Ah, the great US Bureau of Economic Analysis (BEA) has bestowed upon us its Q1 2025 reports! The PCE and GDP figures are out today, and while inflation was more cooperative than expected, the US GDP shrank before the tariffs even had a chance to throw their tantrum. Recession fears, naturally, are creeping in like uninvited guests at a dinner party.

But wait—what’s this? Bitcoin, ever the rebellious one, remains defiant, even reaching a new all-time high in Argentina. Yes, you read that right. It’s as if Bitcoin is smugly declaring, “I’m not just a digital asset; I’m a fortress in a storm of economic chaos.” 💰

Trump’s Tariffs: Recession or Just a Really Bad Mood?

The global economy is a circus, complete with acrobats juggling contradictory signals. Trump’s tariffs have set the stage for a recession drama, though some might say the plot’s been overly dramatic. As soon as they began taking effect, markets trembled like an anxious cat at a thunderstorm. But then—just as we thought the plot would get really juicy—the BEA released its Q1 2025 PCE report, and suddenly, the mood lightened a tad.

“Personal income increased $116.8 billion (0.5 percent at a monthly rate) in March, according to estimates released today by the [BEA]. The increase in current-dollar personal income in March primarily reflected increases in compensation and proprietors’ income,” the report generously offered.

At first glance, this data feels like a refreshing breeze on a stuffy day. The PCE (Personal Consumer Expenditures) report—always the Federal Reserve’s favorite child—was stuffed with heartwarming details. A core PCE price index YoY of 2.6% in March? That’s the lowest since June 2024! Oh, and the MoM index hit its lowest since April 2020. Who knew the dollar could still stretch so far?

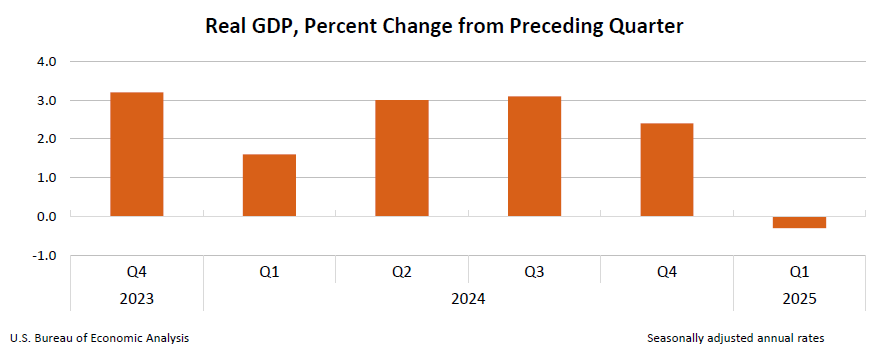

But hold your applause, folks. The BEA also released its GDP report. And guess what? It revealed that the US officially ticked into recession territory with negative GDP growth in Q1. How convenient that this data was all pre-tariff chaos. 😬

Now, CNN, ever the watchful observer, speculates that the inflation numbers may have been boosted artificially by the tariffs. Apparently, Americans—always the optimists—may have rushed to buy goods, anticipating prices would rise once the tariffs made their grand entrance. Classic overreaction. As usual, the numbers don’t quite add up.

And what does all this mean for Bitcoin? The star of the show, Bitcoin, is completely unfazed by all this talk of tariffs and recessions. In fact, it seems to be basking in the glow of the storm, holding steady above $94,000. Could it actually be a safe haven from the economic whirlpool? Analysts, ever the curious creatures, are starting to wonder if Bitcoin will be the financial world’s lifeboat in the coming storm.

Meanwhile, Bitcoin has reached a new all-time high in Argentina, surpassing 110 million ARS per BTC. The surge? Oh, just a result of the Argentine peso plunging to new lows, trading at a glorious 1,165 ARS to the US dollar. It’s almost like Bitcoin is winking at the Argentine peso, “Good luck with that, buddy!”

So, Bitcoin might be emerging as the economic lifeline we never knew we needed. Will it withstand the inevitable recession that Trump’s tariffs are bound to bring? Only time will tell. But from where we stand today, it seems that Bitcoin might just be the one asset that can hold steady through the madness. Let’s keep our fingers crossed, shall we? 🤞

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- Basketball Zero Boombox & Music ID Codes – Roblox

2025-05-01 01:33