What to know:

Welcome, dear readers, to the delightful world of Crypto Long & Short, your weekly dose of insights, news, and analysis for the discerning investor. Do sign up here to have it delivered to your inbox every Wednesday—because who doesn’t love a little midweek excitement?

1) collateral mobility and new utility enhancing real-world assets, and 2) the delightful effects tokenization will have on investment strategies and workflows.

Adding utility and collateral mobility

“I think that’s actually what makes this technology so powerful is that you’re talking about the same token but it can be used in very different ways for very different investors as long as, of course, the risk framework is right,” mused Maredith Hannon, head of business development, digital assets at WisdomTree. Quite the sage, isn’t she?

While tokenizing assets is as straightforward as ordering a cup of tea, the real opportunity lies in enabling a more streamlined usage of assets compared to their traditional counterparts. A panel dedicated to this topic shared examples of tokenized treasury products that can be used in both retail and institutional settings. Thanks to blockchain, an asset can move more freely than a socialite at a cocktail party! A money market fund could be used as collateral on a prime brokerage, allowing investors to earn their yield without having to exit their position. How positively civilized! 🥂

And let’s not forget the delightful disruption in lending and borrowing, all thanks to tokenization. Going to a traditional lender for cash is about as enjoyable as a root canal.

“The end goal, in my opinion, would be that my kids, when doing their first mortgage, just apply anonymously, saying ‘this is my situation, I want to borrow this for that,’ and then they just borrow it from many people at the same time, repaying in stablecoins… it’s already quite daunting to talk to 20 banks for one apartment, at least this is how it works in France right now,” lamented Jerome de Tychey, CEO at Cometh. Oh, the horror!

