Ah, Solana (SOL), that fickle minx! Today, it dances a merry jig—jumping a splendid 12%—but like a pie left too long in the oven, the enticing aroma is accompanied by the unmistakable hint of potential disaster. All thanks to Trump magically waving a wand for 90 days of tariff reprieve, we find ourselves caught in this whirlwind of hope and despair. Yet, how ironic! Despite that leap, those ever-persistent technical indicators continue to holler ominous warnings, like an old crone predicting doom. Bearish vibes are on the airwaves again, dear reader. Who knew a cryptocurrency could be so… dramatic?

Solana’s RSI: A Flickering Flame of Buyer Conviction

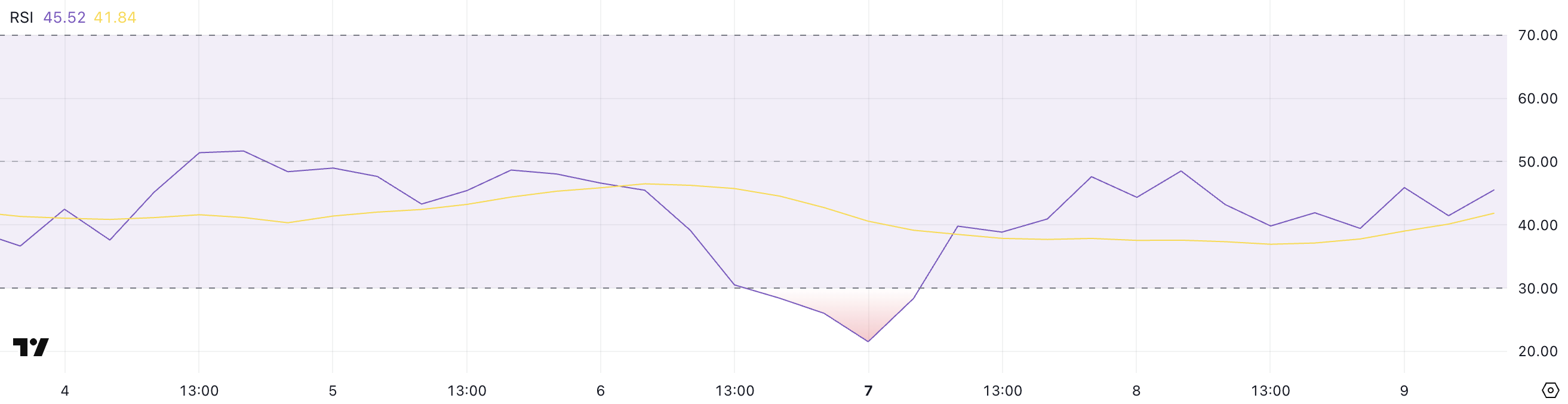

Behold the wretched Relative Strength Index (RSI) at 45.52, that treacherous neutral ground—lower than a caterpillar dreaming of becoming a butterfly for nearly two days now! How exhilarating! 🥱 Just days ago, it plummeted to the depths of 21.53, where sellers were having a grand old time, twirling their mustaches as buyers cowered in fear. The flicker back toward neutrality may seem encouraging, but isn’t it just like a candle burning low, threatening to extinguish at any moment?

This RSI, a charming little oscillator, should remind us that it operates between 0 and 100—much like our emotional states as we watch our dwindling investments. Readings gallivanting above 70 whisper of overbought conditions and inevitable pullbacks, while those below 30 croon tales of oversold tragedies and potential rebounds. Now, at 45.52, Solana is merely wearing the recovery cloak, but alas, it is threadbare and lacks the fortitude of true conviction. Without scaling above 50 soon, who knows what shall become of our wayward hero?

