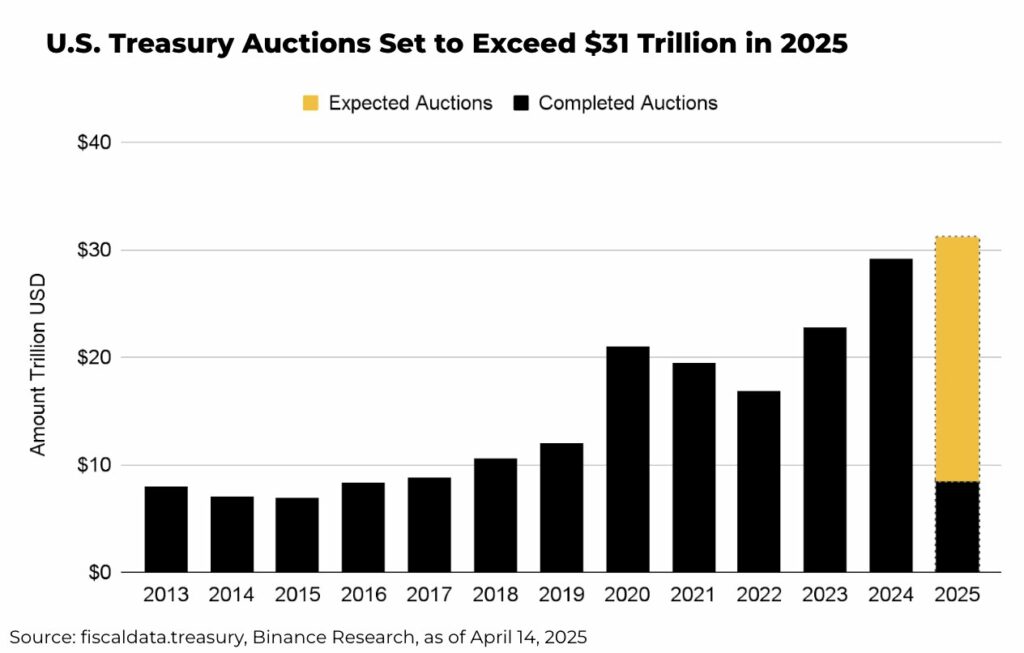

It has been most earnestly reported by the esteemed Binance, that the United States Treasury shall, by the year 2025, reach a sum most astonishing and unprecedented: the staggering amount of thirty-one trillion dollars. Such a prospect, one must admit, casts a rather long shadow upon the affairs of state and, indeed, upon those whimsical inventions known as cryptocurrencies.

According to the most recent discourse issued by Binance Research upon the eighteenth day of April, the issuance of Treasury bonds is anticipated to rise to an extent so extraordinary that it shall comprise a hundred and nine percent of the gross domestic product, and an astonishing one hundred and forty-four percent of the M2 money supply. Truly, it is a spectacle that might cause even the most composed financier to clutch one’s bonnet.

This prodigious increase portends a pressure upon the means of financing—namely, through auction refinancing—which should surely command the most attentive regard from investors. For these alterations in M2 do, as fate would have it, bear considerable consequences upon stocks, bonds, and the curious sphere of crypto-assets.

Pray, take note that the analysts at Binance Research point out that the foreign appetite for such government debt shall be a most important element within this unfolding drama.

Of this enormous supply, nearly one-third shall find its way into foreign hands, a circumstance not without its precarious charm. Should this enthusiasm for United States debt falter, or worse—be overtaken by outright selling, driven perhaps by geopolitical tempests or the ever capricious tides of portfolio rebalancing—then one must brace for the dreaded ballooning of financing costs. Yields, already elevated, shall ascend even higher, much like a lady’s eyebrow at an unsuitable remark.

“Even if demand remains as steady as a governess supervising a ballroom, the sheer magnitude of issuance presents a structural challenge most formidable. The recent alleviation of risk—potentially inspired by hopeful whispers of trade negotiations—does little to abate the relentless pressure this colossal supply exerts upon interest rate markets throughout the year of our Lord 2025,” the learned company of Binance Research did observe with commendable forthrightness.

In recent weeks, both the stocks and the mercurial creatures of crypto, including the illustrious Bitcoin (BTC), have suffered considerable decline. Tariffs have done little to soothe nervous dispositions, whilst the Federal Reserve has declined to grace the assembly with a rate cut. Even the President himself has threatened to dismiss the honorable Fed chair Jerome Powell—as if one might remove the conductor amidst a cacophonous orchestra!

The learned analysts caution that the persistent upward pressure amid the flood of Treasury supply may yet influence risk assets profoundly. Yet, one cannot help but entertain the curious notion that should the government resort to debt monetization, with the money printer emitting its merry “brrrr,” the scene might brighten considerably for risk assets.

In such a tableau, it is predicted that investors, eager to shield their fortunes from the slow decay of currency, shall make swift pilgrimage toward Bitcoin and other “hard assets,” as one might to a charming country estate in times of social upheaval.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- Lottery apologizes after thousands mistakenly told they won millions

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

2025-04-18 21:25