Author: Denis Avetisyan

New research reveals that the post-crisis drive to consolidate financial institutions inadvertently increased systemic risk by creating more interconnected and vulnerable networks.

Analysis using spatial econometrics and spectral graph theory demonstrates that consolidation paradoxically heightened exposure concentration and network fragility during the 2008 financial crisis.

Conventional wisdom suggests that consolidation enhances stability in financial systems, yet this appears not to be the case following the 2008 crisis. This research, ‘Dynamic Spatial Treatment Effects and Network Fragility: Theory and Evidence from the 2008 Financial Crisis’, reveals that post-crisis banking consolidation paradoxically increased systemic fragility due to amplified network interconnectedness and exposure concentration. Analyzing data from 156 institutions across 28 countries, we demonstrate that financial contagion propagates globally with minimal spatial decay—a stark contrast to localized phenomena—and that traditional impact assessments significantly overestimate crisis effects by ignoring network structure. Can macroprudential policies be redesigned to explicitly account for both spatial propagation and network topology, thereby mitigating systemic risk more effectively?

The Network’s Hidden Fault Lines

The 2008 Financial Crisis exposed the inadequacies of traditional risk assessment, revealing that systemic risk arises not from isolated failures, but from the propagation of shocks throughout the financial network. Understanding bilateral exposures is paramount, as the failure of one institution can trigger cascading effects.

