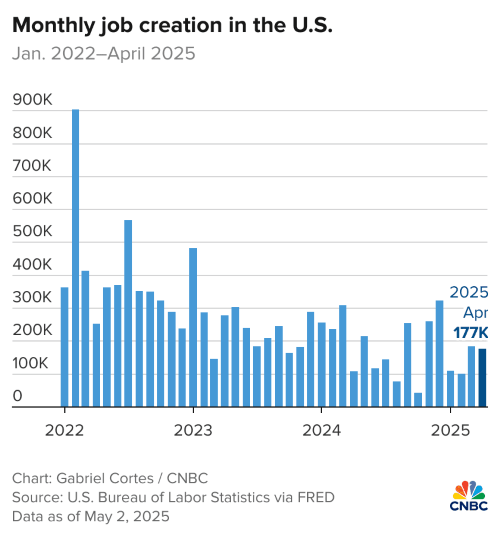

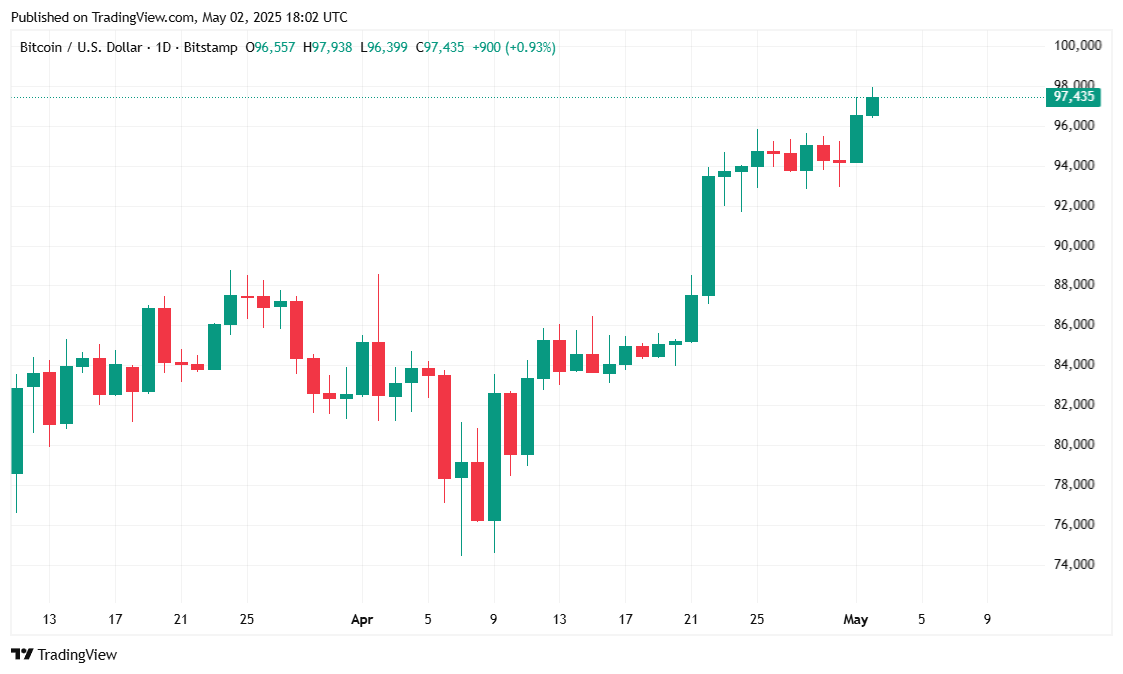

Picture it: 177,000 American souls gainfully employed in April, to the stunned gasps of economists with all the predictive prowess of a weathercock in a hurricane. Wall Street positively swooned, bitcoin pirouetted up to $98k, and somewhere, a hedge fund manager popped a cork. 🍾

Employment Figures Swagger In, Bitcoin Flirts Recklessly With $98K—Scandal Ensues

The U.S. Department of Labor, obviously feeling mischievous, unveiled its jobs report on Friday. Not only did they foxtrot past the glum prediction of 135,000 new jobs, they landed at a joyous 177,000, sparking euphoria in every trading pit from New York to the wild crypto hinterlands. Unemployment, steadfast as a butler at a garden party, remained at 4.2%. Meanwhile, bitcoin (BTC), never one to be left out of the excitement, sidled up to $98K. Exhilarating stuff—if you like your markets shaken, not stirred.

