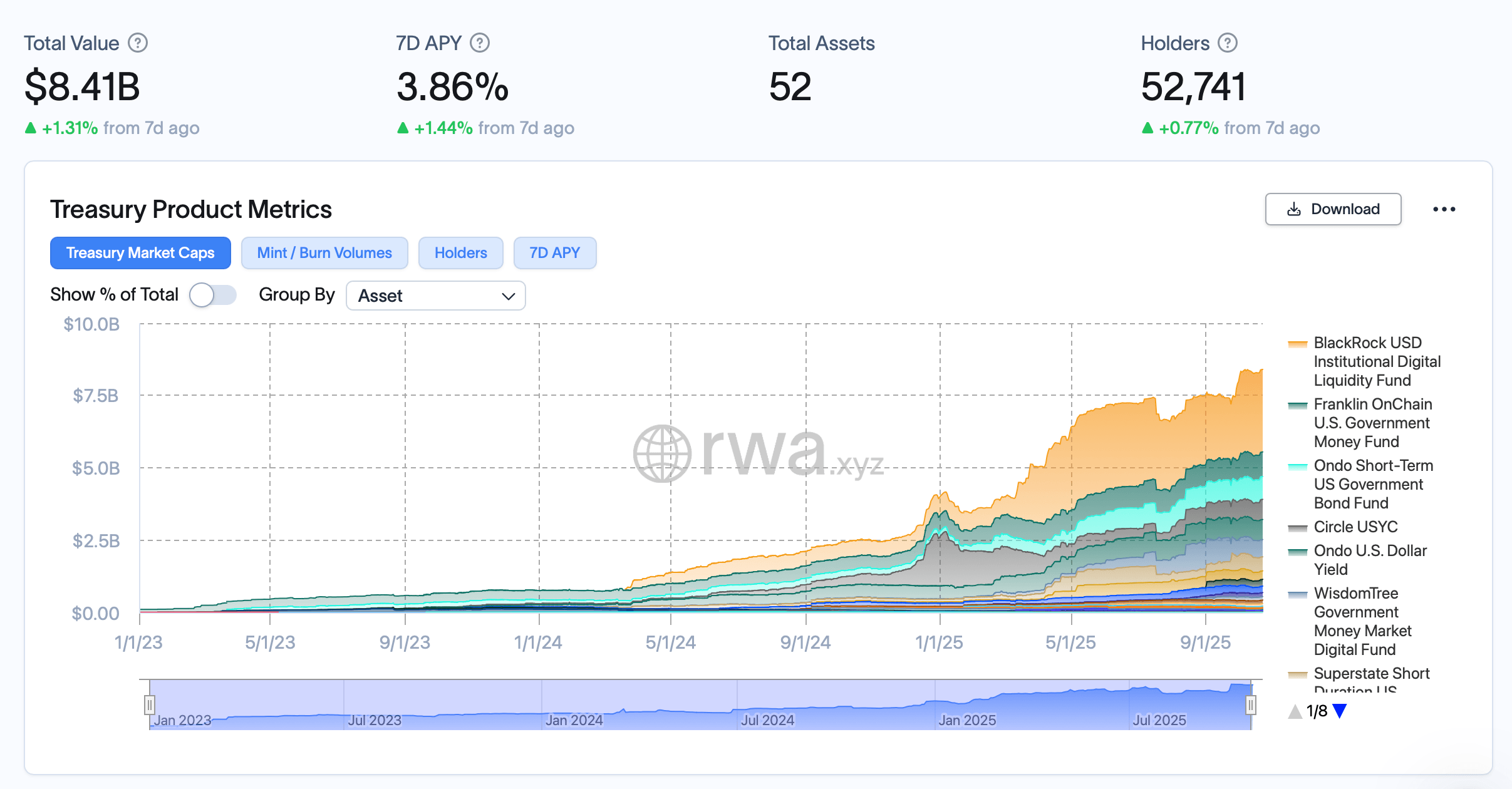

Tokenized U.S. Treasuries, those sly financial acrobats, executed a silent, sinuous flex upon the blockchain’s digital loom this week, swelling to $8.41 billion in value as investors pirouetted toward yield-bearing assets between Oct. 17 and Oct. 24, 2025. A modest 1.31% ascent? More like a grand overture in the symphony of decentralization.