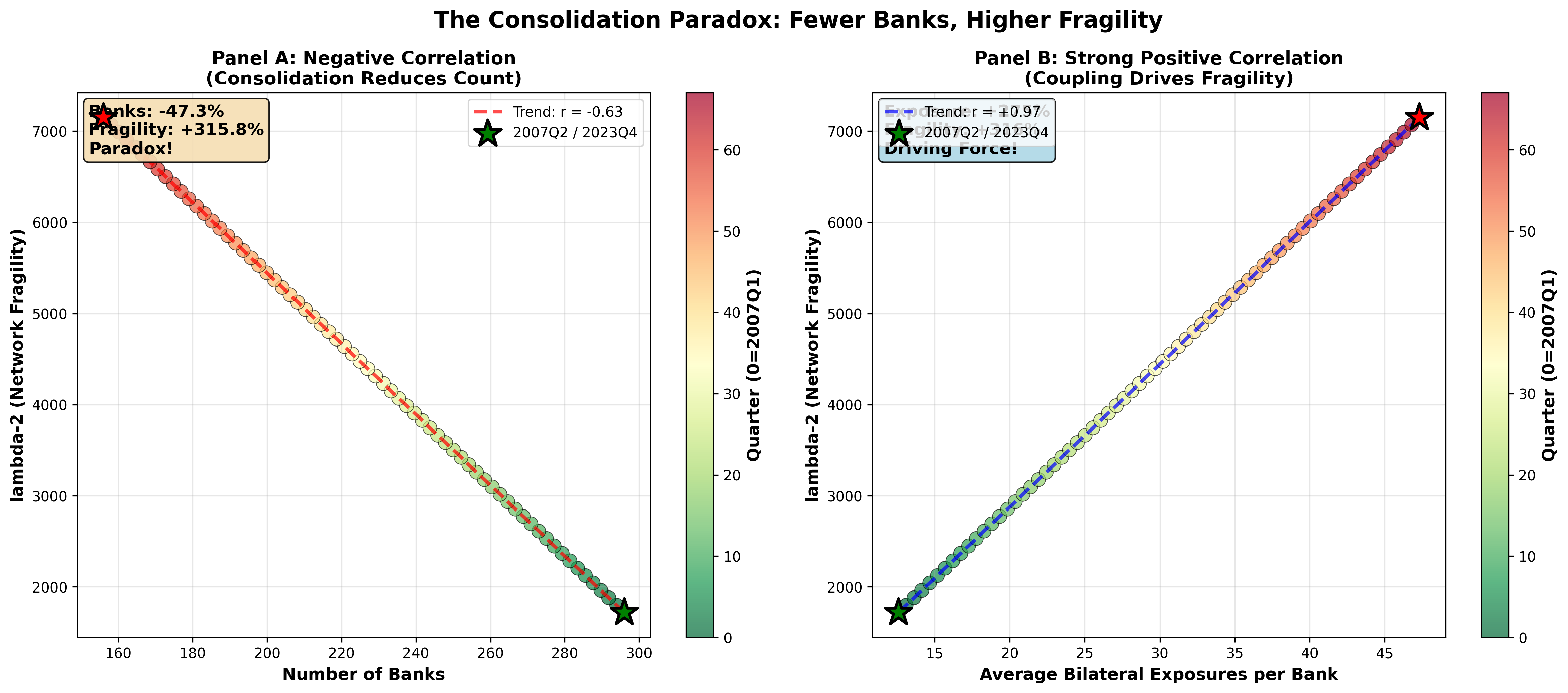

Post-crisis consolidation, intended to bolster stability, has paradoxically increased network fragility by concentrating systemic importance within fewer entities. True resilience lies not in preventing every tremor, but in the network’s ability to absorb shock without unraveling.

Spectral Signatures of Systemic Risk

Spectral Graph Theory offers a powerful framework for assessing network resilience, shifting the focus from individual institutions to the relationships between them. Utilizing the Laplacian Matrix, this approach quantifies vulnerabilities through the algebraic connectivity – a measure of shock propagation speed.