Factset’s star-gazing economists bravely predicted a dreary 135,000 jobs. The government cheerfully ignored them, outpacing expectations by 42,000. The S&P 500, Nasdaq, and Dow Jones all took their cue and jetted up by 1.64%, 1.88%, and 1.50% respectively—a performance that would have won them a standing ovation at the Palladium. And in the crypto corner: Coinmarketcap reveals a modest 0.21% bump, with an impressively bloated $3.04 trillion market cap. One imagines the celebratory monocles being polished as we speak. 🧐

Earlier this week, the Department of Commerce played the role of gloom-monger, telling us the economy had shrunk by 0.3%. On Thursday, as if determined to keep up appearances, the Department of Labor reported 241,000 claims for jobless benefits. President Trump’s tariffs got most of the blame—proving once again that even in economics, there is always a villain in the drawing room. Bitcoin (BTC) wobbled, the Dow blanched. But, true to form, Friday’s robust job numbers rallied the party; suddenly Standard Chartered’s “fresh all-time high” of $120K by midsummer sounds less like late-night banter and more like tomorrow’s headlines.

The ever-dapper Geoffrey Kendrick, head of digital assets research (which surely must mean he wears a tailored waistcoat), cheerfully forecasts: “I look for a fresh all-time high of $120K in Q2. Then onto my $200K end-year forecast.” One wonders if he writes those numbers on birthday cakes. 🎂

Market Metrics—Because Numbers Have Feelings Too

Friday morning saw bitcoin performing an elegant little leap to $97,905.90, before pausing for breath and pirouetting gracefully back to $97,337.50—a sprightly 0.14% improvement over 24 hours, says Coinmarketcap. For those counting every move: the range this week was between $96,222.76 and $97,905.90, with a weekly performance of 1.88%. Much better odds than finding a good martini in Midtown.

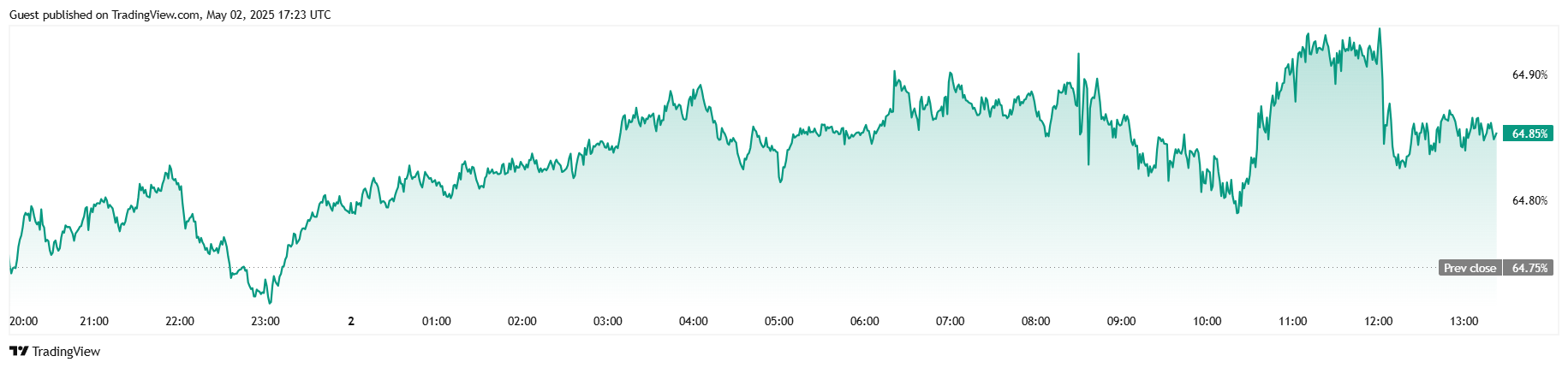

Despite the applause, bitcoin’s 24-hour trading volume slumped 15.10% to $27.20 billion, as some traders, no doubt exhausted, retreated for a restorative weekend in the Hamptons. Market capitalization, meanwhile, nudged ever so slightly higher to $1.93 trillion—because apparently, “trillionaire” is a job title now. Bitcoin’s share of the crypto world crept to 64.85%, its highest since 2021. I suppose that makes the other cryptocurrencies the poor relations at the family reunion. 🥂

As for the derivatives market, the signals are about as clear as a foggy night at the Savoy. According to Coinglass, BTC futures open interest edged down by 0.30% to $67.69 billion. Total liquidations in 24 hours reached $661,120—with the bullish brigade suffering a rather poetic $551,770. Bears suffered a more polite $109,350, proving once again: fortune sometimes favours caution, especially if you wear sensible shoes.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-02 21:27