What to know:

Last year, U.S. crypto mining companies listed on public exchanges nearly doubled their Bitcoin (BTC) reserves, bringing the total to approximately 92,473 BTC worth around $8.6 billion as of December 31st. Notably, the value of the largest cryptocurrency increased by approximately 120% during this period, based on data from TheMiningMag.

Approximately half of the total Bitcoin holdings are controlled by MARA Holdings (MARA), with a substantial 44,893 BTC in their possession. Among publicly listed companies, only MicroStrategy (MSTR) holds more Bitcoin, with an impressive 450,000 BTC.

The practice of buying bitcoin and holding onto it for an extended period, famously referred to as “HODL” due to a typo from over a decade back, has gained significant traction in the last year.

As an analyst, I’ve uncovered some interesting insights regarding the distribution of Bitcoin among miners. Specifically, three mining companies – Riot Platforms (RIOT), Hut 8 (HUT), and CleanSpark (CLSK) – collectively hold over 10,000 Bitcoins each, as reported by Bitcoin Treasuries. Here’s a quick breakdown:

– Riot Platforms holds approximately 17,722 BTC.

– Hut 8 has around 10,171 BTC in their reserves.

– CleanSpark is sitting on about 10,097 BTC.

This information underscores the significant Bitcoin holdings these companies have amassed, which could potentially influence market dynamics and trends moving forward.

Some miners don’t adhere to the HODL strategy. Instead, entities like IREN, TeraWulf, and Core Scientific tend to hold minimal or no bitcoin themselves. Given the cutthroat nature of their industry, these companies have shifted their focus towards the artificial intelligence (AI) and high-performance computing (HPC) sectors.

The prices of common stocks have not followed the same path as that of Bitcoin. In essence, mining companies generally underperformed Bitcoin and other equities associated with cryptocurrencies like MicroStrategy. However, some notable exceptions were Core Scientific and Terawulf, which, due to their recent shift towards Artificial Intelligence, achieved over 300% returns each.

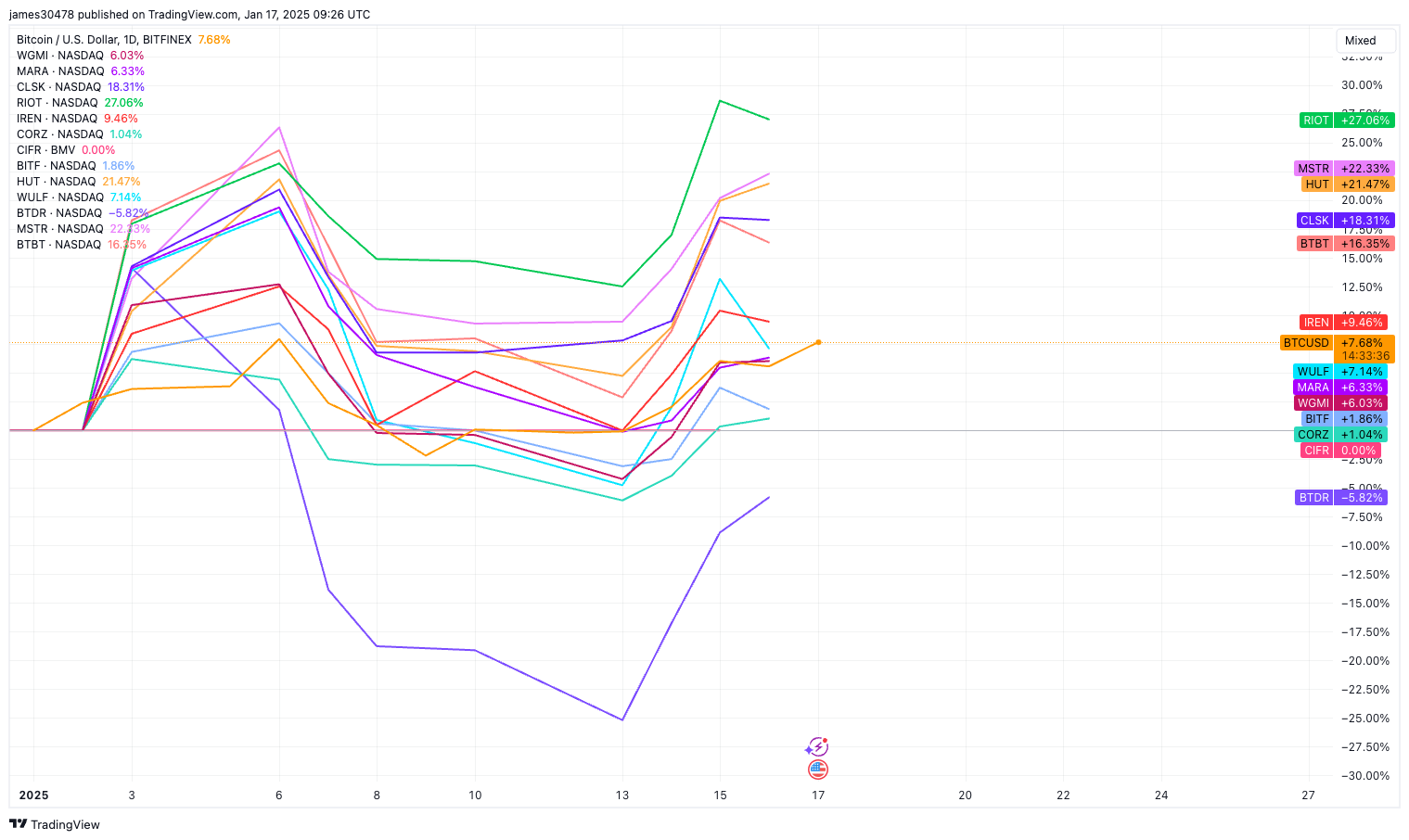

This year, it’s been the miners holding Bitcoin who have seen significant gains. Companies like RIOT, HUT, and CLSK have done particularly well, even surpassing Bitcoin itself. However, Bitdeer (BTDR) has experienced negative returns, contrasting its strong performance in 2024.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-17 13:47