What to know:

- SOL block trades accounted for nearly 25% of the total Solana options activity on Deribit last week. 🐋

- Most of the block trades featured put options, which offer downside protection. Because who doesn’t love a safety net? 🤹♂️

- Slowdown in the on-chain activity and the impending unlock weigh over the token’s price like a particularly heavy anvil. ⚖️

In a universe where the SOL token is plummeting faster than a Vogon poetry reading, Deribit’s options market has become a bustling bazaar of bearish bets. Whales are diving deep into the murky waters of put options as the price continues its downward spiral, all while preparing for a multi-billion dollar unlock that could make even the most stoic of traders weep. 😱

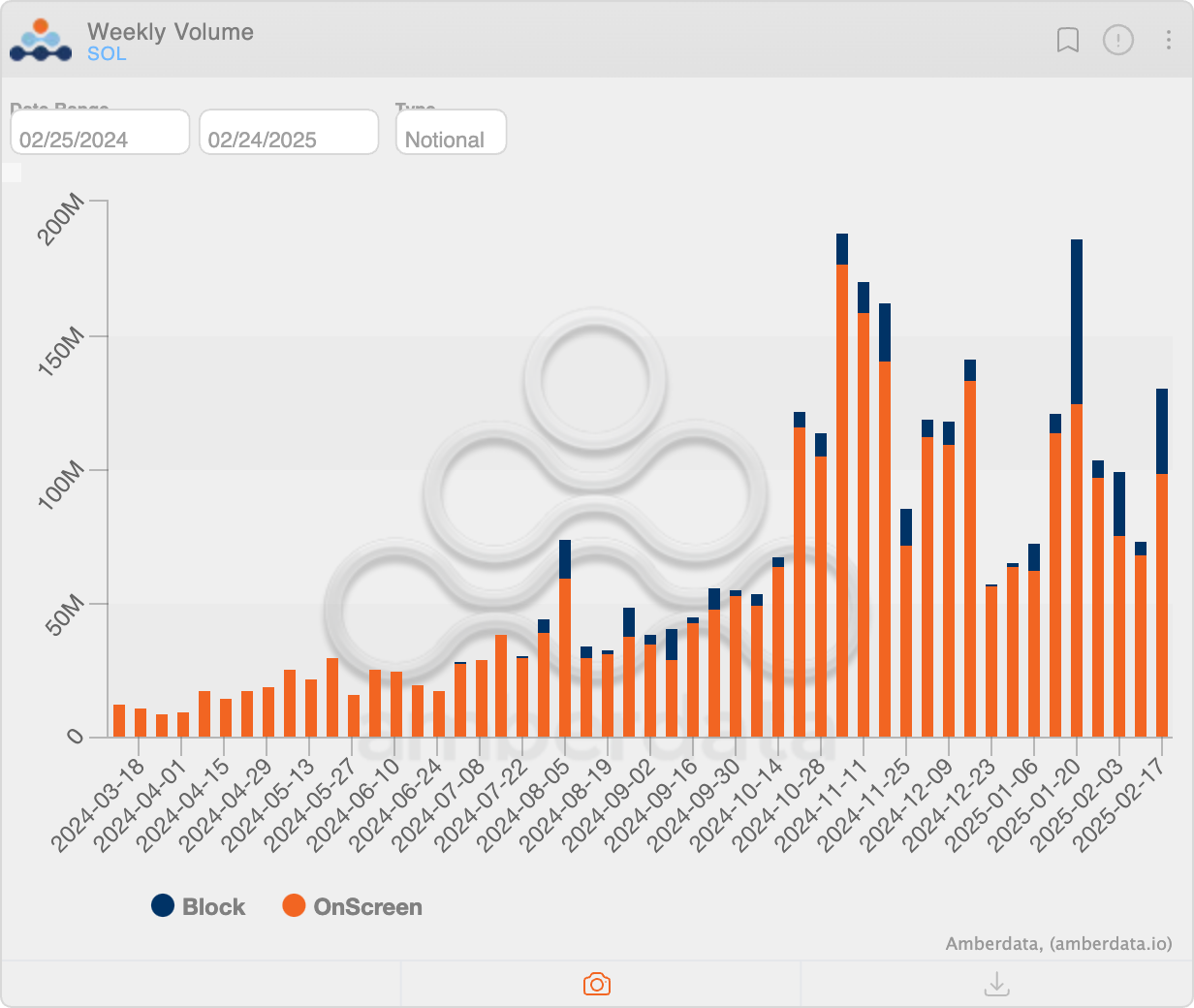

Last week, SOL block trades totaling a staggering $32.39 million in notional value crossed the tape on Deribit, representing nearly 25% of the total options activity of $130.74 million. The rest? Just a smattering of screen trades, according to Amberdata. That’s the second-highest proportion of block trades to total activity on record, which is a bit like winning a gold medal in the Olympics of financial chaos. 🥇

A “block trade” in options is a fancy term for a significant, privately negotiated transaction between two parties involving a large number of contracts. Think of it as a secret handshake between whales, executed over-the-counter and outside the regular order book, allowing for minimal impact on market prices. Because who wants to cause a scene? 🙄

