What to know:

- Markets reacted negatively to the Fed’s 25 basis point cut and hawkish outlook, causing bitcoin to tumble below $100,000 and U.S. equities to drop by 3%.

- The CBOE Volatility Index (VIX) jumped 74% on Wednesday, marking the biggest one-day jump since Feb. 5, 2018.

- Historical data suggests that significant spikes in the VIX are often followed by strong performance of bitcoin and the S&P 500.

As a seasoned researcher with over two decades of market analysis under my belt, I have witnessed countless instances of market volatility that would make even the most hardened investor’s heart race. However, Wednesday, Dec. 18, was a day that will undoubtedly go down in history as a stark reminder of the unpredictable nature of financial markets.

On December 18th, 20XX, will be remembered as a day of financial turmoil, caused by the Federal Reserve’s 25 basis point interest rate decrease and Chairman Jerome Powell’s more aggressive (hawkish) economic stance.

For a moment, Bitcoin’s price dipped below $100,000; meanwhile, American stocks fell approximately 3%, and the U.S. Dollar Index (DXY) reached a two-year peak of 108, exerting pressure on currencies globally.

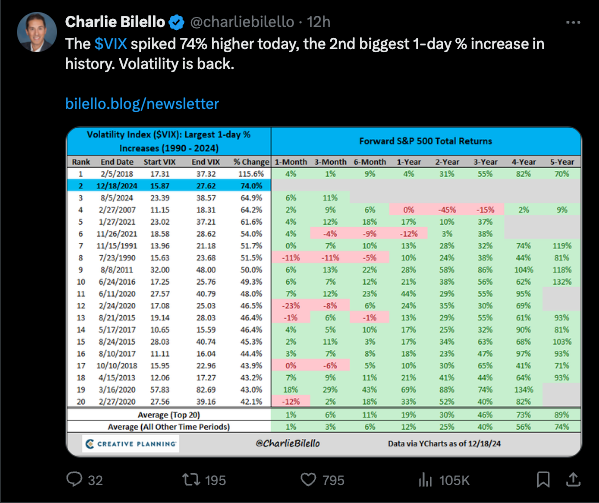

The largest surge in the CBOE Volatility Index (VIX), often referred to as the “fear gauge” on Wall Street, was witnessed recently, with a jump of 74%. This is the highest one-day increase since February 5, 2018, and the second-largest leap in its entire history. The VIX provides an indication of market anxiety and anticipated volatility over the next month.

In the past, major surges in the VIX (Volatility Index) have often signaled temporary low points or bottoms for both Bitcoin and the S&P 500.

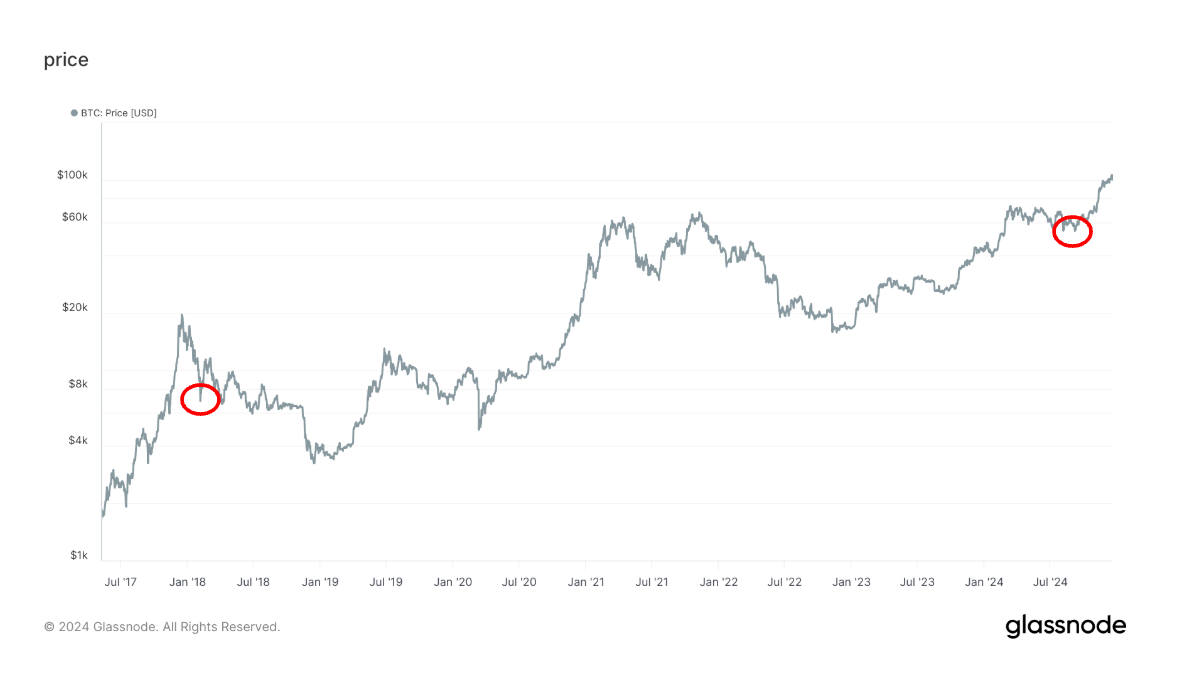

Looking at the most significant daily increases in the VIX, the initial spike happened on February 5, 2018, with a jump of 116%. On this day, bitcoin dropped 16% to reach $6,891, marking a temporary low. Within two weeks, by February 20, the price had bounced back, exceeding $11,000.

The second-largest spike in the VIX occurred on Dec. 18, registering a 74% increase.

On August 5, 2024, the third most significant surge occurred during the unwinding of the Yen carry trade, which saw the VIX increase by 65%. This event caused bitcoin to plummet by 6%, reaching a local minimum around $54,000. However, it rebounded and surpassed $64,000 by August 23.

Over the years, a recurring trend has been observed in the S&P 500, as evidenced by the data presented by Charlie Bilello, who serves as the Chief Market Strategist at Creative Planning.

Let’s see if history repeats itself. At press time, BTC traded above $102,000 while the S&P 500 futures pointed to a positive open with a 0.37% gain.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-19 15:19