Vanguard’s move to open crypto ETF access marks a pivotal expansion for millions of investors, widening mainstream exposure to digital assets such as BTC, ETH, XRP, and SOL while reshaping how traditional portfolios approach emerging markets. 🚀

Vanguard Opens Door to Crypto ETFs With BTC, ETH, XRP, SOL Gaining Traction 🌌

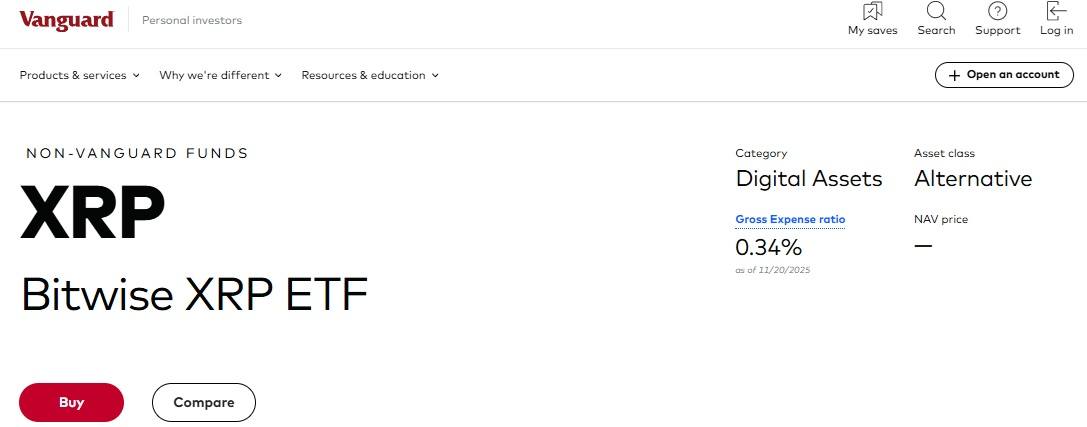

Vanguard Group, which oversees about $11 trillion in assets, has started offering access to crypto exchange-traded funds (ETFs) and mutual funds holding cryptocurrencies on its platform. The shift opens access to products tied to a broad range of crypto, including BTC, ETH, XRP, SOL, HBAR, and LTC. 🧾

Andrew Kadjeski, Vanguard’s head of brokerage and investments, was quoted by Bloomberg on Dec. 1:

Cryptocurrency ETFs and mutual funds have been tested through periods of market volatility, performing as designed while maintaining liquidity. 💸

His view underscored stronger administrative systems and changing investor preferences as crypto markets developed. As of writing, Vanguard’s website already shows many crypto ETFs available for purchase, including recently launched XRP ETFs. 📈

Vanguard’s pivot follows years of internal skepticism toward digital assets. Executives had long described crypto as overly speculative, with senior leaders arguing that bitcoin “lacks intrinsic value” and has “no role in long-term investment portfolios.” Critics inside the firm said: “While many speculators have made money on cryptocurrencies, there are as many if not more who have made a loss. And I suspect a lot more will lose money in the future.” 🤯

The policy change expands access for more than 50 million investors and treats crypto-linked funds similarly to other non-core exposures, including gold. Kadjeski also clarified: “While Vanguard has no plans to launch its own crypto products, we serve millions of investors that have diverse needs and risk profiles, and we aim to provide a brokerage trading platform that gives our brokerage clients the ability to invest in products they choose.” 🧠

Bloomberg ETF analyst Eric Balchunas commented on social media platform X on Dec. 2 about the impact of Vanguard’s decision to lift its ban on bitcoin ETFs, stating:

THE VANGUARD EFFECT: Bitcoin jumps 6% right around US open on first day after bitcoin ETF ban lifted. Coincidence? I think not. 🤯

“Also $1b in IBIT [Blackrock’s Ishares Bitcoin Trust] volume in first 30min of trading. I knew those Vanguardians had a little degen in them, even some of the most conservative investors like to add a little hot sauce to their portfolio,” he added. 🌶️

FAQ ⏰

- What crypto products are now tradable on Vanguard?

Vanguard now allows trading of ETFs and mutual funds tied to cryptocurrencies, including BTC, ETH, XRP, SOL, HBAR, and LTC. 🧾 - Why did Vanguard change its stance on crypto?

Analysts say shifting market dynamics and pressure from millions of clients pushed the firm to reverse its long-held skepticism. 🌍 - Does Vanguard plan to launch its own crypto ETFs?

No, the firm says it will not create proprietary crypto products despite enabling access to third-party funds. 🚫 - How many investors are affected by Vanguard’s policy shift?

The change opens crypto-linked fund access for more than 50 million Vanguard clients. 🧮

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Gold Rate Forecast

- He Had One Night to Write the Music for Shane and Ilya’s First Time

- Brent Oil Forecast

- Mario Tennis Fever Review: Game, Set, Match

2025-12-02 21:03