyperliquid Labs denied any form of security breach, saying:

Hyperliquid has not experienced any exploitation by the DPRK, or any other party for that matter. The funds of all users remain secure and accounted for.

Their dedication to ensuring security was emphasized, with reference made to their bug bounty initiative and their commitment to abiding by industry norms in the field of blockchain analysis.

At the moment I’m writing this manual, there haven’t been any instances where the protocol has caused problems. Interestingly, the digital wallets linked to North Korean hackers were emptied through the blockchain for approximately $500,000.

What Makes Hyperliquid Unique?

Let’s round up what makes Hyperliquid stand out from its competitors in such a heated market.

Low Slippage with Decentralized Orderbooks

On decentralized trading platforms, high slippage can be a worry for traders because of their dependence on automated market makers (AMMs). To address this issue, Hyperliquid combines aspects from traditional trading platforms and uses a decentralized orderbook model. This results in more efficient price matching, increased transparency, and substantially less slippage—even during unpredictable market conditions.

Cross-Chain Bridging Capabilities

With Hyperliquid, users are enabled to conduct inter-chain transactions throughout the whole network. This empowers you to move digital currencies between various blockchains, including Ethereum, Solana, Arbitrum, Avalanche, and Binance Smart Chain.

There are several bridges to choose from:

- Arbitrum Bridge: The native Arbitrum bridge is the primary option if you want to transfer USDC from Arbitrum to Hyperliquid without transfer fees. While highly safe and free, it’s limited to Arbitrum.

- Synapse: A popular bridge that works with Ethereum, Base and Solana, allowing you to transfer crypto from around 20 blockchains with minimal fees.

- HyBridge: Hyperliquid’s community-developed protocol, which records millions of transactions daily. It supports transfers from seven blockchains, including Ethereum, Optimism, and Avalanche, to Hyperliquid

Founders of Hyperliquid

Hyperliquid was jointly established by Jeff Yan, who initially worked at Hudson River Trading before launching Chameleon Trading, a market-making business. Known for his frequent activity on social media, Yan has participated in multiple conferences and been featured in well-known cryptocurrency podcast discussions.

In many decentralized finance (DeFi) projects, the majority of team members choose to remain unidentified or use aliases to safeguard their personal information. For example, Hyperliquid was established by Iliensinc, while Xulian HL (@KingJulianIAm on X) is recognized as a key contributor.

Yan and his group have indicated that a significant number of contributors to Hyperliquid are affiliated with institutions such as MIT, Harvard, and Hudson River Trading.

Hyperliquid Main Competitors

Although it’s innovative, Hyperliquid faces tough rivalry from other platforms. Here are some leading decentralized exchange giants that are making a significant impact on the derivatives market.

GMX

GMX stands out as one of the oldest and most expansive Decentralized Exchanges (DEX), specializing in both immediate and continuous futures trading for a variety of digital currencies. Similar to Hyperliquid, traders can engage in transactions involving Bitcoin, Ethereum, Solana, among others, with up to 50 times the leverage.

At GMX, the fees vary based on the type of transaction you make. Opening or closing a position will incur a fee of 0.1%, while swap transactions can range from 0.2% to 0.8%, with the exact percentage depending on the influence of your pool balance. It’s worth noting that GMX V2 offers reduced fees, ranging from 0.05% to 0.07% for positions and standard token swaps. When it comes to stablecoin swaps, the cost is between 0.005% and 0.02%.

dYdX

As a researcher delving into the dynamic world of decentralized finance, I can confidently assert that DYdX stands out as a trailblazing Decentralized Exchange (DEX), particularly renowned for its innovative Perpetual Futures Contracts and margin trading solutions. By December 2023, this platform had accumulated an astounding total trading volume exceeding one trillion dollars.

Although dYdX has achieved notable success, it adopts a more cautious strategy by providing a maximum leverage of only 20 times for certain cryptocurrencies. The primary attractions of this platform lie in its low fees (at 0.02% and 0.05%) and its advanced trading features combined with a user-friendly interface, making it highly appealing to users.

It was built on the Ethereum blockchain before transitioning into its own chain, the dYdX Chain.

Jupiter Perps

In 2022, Jupiter Perps was introduced as a decentralized exchange (DEX) and liquidity aggregator built on the Solana blockchain. Not only is it quick, but it’s also particularly favorable for aggressive traders, offering them the opportunity to trade futures contracts with up to 100 times leverage.

On this platform, you’ll find support for assets like WBTC, USDT, USDC, SOL, ETH, and many others. It offers liquidity providers the option to deposit their assets in its vault for yields, with Annual Percentage Yields (APY) ranging from 50% up to over 70%.

Frequently Asked Questions (FAQ)

What is Hyperliquid and how does it work?

Hyperliquid is a well-known decentralized exchange functioning on a self-titled blockchain. It provides an opportunity for perpetual futures trading, much like traditional future contracts.

This protocol integrates aspects of Centralized Finance (CeFi) and Decentralized Finance (DeFi), offering users a high-performing, low-slippage environment that’s easy to navigate. It accommodates numerous cryptocurrencies and offers advanced features like scale orders, Hyperps, copy trading vaults, and resources for DeFi developers.

What makes Hyperliquid different from other decentralized exchanges?

Hyperliquid distinguishes itself by combining its proprietary blockchain with smart contracts compatible with Ethereum, delivering fast transaction rates and substantial liquidity. This integration invites developers to develop their own financial applications within this ecosystem.

Additionally, it offers sophisticated trade options such as scaling orders, presale token trading before launch, and decentralized order books which help minimize slippage and improve pricing effectiveness. The system’s environment includes exclusive tools like Hyperp perpetuals and community-driven market-making tactics via liquidity pools.

Is Hyperliquid Safe?

Although Hyperliquid primarily strives to offer one of the top Decentralized Exchanges (DEXs) available, there have been security issues brought up following tests by North Korean hackers on their trading platform. Additionally, the platform’s dependence on a limited number of validators for transaction approval and the quorum-based system used has instilled apprehension among users.

Despite this, the platform has not suffered any hack or experienced any exploits or attacks.

Closing Thoughts

In the realm of perpetual trading, Hyperliquid stands out by boldly exploring riskier opportunities where many opt for a more cautious approach.

As a seasoned trader with years of experience under my belt, I find the most appealing aspects of this protocol to be its intuitive and uncluttered user interface (UI) and the extensive array of trading options it offers. What truly sets it apart are unique features such as Scale Orders, Hyperps, and their proprietary copy trading system. These additions not only enhance the overall user experience but also provide a level of customization that caters to my specific trading needs and strategies. I believe this protocol is a game-changer for traders like myself who value simplicity, flexibility, and innovative solutions in one platform.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- XRP, Solana Caught in a Squall: CME’s Leaked Plan Rocks the Seas!

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- Persona Players Unite: Good Luck on Your Journey to the End!

- Chris Brown Files $500M Defamation Suit Against Warner Bros. Over Documentary

- Rabbit Trap Needs More Than Technical Razzle Dazzle

- How Sim Racing Might Have Literally Saved a Life!

- Granblue Fantasy: Players Crave More Content, Hope for a Sequel

2025-01-01 16:24