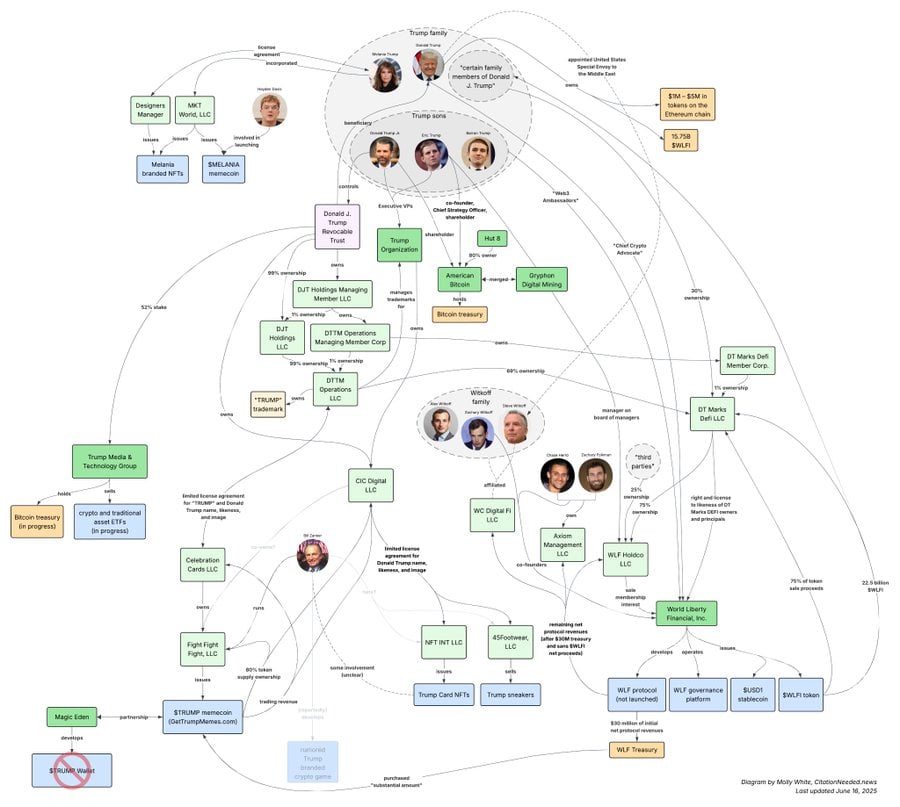

So, it’s December and DT Marks is practically sitting on a crypto throne with a whopping 75% stake in World Liberty Financial. Fast-forward to January, and poof! Just like my New Year’s resolutions, that little number has plummeted to around 60% according to WLF’s own website, as reported by the magnanimous folks at Forbes. By June? A sporty 40%! No graceful exit, no newsflashes, just a quiet cash-out. Typical! 🎤

But what does this dubious withdrawal mean for WLF’s plans to create some mysterious reserve of digital assets? Well, your guess is as good as mine, darling! 🤔💭

What’s driving this crypto exodus? Timing, my dear! It’s all in the timing. People in Congress have suddenly developed a keen sensitivity to Trump’s entanglements with the crypto world. Those lawmaker noses have been sniffing around WLF like bloodhounds, especially since the platform pranced out its USD1 stablecoin back in March—right when everyone was debating the audaciously titled GENIUS Act that aims to regulate dollar-pegged digital tokens 🎩💰.

The Crypto Commander-in-Chief?

