Behold, the market’s fragile heart, now trembling under the weight of indifference. The derivatives, once fervent lovers, now turn cold, their appetites waning like a fading sunset. The spot metrics, those fickle companions, whisper of a momentum lost, as buyers, like weary travelers, reassess their paths. 🤷♂️

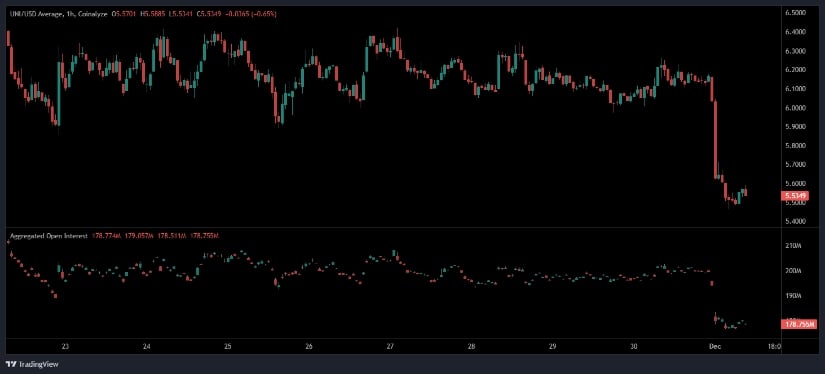

Open Interest Sees Rapid Decline

The open interest, that once proud sentinel, now cowers in a corner, its numbers shrinking like a snowball in a furnace. The 1-hour chart, a tragic play, reveals the price slipping from $6.20 to $5.50, a dramatic exit from the stage of high prices. The sell-side candle, fierce and unrelenting, triggers a wave of liquidations-oh, the drama! 💸

This drop, a cruel jest, coincides with open interest shrinking to $178M, a testament to the market’s cautious soul. The leveraged exposure, once bold, now timid, as participants sip tea and ponder their next move. 🍵

The week’s tightening pattern of open interest, a slow dance of uncertainty, hinted at a lack of conviction. The sudden unwind, a surprise party no one wanted, confirms the buyers’ reluctance to hold higher positions. 🎉

As the coin stabilizes near $5.53, the muted open interest environment, a quiet sigh, points to low speculative demand. The token, like a lonely wanderer, may rely on spot-driven flows before attempting a recovery. A restrained tone, indeed. 🚶♂️

Uniswap Faces Pressure as Data Shows Steady Decline

BraveNewCoin’s metrics, those relentless truth-tellers, confirm the cooling momentum. The coin, now trading at $5.51, has taken a 9.16% hit, its market cap now a mere $3.47B. Trading volume surges above $424M-a frantic dance of repositioning. Yet, the downward trend, a relentless river, highlights supply-side pressure. 🌊

The circulating supply, a vast sea of 629.89M tokens, places the coin at Rank 43-a humble position. The price chart, a mirror of past struggles, dips into a consolidation zone, a familiar haunt during mid-year pullbacks. 🕳️

This positioning, a precarious tightrope, tests the coin’s price prediction models. To maintain this region is a battle against deeper historical support. The corrective structure, paired with a volume spike, reveals heightened sensitivity among market participants. A tense game of chess, indeed. 🏰

TradingView Indicators Turn Bearish

The daily chart, a grim tale, shows technical indicators weakening further. The MACD histogram, now in negative territory, with the MACD line below the signal line, a harbinger of bearish continuation. This momentum loss, a sigh of resignation, reflects sustained downside pressure after weeks of lower highs. 🌑

The Chaikin Money Flow, a fickle friend, remains below zero at 0.31, revealing capital outflows. Selling activity, like a storm, outweighs accumulation. Price action, a descending waltz, struggles to reclaim the $6.00 region, once a pivot point. The current candle, near $5.55, shows limited rebound interest after the sharp decline. 🌩️

These readings, a somber chorus, paint a cautious technical picture. Indicators signal hesitation from buyers, as broader sentiment cools. A bleak outlook, indeed. ❄️

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Gold Rate Forecast

- Brent Oil Forecast

- He Had One Night to Write the Music for Shane and Ilya’s First Time

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

2025-12-02 21:37