SOL BBTrend: Plummeting into the Abyss

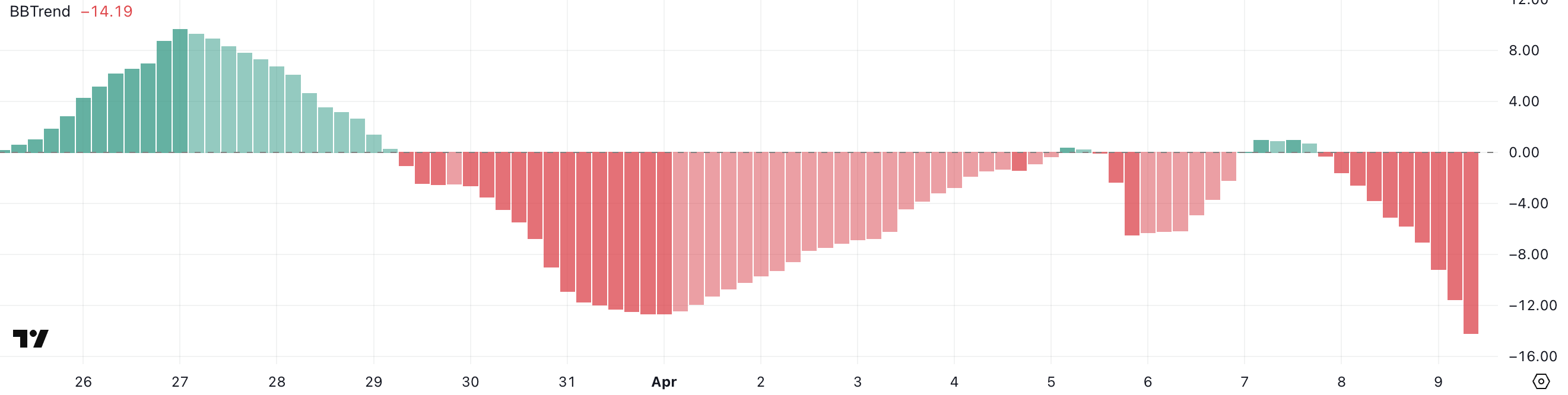

And behold! The BBTrend indicator has succumbed to a disheartening -14.19, as though it were a sad poet lamenting the passage of spring. This number, the lowest it has tread since March 13—nearly a month ago—reveals a troubling trend indeed. Like a castle besieged by relentless foes, bearish momentum reigns once more.

This BBTrend, a volatility oracle that emerges from the shadows of Bollinger Bands, unveils its intentions. Positive states flirt with bullish prospects, while their negative brethren usher in dire portents. At -14.19, Solana finds itself ensnared in a bearish grip; one must fret for its future should the tides of sentiment fail to shift in favor of our beleaguered compatriot.

