Ah, the tortured soul of Ethereum, wandering through the bleak wastelands of the market, haunted by the cold, unfeeling words of Jerome Powell — a man whose utterances hold the weight of destiny itself. On that grim April day in Chicago, Powell, like a cryptic prophet, declared the Federal Reserve’s patience: no rush to lower interest rates, only a morbid “wait-and-see.” And so, with trembling hands and faltering hope, the price of Ethereum sank into shadows, its upward dreams shattered beyond recognition. The masses, sensing impending doom, poured forth their coins to the exchanges, heralding the specter of a bearish correction lurking just beyond the horizon.

Ethereum’s Descent into the Bearish Abyss

What agony it is to witness Ethereum’s price, that once-proud titan, now dragged down by the grim economic outlook of the Federal Reserve! Investors’ hearts clench in despair; according to the ominous scrolls of Coinglass, a staggering $40.6 million has been liquidated in a mere 24 hours — a veritable bloodbath! Of this torment, long positions have perished to the tune of $26 million, while the short positions, cunning puppeteers of misfortune, claimed $14.6 million.

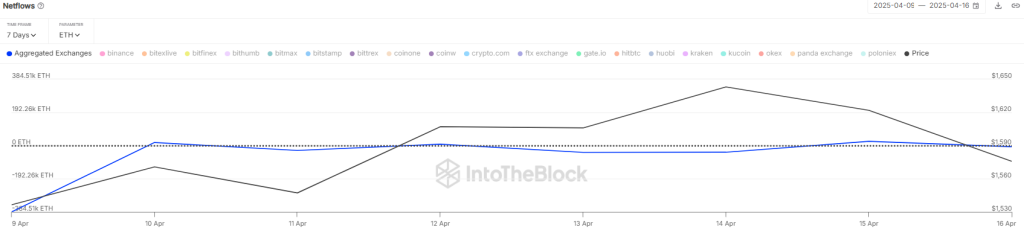

The darkest day revealed an influx of over 77,000 ETH riding the tides to derivative exchanges — a flood not seen in months. This deluge is but a whispered herald of the selling pressure that may yet bring Ethereum lower, into the merciless depths below.

But lo, amidst this dirge, the data from IntoTheBlock speaks a paradox: the Netflow metric, dark and forbidding at -6,800 ETH, reveals that despite the chaos, many brave souls—those investors clinging to hope—were hoarding Ethereum even as the shadows deepened.

Coinglass proclaims that open interest climbs like a beast from the underworld, a monstrous 3.87% rise to over $18 billion. Yet, the funding rate skulks in negative precincts at 0.0015%, meaning the bears still grip Ethereum’s throat, consolidating their dominion near critical support lines.

And yet, like a Dostoevskian hero caught in the throes of despair only to find flickers of redemption, a CryptoQuant oracle whispers promises of a mighty rebound. Ethereum trades near its realized price, around $1,585 — a threshold where past sorrows birthed great rallies. The price hovers on this precipice, a dark cliff where doom and salvation wrestle.

The Crossroads: What Fate Awaits ETH?

Ethereum’s fragile bid for recovery staggers near the EMA trend lines, where bear sentinels fiercely guard the EMA20 citadel. The price hovers at $1,588, slipping 1.5% in this cruel 24-hour waltz. If the sellers succeed in pressing below the $1,400 abyss, the descent may spiral deeper still — down, down into the cold embrace of $1,130, the dark channel’s end. Buyers might muster a tremulous resistance here, yet if the bearish tempest rages on, the unthinkable $1,000 realm awaits.

Yet, in this grim theater, hope dares to peak: a resounding breach above $1,700 could awaken the buyers’ legion, sparking a charge toward the elusive $2,000 prize. Though the 50-day SMA may stand as a stoic sentinel to this rally, the bullish spirit might surge past this threshold, transforming dread into triumph. Should Ethereum claw above $2K, the long, dark night might finally yield to dawn.

But dear reader, do not forget: in this monstrous dance of markets — every crest invites a fall, every hope, a shadow. And so the tragicomic saga of Ethereum unfolds, where bears 🐻, bulls, and fools alike play their parts on the mad stage of fate.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-04-17 22:37