Ah, Bitcoin! The drama queen of the crypto world is back in the spotlight, not just because it’s flirting with its all-time high, but also due to some behind-the-scenes shenanigans. Recently, a strategy (yes, that’s a thing) decided to splurge on 4,020 BTC for a cool $427 million. Talk about a shopping spree! 🛒 But hold your horses, because the market is as divided as a family at Thanksgiving. While Bitcoin is strutting its stuff above $109k, investors are playing detective with on-chain trends, liquidation data, and whale movements. 🕵️♀️

Smart Money vs. Retail Money? 🤷♂️

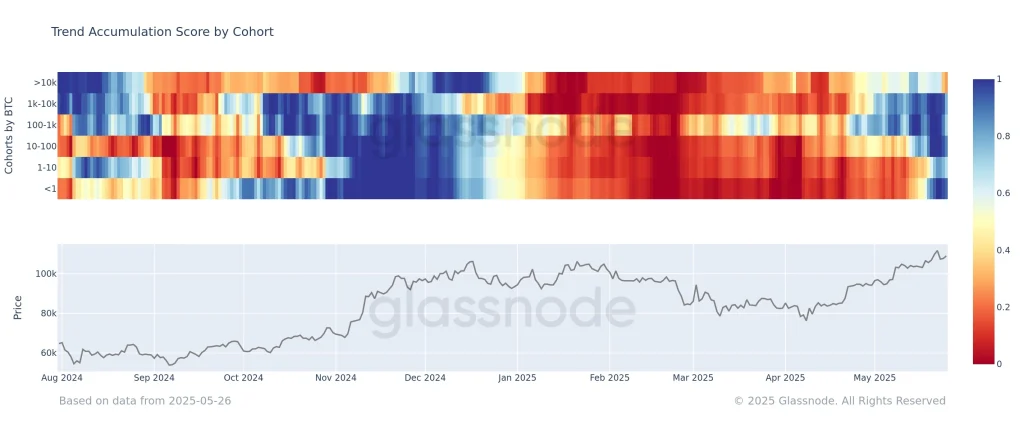

According to our friends at Glassnode, there’s been a dramatic plot twist! The big players (those with more than 10k BTC) have decided to distribute their wealth like it’s a holiday party. Their score? A measly 0.3. This is a far cry from earlier this year when whales were hoarding BTC like it was the last slice of pizza. 🍕

Meanwhile, the smaller fish (1k to 10k BTC holders) are also slowing down, while the wallets with 10 to 100 BTC and those with less than 1 BTC are on a shopping spree. It’s like watching a game of musical chairs, but the music is just a sad violin. 🎻 Retail investors are buying the dip, while the whales are either cashing out or preparing for a wild ride ahead.

What Does the Liquidation Heat Map Say? 🔥

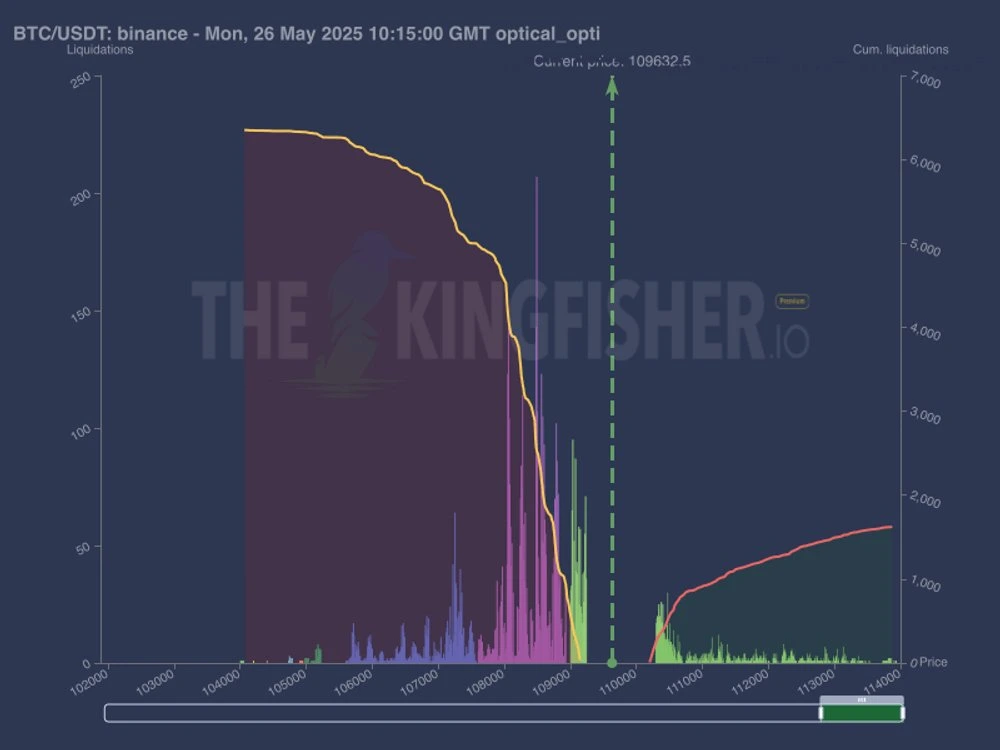

Now, let’s consult the liquidation map by Kingfisher, which is basically the crystal ball of crypto. With Bitcoin chilling around $109k, there’s a hefty pile of long liquidations just waiting to happen below the $109k, $108.5k, and $107k marks. It’s like a trapdoor waiting for someone to step on it! 🚪

Above our dear BTC price, the short liquidation levels are looking a bit weak, which means the chances of an upward squeeze are about as likely as finding a unicorn. 🦄 Correlating this with the distribution by large holders suggests that short-term downside volatility is not just possible, it’s practically guaranteed. But hey, these moves often reset leverage and set the stage for a comeback. 🎭

Bitcoin (BTC) Price Analysis:

Today, Bitcoin is down a tiny 0.40% at $109,222.37, but don’t worry, it’s still basking in a 3.37% gain over the past week. The market cap is sitting pretty at $2.17 trillion, slightly lower than yesterday, while the 24-hour trading volume has skyrocketed to $50.45 billion. The price has been bouncing between $107,609.56 and $110,376.88, showing that short-term volatility is the name of the game. Expect a pullback before we hit that next ATH, which could be around $113k. 🎢

If you’re a hodler, you absolutely MUST read our Bitcoin (BTC) price prediction for 2025, 2026-2030 NOW! 📈

FAQs

1. How much is Bitcoin selling today?

Bitcoin is down a negligible 0.40% to $109,222.37, but trading volume is up 5.77% with an inflow of $50.45 billion. So, it’s like a rollercoaster ride! 🎢

2. What levels should investors watch?

The key levels to keep an eye on are $107k–$109k. If BTC dips here, expect some dramatic reactions from liquidation-driven volatility. Grab your popcorn! 🍿

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

2025-05-27 11:07