Options are derivative contracts that give the purchaser the right but not the obligation to buy or sell the underlying asset, in this case, SOL, at a preset price on or before a specific date. A call option gives the right to buy, while a put option provides the right to sell. On Deribit, which accounts for over 85% of the global crypto options activity, one options contract represents 1 SOL. Simple, right? Or is it? 🤔

Last week’s spike in SOL block trades featured a preference for put options, which traders use to hedge against or profit from a potential price slide. Because who doesn’t want to profit from disaster? 💸

“Nearly 80% of the block-trade volume was concentrated in put contracts. Compared to only 40% puts for BTC and 37.5% puts for ETH during the same timeframe,” Greg Magadini, director of derivatives at Amberdata, said. Sounds like a party, doesn’t it? 🎉

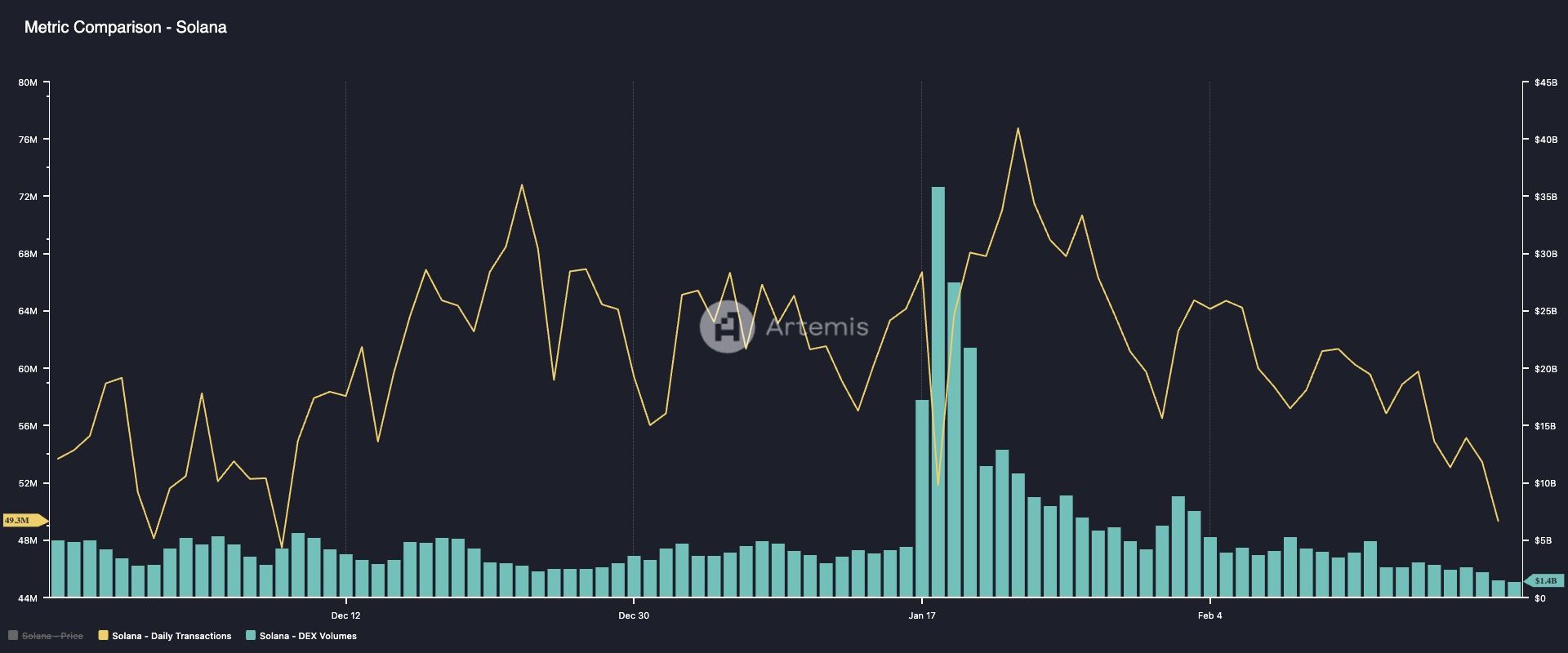

The whale demand for put options comes as SOL’s outlook appears as grim as a rainy day in the middle of a desert, following a 46% price slide to $160 in just over five weeks. The activity on the Solana blockchain, which became a go-to place for memecoin traders last year, peaked with the launch of the TRUMP token on Jan. 17, three days before Donald Trump was inaugurated as the President of the U.S. Coincidence? I think not! 🧐

Since then, the number of daily transactions on Solana and the cumulative daily volume on the Solana-based decentralized exchanges has declined significantly, according to data source Artemis. That has weakened the bullish case for SOL, much like a deflated balloon at a birthday party. 🎈

Plus, the impending SOL token unlock on Jan. 1 presents a significant headwind, per Deribit’s Asia Business Development Head Lin Chen. Because what’s a little market chaos without a token unlock? 😅

“Solana (SOL) will have a major token unlock

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- KPop Demon Hunters: Real Ages Revealed?!

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

2025-02-24 09:21