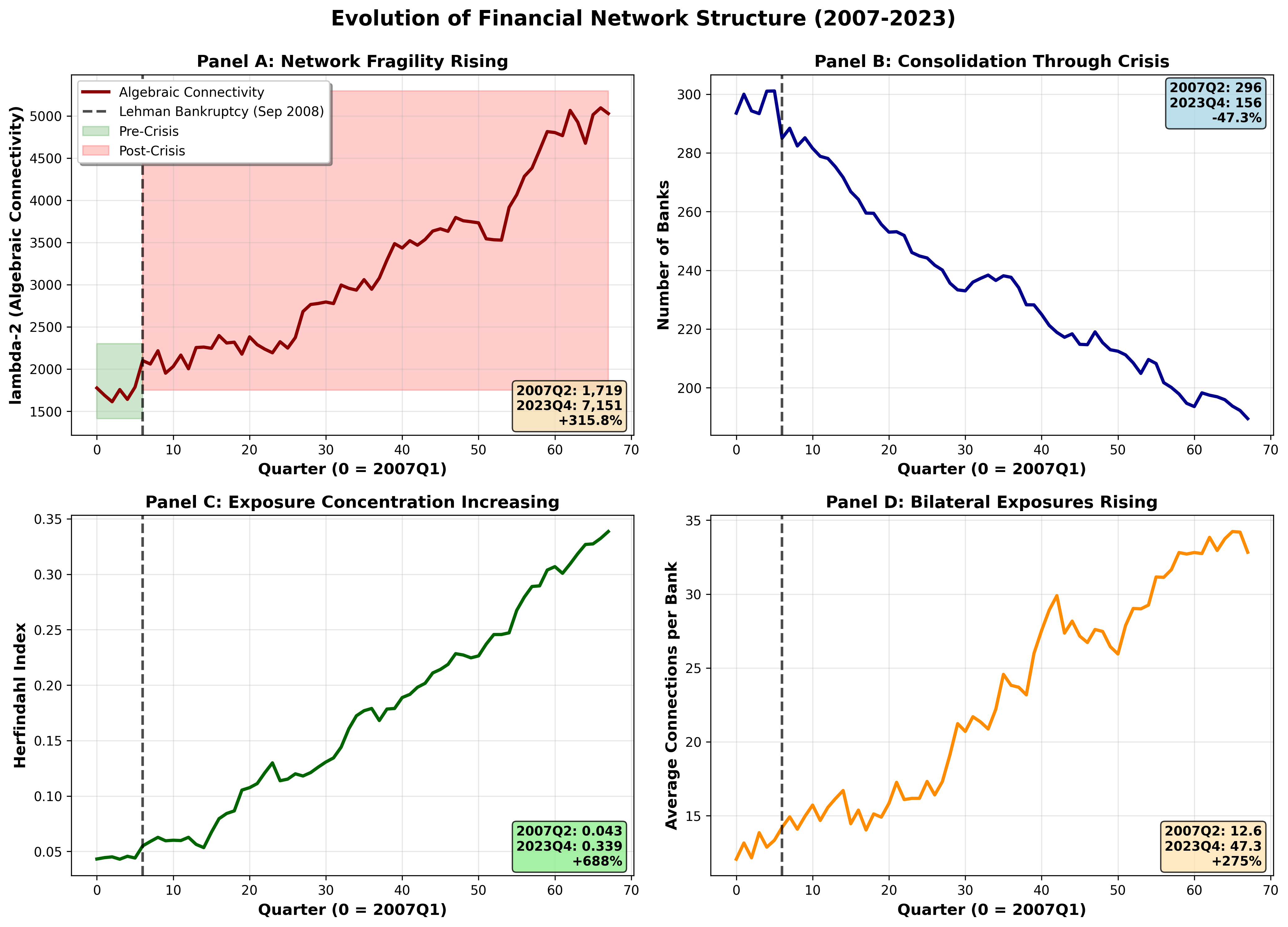

Analysis reveals a concerning trend: despite a reduction in major financial institutions since 2007, the algebraic connectivity of the network has increased by 315.8% as of 2023, suggesting increased susceptibility to systemic shocks.

