In the grand tapestry of finance, a stirring tale unfolds—a recent examination by Atmos has placed the United States at the forefront of the digital asset revolution, like a lone cowboy striding into town with a shiny new badge. This commitment to blockchain technology is not merely a trend; it’s a full-blown stampede towards tokenization, with rules that make even the most progressive banker nod in approval, courtesy of BoxBet’s findings.

Now, let’s consider some titans of the banking world: J.P. Morgan, Citibank, and their European pals like UBS and Deutsche Bank. They’re not just twiddling their thumbs; they’re kicking up dust as they dive headfirst into digital asset services, propelling the tokenization trend into the sunset. It’s like watching a bunch of cowboys trying to ride a bull that just learned how to dance!

Embracing these newfangled digital technologies is akin to swapping an old mule for a shiny new tractor—financial institutions stand to save a pretty penny, enhance transparency, and offer services that make traditional banking feel like using a quill pen in a world of email. Vivek Raman, the CEO of Etherealize, shakes things up with a bold proclamation:

“Tokenized deposits will be the largest unlock for liquidity movement within banks. While stablecoins were the first instance of mass product-market fit for the blockchain ecosystem, stablecoins are not capital efficient. Tokenizing deposits allows for more capital-efficient movement. We see this with SAB 121 being repealed; banks’ appetite for tokenized assets is rising. The safest choice? The Ethereum economy, of course.”

What in Blazes are Tokenized Deposits?

Tokenized deposits are what would happen if a traditional bank deposit had a flashy digital makeover. Imagine converting a good old certificate of deposit into a shiny token that can dance across a blockchain. Each token is tied to real deposits, creating a financial mashup that promises faster transactions, transparency, and less risk of good ol’ fraud. What’s not to love?

Instead of hoarding cash or leaving it to collect dust in a bank, investors can now strut their stuff with digital tokens that represent their nest egg, all recorded on a decentralized ledger. Picture this: a tokenized certificate of deposit—a once-humble investment that’s now ready to mingle on digital asset exchanges, without the pesky early redemption penalties that traditional CDs love to throw around like confetti.

UDPN’s Tokenized Deposit Platform

Last year, the Universal Digital Payments Network (UDPN) galloped into the fray after testing its mettle with a myriad of banks and tech firms. They unleashed two groundbreaking asset management systems, aiming to reshape the financial landscape:

- Tokenized deposit/stablecoin management system: A device for both banks and stablecoin aficionados, streamlining the entire journey of tokenized deposits as it traverses the wild west of digital finance.

- Digital asset tokenization system: A sturdy platform allowing institutions to tokenize real-world assets while staying within the safe confines of regulations. Think of it as a lifeboat on a turbulent sea of finance.

Managing a digital asset system is no walk in the park—it’s more like herding cats in a thunderstorm. These innovative systems integrate seamlessly into banks’ operations, ensuring compliance and security are not mere wishes on a lucky star.

UDPN’s solutions flirt effortlessly with legacy systems via APIs, granting institutions the autonomy to operate on their own terms—a veritable feast of data sovereignty, where they can pick their blockchain playground. These systems even allow a bit of free-range with other regulated digital currency systems, promoting collaboration like a town hall meeting on steroids.

Tim Bailey, VP of Global Business and Operations at Red Date Technology, chimes in:

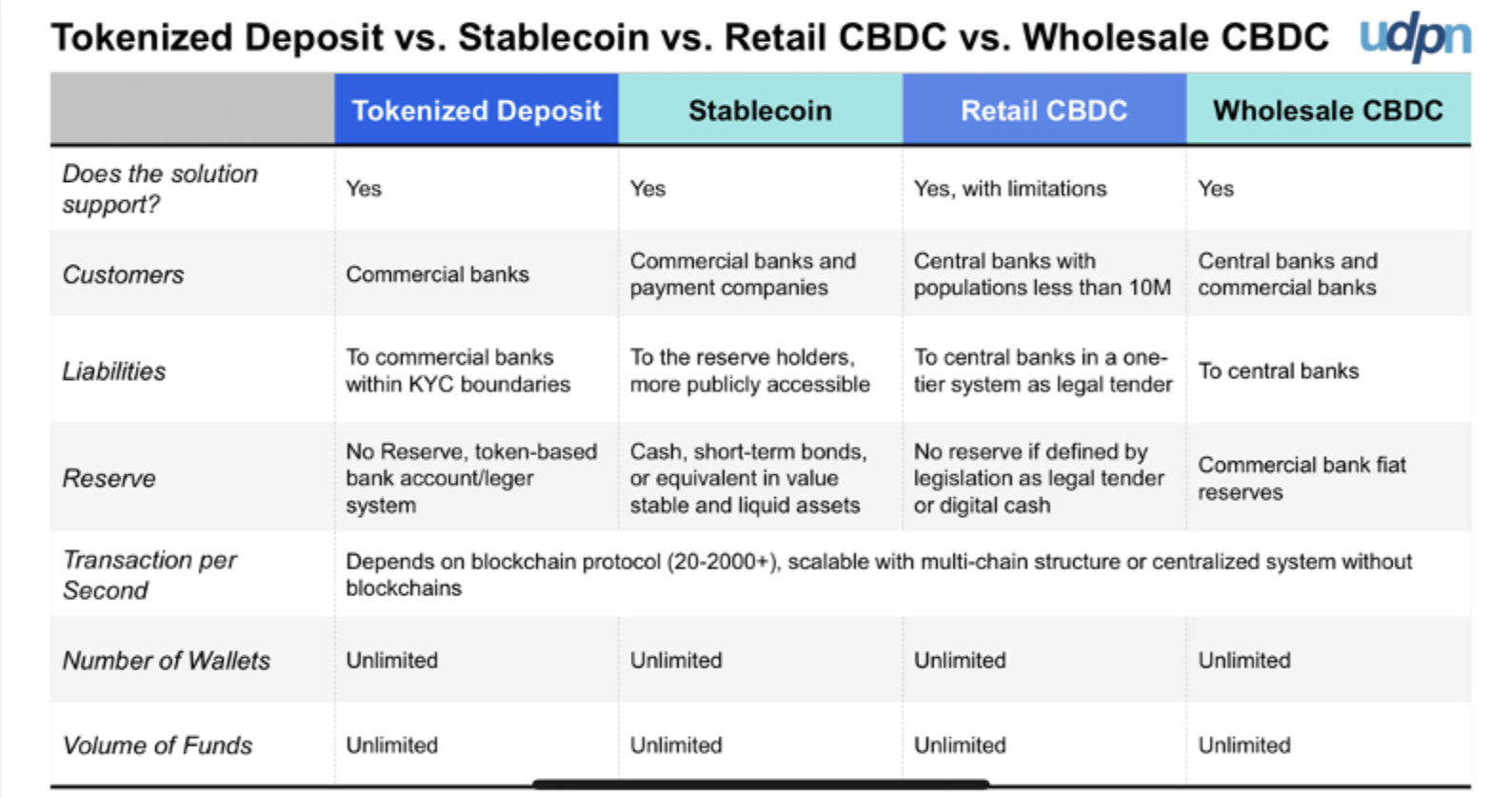

“Financial institutions and banks are embracing innovation to stay ahead by utilizing UDPN’s cutting-edge technologies. The chart above compares digital currencies, but remember, not all are created equal—some may be better than others, much like choosing between fine wine and a cheap knockoff.”

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- LINK PREDICTION. LINK cryptocurrency

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

2025-04-06 16:43