Is the $100 Threshold Merely a Memory? 🥴

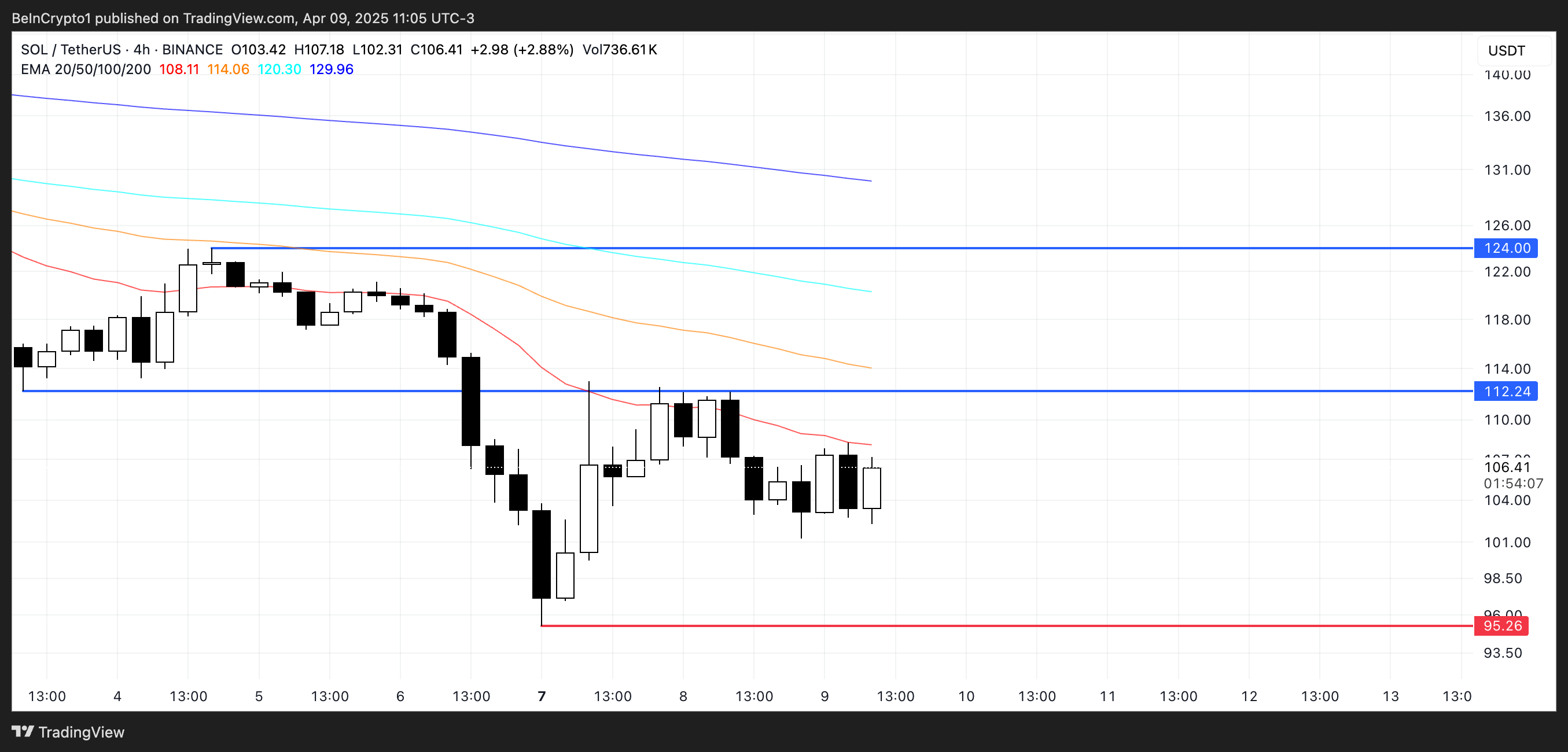

The EMA setup, that stern arbiter of fate, offers no solace, displaying a bearish configuration that leaves short-term moving averages basking in the shadow of their long-term counterparts. Downward momentum asserts its dominance, leaving sellers stewing in the cauldron of success—but perhaps not for long.

If Solana’s fortunes manage to cling to the fragile hope of buying interest, it may yet test resistance at $120—a challenge! Should it transcend that barrier, a narrow path to $134 unfolds like a damp spring day. On the flip side, the persistent bearish narrative looms ominously, with the specter of revisiting support near $95—an echo of the past that haunts us all. Losing this threshold? That could thrust our dear SOL below $90, a tragedy not seen since those dark January days of 2024. Oh, what a tangled web we weave!

Read More

- Lucky Offense Tier List & Reroll Guide

- Indonesian Horror Smash ‘Pabrik Gula’ Haunts Local Box Office With $7 Million Haul Ahead of U.S. Release

- Best Crosshair Codes for Fragpunk

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- League of Legends: The Spirit Blossom 2025 Splash Arts Unearthed and Unplugged!

- ‘Severance’ Renewed for Season 3 at Apple TV+

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- How To Find And Solve Every Overflowing Palette Puzzle In Avinoleum Of WuWa

- Ultimate Half Sword Beginners Guide

- Skull and Bones Year 2 Showcase: Get Ready for Big Ships and Land Combat!

2025-04-10 04:39