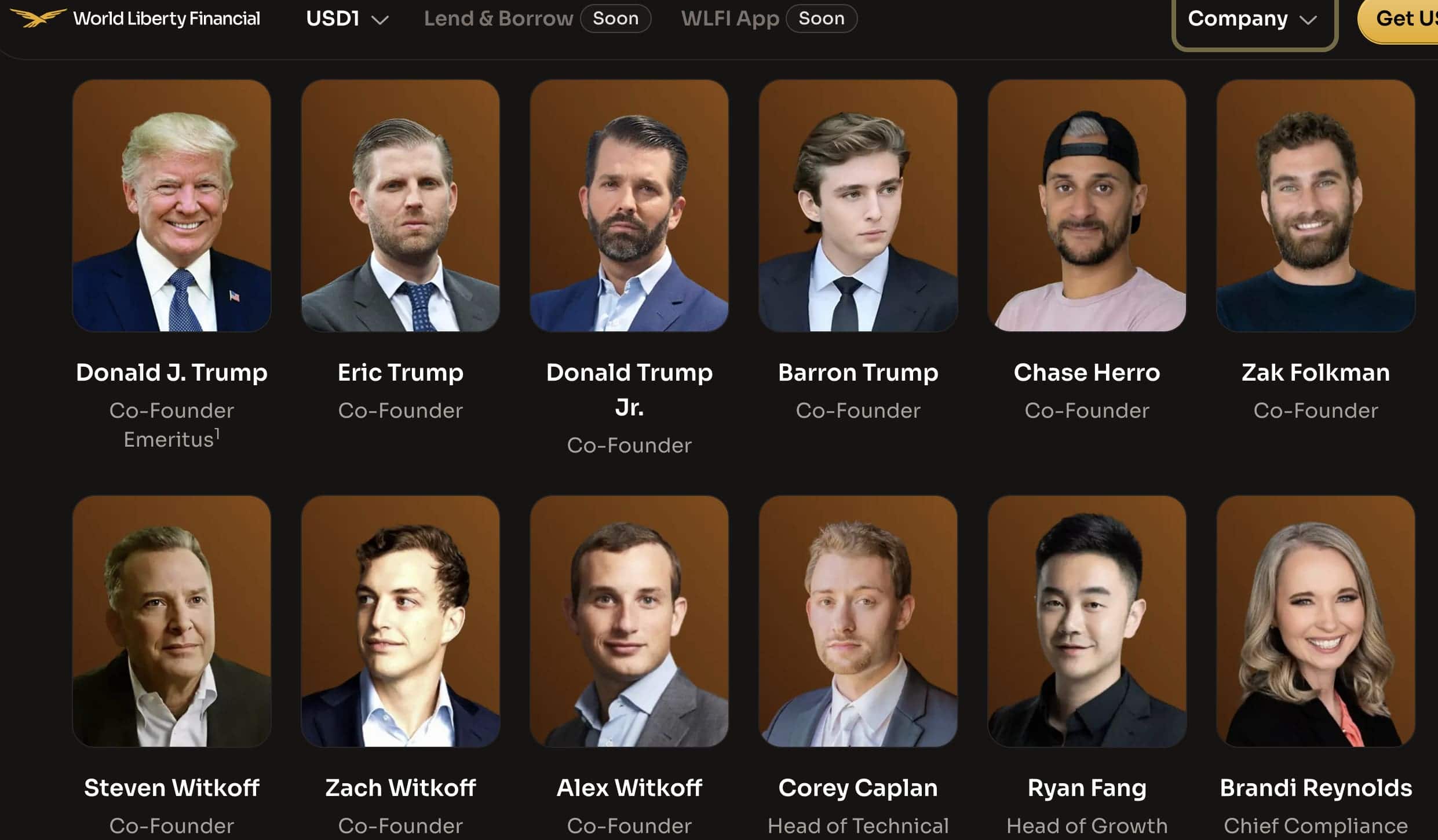

Let’s not fool ourselves. Trump isn’t merely ‘having a go’ at crypto—he’s practically gifting it campaign cash left and right! According to all those delightful filings, he’s raked in more than $57 million from WLF and its merry band of crypto misfits since last June—thanks to a jaw-dropping $550 million in token sales! 💵💥

Now, as the beloved leader he is, he’s pushing for some great regulatory clarity on stablecoins and asking Congress to pass that GENIUS Act “ASAP.” And normally, one would applaud such ambition—if it didn’t have that familiar whiff of a conflict of interest. 🍵⚖️

The Global Play

In a plot twist that would leave any soap opera scriptwriter green with envy, a $2 billion investment from some Abu Dhabi fund is reportedly going to be settled via WLF’s USD1 token—because obviously! Nothing says “trust us” quite like a presidential-linked crypto coin conducting billion-dollar business with foreign investors! 😏💼

The Senate hurriedly passed the GENIUS Act, all smiles and handshakes across the aisle, but now the House is acting like that one friend who always flakes on plans—thanks to Trump’s crypto baggage. If the bill sails through, it could flip the whole privately issued digital dollar scene upside down, but with Trump coiling around both the bill and a private stablecoin, the optics are… well, let’s say ‘not looking fabulous.’ 🌪️

Controlled Burn or Political Cleanup?

Is this a well-thought-out tactical retreat or just good old-fashioned damage control before the 2025 campaign kicks into gear? One thing’s for sure: this isn’t merely about cashing in. It’s about minimizing those juicy liabilities! With regulators zooming in and media outlets getting spicy, the Trump clan seems to be performing some digital asset detox. 🚫📉

The delicious irony? In trying to legitimize crypto by throwing rules at it, Trump may just torch the very empire he’s constructed in the shadows. If that GENIUS Act goes live, stablecoin issuers will need licenses, audits, and reserve requirements—things that WLF hasn’t exactly bragged about. 🛑🔥

So, is our dear Trump making a strategic move to get ahead of the regulation curve, or is he yanking the ripcord just before the *you-know-what* hits the fan? As always in the wild world of Trumpland, the real drama isn’t just in what they proclaim—it’s in what they’re selling without a peep! 🎭💰

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- Umamusume: Pretty Derby Support Card Tier List [Release]

2025-06-20 00:25