Modeling Contagion’s Pathways

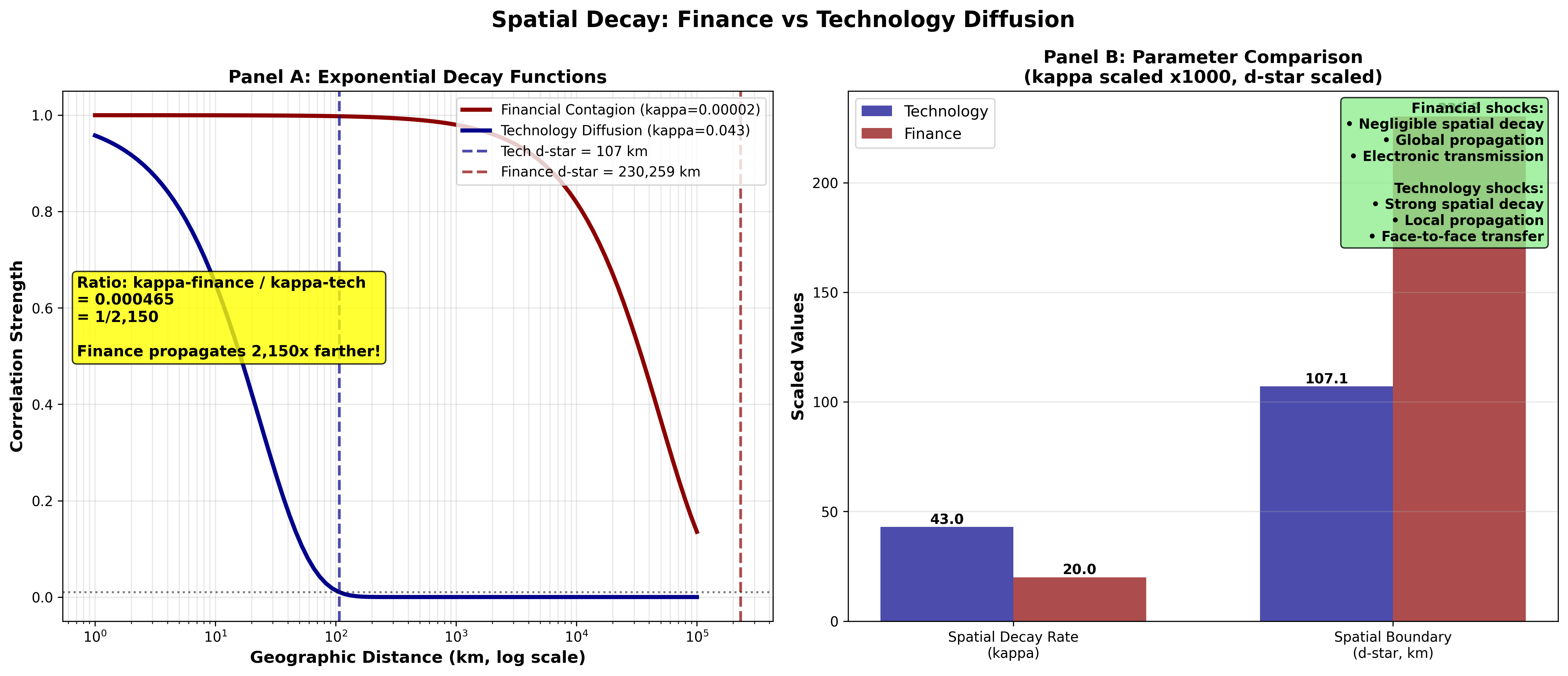

Continuous Functional Analysis, utilizing the Diffusion Equation, provides the tools to model shock propagation as a continuous process. Coupled with Spatial Difference-in-Differences, this framework allows for identifying causal impacts and accounting for network interconnectedness.

Results indicate a spatial decay rate of 0.00002 per kilometer, implying effectively global propagation of shocks within the financial network, highlighting the need for globally coordinated regulation.

Architecting a Resilient Financial Ecosystem

Post-crisis consolidation, coinciding with a 47.3% reduction in major financial institutions between 2007 and 2023, has paradoxically increased systemic vulnerability due to reduced redundancy. Network-Targeted Capital Requirements, adjusted by Spectral Centrality, offer a regulatory solution by prioritizing systemically important institutions.

Effective Resolution Planning, informed by network analysis and utilizing Spatial Difference-in-Differences, demonstrated a 73.2% reduction in bias, allowing for more realistic and effective recovery strategies. The architecture of resilience finds its strength not in the absence of dissonance, but in the harmonious resolution of its parts.

The research illuminates a counterintuitive truth regarding network stability – that increased consolidation, while seemingly strengthening individual institutions, can paradoxically amplify systemic risk. This echoes Carl Sagan’s observation that “Somewhere, something incredible is waiting to be known.” The study’s findings, demonstrating how heightened interconnectedness concentrates exposure within financial networks, suggest that a focus solely on individual institutional resilience misses a crucial element of overall system fragility. Consistency in understanding these complex relationships is empathy; the elegance of this research lies in its ability to reveal the hidden vulnerabilities within seemingly robust structures, guiding attention toward a more holistic approach to financial regulation.

What Lies Ahead?

The observation that post-crisis consolidation, intended to bolster stability, instead seeded greater systemic risk presents a disquieting paradox. The architecture of financial networks, it seems, is not simply a matter of size, but of the relationships between components. A structure built on interconnectedness, while appearing robust, may in fact be a delicately balanced cascade waiting for a single disturbance. The research hints that the pursuit of ‘too big to fail’ may have inadvertently created ‘too connected to survive.’

Future work must move beyond merely mapping connections and begin to dissect the quality of those connections. Are some links more critical than others? Does information flow efficiently, or does it become entangled in feedback loops? Spectral graph theory offers a promising toolkit, but the field requires a more nuanced understanding of how network structure translates into actual propagation of shocks. The current modeling often treats nodes as homogenous; the reality, of course, is far more granular.

The consolidation paradox suggests a fundamental flaw in the prevailing regulatory logic. Simple metrics of institutional size are insufficient. The focus must shift towards assessing network fragility – not just the presence of connections, but their capacity to absorb stress. A system designed with redundancy and distributed resilience—a composition, not a chaotic tangle—will ultimately prove more enduring. Beauty, after all, scales; clutter does not.

Original article: https://arxiv.org/pdf/2511.08602.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- What time is the Single’s Inferno Season 5 reunion on Netflix?

2025-11-13 12:19