TL;DR

- Whale purchase of 227.8B PEPE came hours before a sharp rally, triggering a shift in market momentum.

- PEPE breaks trendline after support holds; traders eye breakout retest near $0.00001179.

- 57% of holders are now in profit, reducing selling pressure and boosting market confidence.

Large Whale Purchase Fuels Market Interest

A whale wallet, charmingly identified as 0x06b3, recently spent a modest $2.68 million to purchase 227.8 billion PEPE tokens, according to the ever-reliable blockchain analytics platform Lookonchain. This transaction, which occurred sometime yesterday, has drawn the attention of traders across the market, much like a particularly witty cocktail party anecdote.

Whale 0x06b3 spent $2.68M to buy 227.8B $PEPE 12 hours ago.

— Lookonchain (@lookonchain) July 11, 2025

Following the large buy, PEPE’s price, much to the delight of its holders, went on the offensive alongside the rest of the market and increased to $0.0000127. The token has gained 15% in the past 24 hours and 30% over the last seven days. The buying activity from this wallet has helped fuel bullish sentiment around PEPE, encouraging traders to re-evaluate their positions, or at least their cocktail napkins.

On the technical side, PEPE/USDT formed a pattern where the price rejected the $0.00001 support level three times, creating a strong base. A Break of Structure (BOS) then occurred as the price moved through the descending trendline, confirming a change in direction. This move is being seen as a shift in momentum from bearish to bullish, or as I like to call it, from gloomy to slightly less gloomy.

In addition, if the asset pulls back and holds above this level, it could act as a new support line, much like a well-placed sofa in a drawing room.

On-Chain Data Points to Growing Confidence

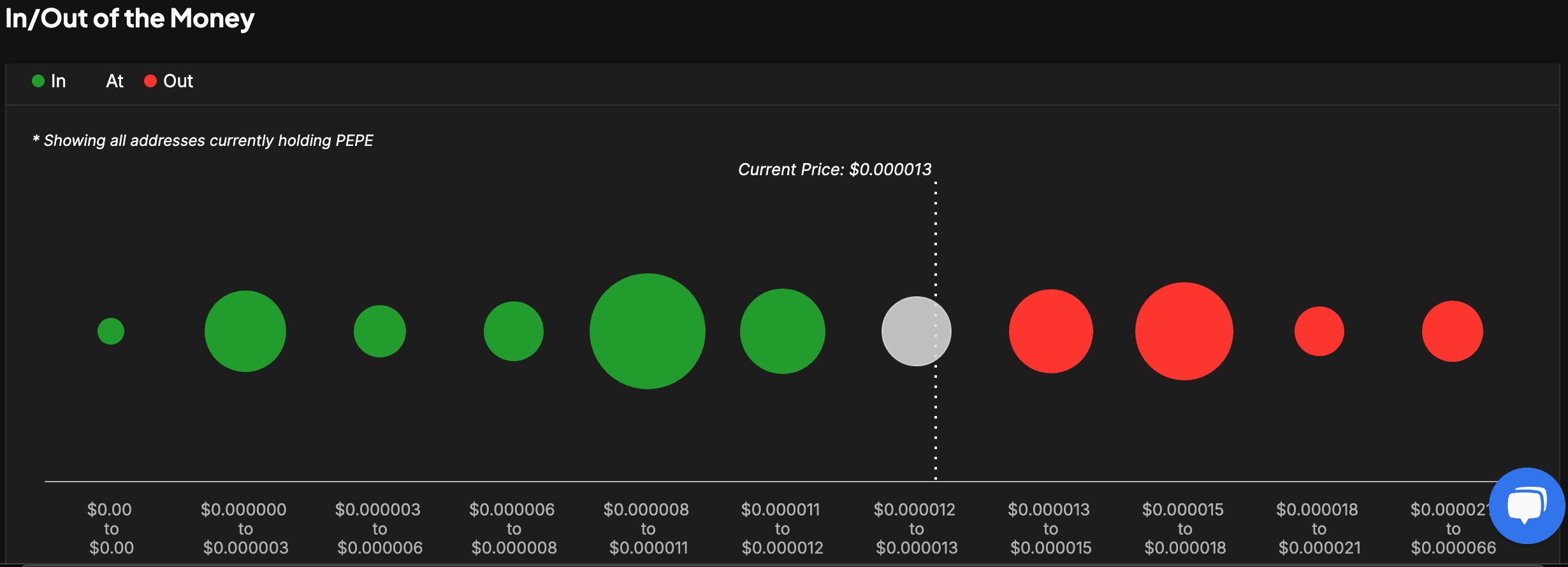

Data from IntoTheBlock shows that 57% of current PEPE holders are in profit, holding around 239.32 trillion tokens worth roughly $3.08 billion. This suggests a lower chance of mass sell-offs from this group, as they are not under pressure to exit at break-even levels. On the other hand, it could result in some profit-taking, especially from investors who have been in the red for a while, much like a guest who overstays their welcome at a dinner party.

A further 6.8% of holders are at the money, with their average entry close to the current price. This group may influence near-term price direction depending on future volatility and market volume, much like a guest who decides to stay for one more drink.

Resistance Zones May Trigger Selling

Meanwhile, around 36% of holders are currently out of the money, with average entries between $0.000013 and $0.000021. As PEPE approaches these levels, this group may begin selling to recover losses, which could slow further upward movement, much like a guest who decides to leave just as the party is getting started.

Despite the current uptrend, traders are monitoring these resistance areas closely. A successful retest of the recent breakout could maintain momentum, but failure to hold support may shift attention back to the $0.000009 zone, much like a plot twist in a particularly engaging novel.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- KPop Demon Hunters: Real Ages Revealed?!

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Come and See

2025-07-11 12:28