Blackrock’s BUIDL: A Tyrant in Velvet Gloves

Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL) reigned supreme, hoarding $2.85 billion while straddling seven chains via Securitize’s platform. A titan in a pinstripe suit, it outshone Franklin Templeton’s BENJI ($851.6M) and Ondo’s OUSG ($788.3M) with the grace of a Wall Street ballerina. One might call it the “blockchain’s favorite child,” if blockchains had favorites.

Inflows: The Unseen Tango of Yields

Rwa.xyz stats revealed a 1.31% crescendo in total value, a $110 million crescendo over seven days. Average yields tiptoed upward to 3.86%, while holder counts swelled by 0.77% to 52,741. Even the most jaded DeFi hedgehog might nod in approval-though they’d probably scoff and demand a 10% cut for their trouble.

Platform Power Plays: A Chess Match of Chains

Securitize, that digital puppeteer, clutched 35.03% market share, buoyed by BUIDL’s expansion. Ondo lingered at 17.58%, while Franklin Templeton and Circle trailed with 10.13% and 8.28%. Meanwhile, Superstate’s USTB fund sprouted a 31.8% bloom over 30 days-a flower in the desert of tokenized treasuries.

Chains: The Great Multi-Chain Masquerade 🎭

Ethereum, that old moneybags, hoarded $4.3 billion in tokenized treasuries, followed by Avalanche ($638M) and Stellar ($609.8M). The multi-chain parade marches on, as issuers hedged network risk like Victorian debutantes dodging scandal. “Diversify or die!” they whisper, clutching their cross-chain portfolios.

Yield Hunters: The Gold Rush of 2025 🏴☠️

BUIDL, that financial pirate, plundered $749 million in 30 days. Circle’s USYC and Superstate’s USTB followed with $119M and $160M respectively, while Ondo’s OUSG added $59M. Wisdomtree’s WTGXX (7.55%) and Fidelity’s FDIT (13.39%) joined the feast. One wonders if these funds will eventually merge into a single entity called “The Yield Syndicate.”

Fee Games: A Carnival of Schemes 🎢

Franklin Templeton’s 0.15% fee felt like a bargain compared to Circle’s 0% management fee (offset by a 10% performance cut-because why not?). Tokenized products, it seems, are playing a game of financial charades, each trying to outwit the investor with the next “innovative” incentive. A circus, really.

The Bigger Picture: A Love Letter to the Future 💌

With 52 products on rwa.xyz-from Ethereum to XRP Ledger-the tokenized treasuries sector has become the bridge between TradFi and DeFi. A modest 1.31% gain? Pfft. This is infrastructure, darling. Infrastructure with a side of sarcasm and a sprinkle of emojis. 🚀

FAQ 💡

- What’s the total value of tokenized U.S. treasuries this week?

The market rose to $8.41 billion, up 1.31% from the previous week. A mere trifle, perhaps, but a trifle with panache. - Which platform leads the tokenized treasuries market?

Securitize leads with 35% share, powered by Blackrock’s BUIDL fund. A duet of dominance and digital dexterity. - Which blockchain hosts the most tokenized treasuries?

Ethereum dominates with $4.3 billion in tokenized treasuries. Because why let Avalanche have all the fun? - How many holders now own tokenized treasuries?

More than 52,700 holders, reflecting steady institutional and DeFi interest. A hive mind of yield-chasing, blockchain-besotted enthusiasts.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- He Had One Night to Write the Music for Shane and Ilya’s First Time

- Gold Rate Forecast

- Brent Oil Forecast

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

2025-10-26 00:09