What to know:

- TRUMP‘s perpetual futures open interest has risen 6% in 24 hours.

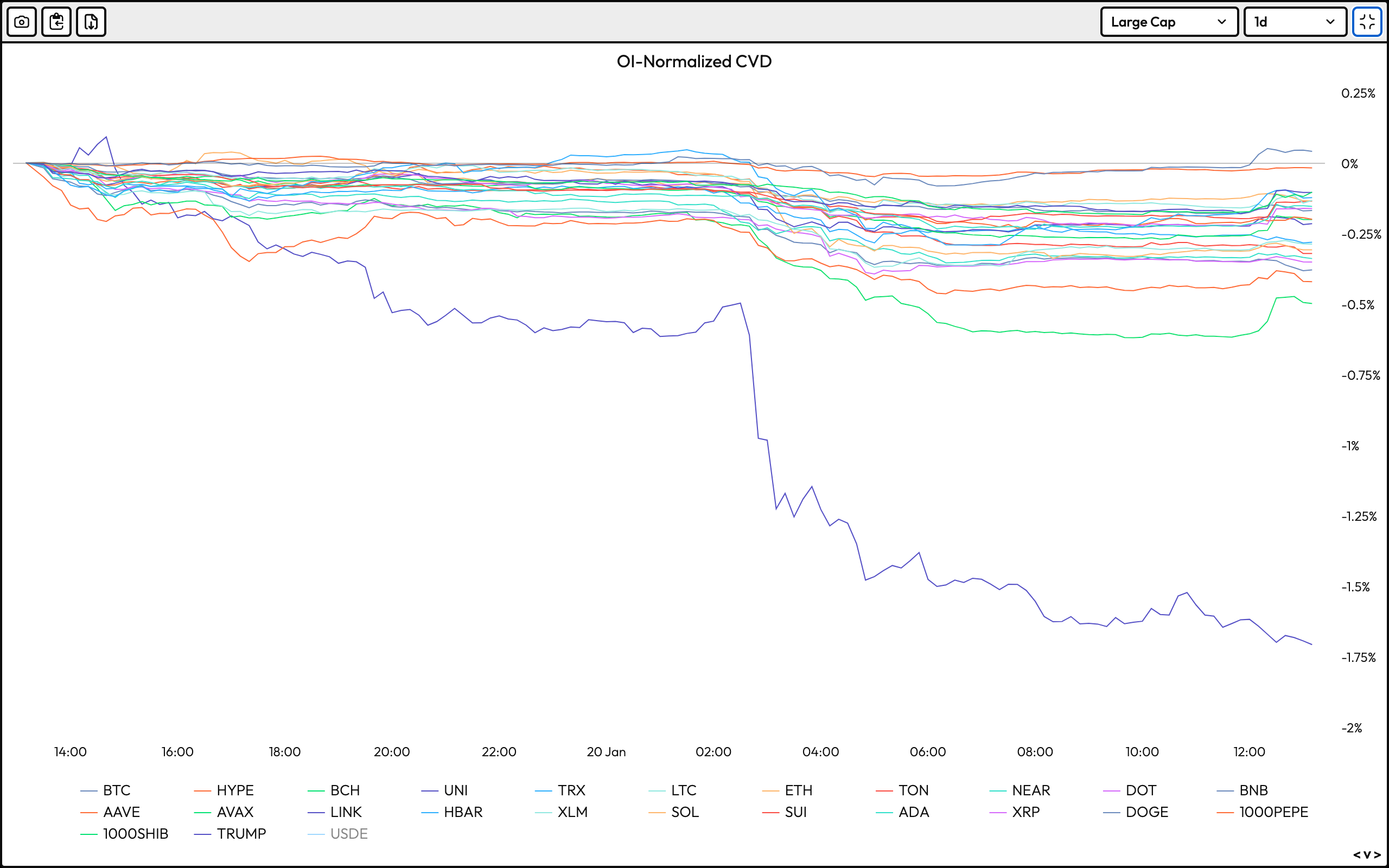

- But, cumulative volume delta is flashing a bearish signal.

- Funding rates indicate overheated market.

In a short span of merely two days, the TRUMP token introduced by U.S. President-elect Donald Trump has created a significant stir in the cryptocurrency sector. It swiftly climbed to rank as the 21st largest digital currency, boasting a market capitalization of approximately $11 billion.

On Binance, the TRUMP/USDT pair has become the busiest trade in the last 24 hours, accounting for approximately 13.3% of the platform’s overall trading volume, as reported by Coingecko.

For those eager to engage in this exciting endeavor, be aware that just before Donald Trump’s inauguration, both the bulls and prospective investors should practice caution. This is because a significant derivatives market signal has shown a negative divergence compared to the token’s increasing futures open interest.

Interest in Trump perpetual futures has risen by 6% over the last 24 hours, as indicated by Velo Data. Despite a drop in price from $70 to $58 during the Asian trading period, it still shows a 3% increase.

On the other hand, the total volume delta of perpetual futures contracts, representing the gap between purchases and sales, has decreased by more than 1%. This suggests that there is a higher level of selling activity compared to buying. In simpler terms, traders might be opening short positions (selling with the expectation of buying back later at a lower price), making bearish wagers, or closing their existing long positions (buying with the expectation of selling later at a higher price).

As a researcher examining the TRUMP market, it’s clear that the current situation appears overly heated. Long positions are currently incurring an annualized funding fee exceeding 170% just to maintain their hold. If this market momentum were to falter, maintaining long positions could become increasingly burdensome, potentially triggering a mass unwinding of bullish bets. This unwinding could lead to a more significant price drop.

As a crypto investor, I noticed that the graph indicates a general trend of net selling in perpetual futures for most major cryptocurrencies over the past 24 hours. This could be due to market participants exhibiting caution and fearing potential widespread price declines, a common response known as “selling the fact,” following Trump’s inauguration.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-20 12:43