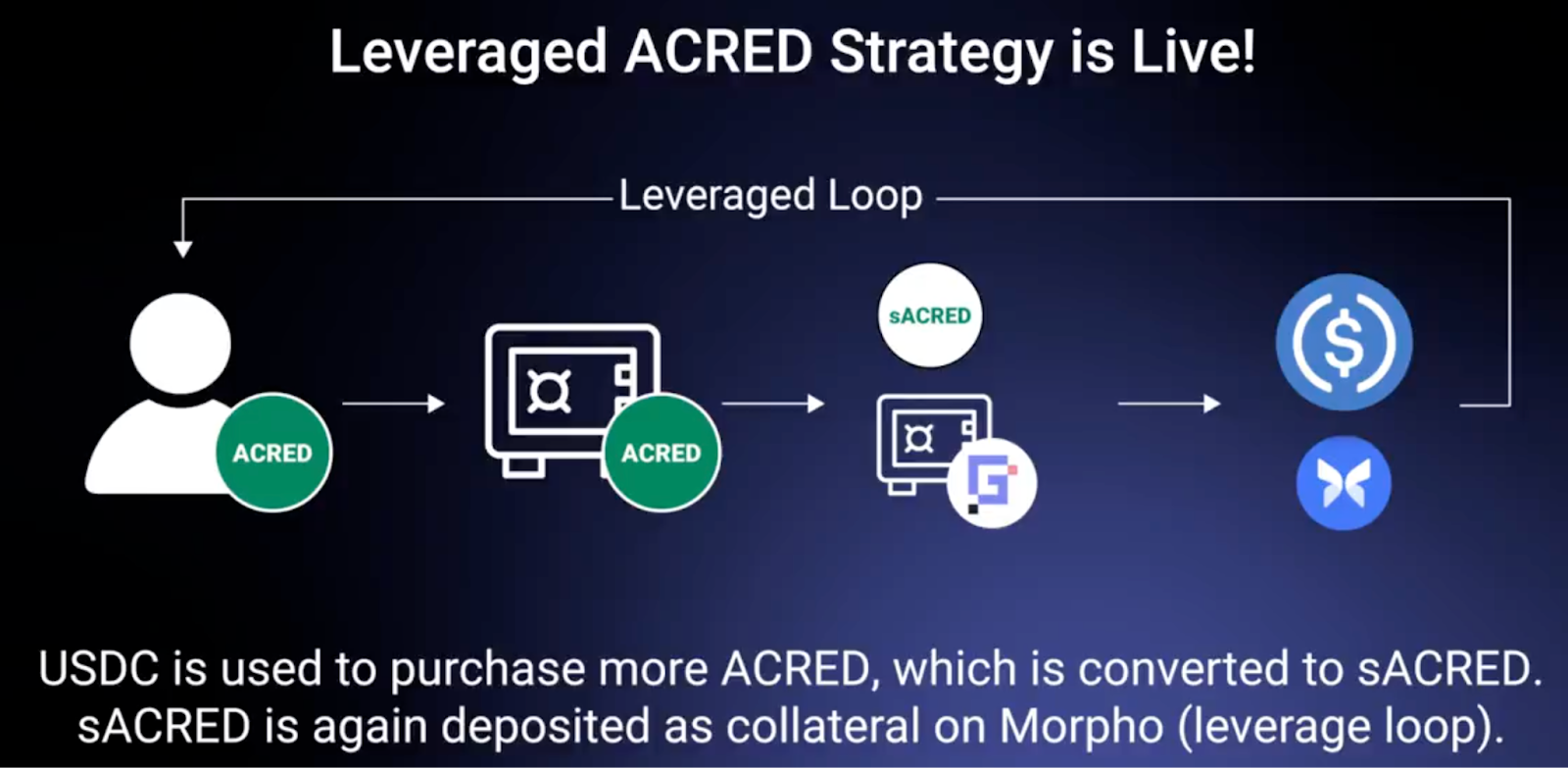

Jerome’s tale illustrates the power of decentralized finance for individuals and how it can fast-track a loan. Figure offers an internet-based solution for home equity lines of credit (HELOCs), and they’re using blockchain in the backend. By issuing, warehousing, and securitizing them, they’ve saved 150 bps in the process—an operational advantage, indeed! From an investment standpoint, the DeFi vaults panel showcased how vaults streamline similar processes for investors, with Apollo’s tokenized private credit fund now using this technology to enable leverage loops. Borrowed stablecoin can be used to buy more of the asset, increasing yield while being subject to a built-in programmatic risk framework. How delightfully clever! 💡

However, challenges remain to be solved before vaults can take off, such as high custody and liquidity provision costs, limited RWA composability in DeFi, and minimal appeal to crypto-native users seeking higher returns. But fear not, dear participants, for enthusiasm for future possibilities remains as high as a kite!

How RWAs are impacting traditional strategies and workflows

“The reason this technology is so powerful is because it’s a computer. If you think about all the middle and back office work from originating an asset to selling it, how many intermediaries touch it and take fees, how many people ensure loan tapes match with received funds—bringing that workflow on-chain is far more meaningful than just focusing on the asset itself,” declared Kevin Miao, head of growth at Steakhouse Financial. Quite the revelation, wouldn’t you say?

Traditional markets have had a challenging time incorporating less liquid, higher-yielding assets into investment strategies due to complex back and middle office needs for transfers, servicing, reporting, and other factors. Automating transfer processes and providing on-chain transparency would make it easier for these assets to be allocated in and out of, in addition to cryptocurrencies introducing new investment opportunities. How positively revolutionary!

Cameron Drinkwater from S&P Dow Jones Indices and Ambre Soubiran from Kaiko discussed how blockchain will unlock previously inaccessible portfolio construction tools. They shared how this could result in blockchain-native investment strategies combining crypto and private asset allocations for greater diversification and new sources of yield. A veritable cornucopia of opportunities!

Achieving this, however, requires interoperability between legacy and blockchain-based infrastructure and between blockchains themselves. Some critical elements include aligning workflows, price transparency, rebalancing, on-chain identity, risk assessment considerations, and risk management solutions. Providing maximum visibility into these assets and tools to navigate markets on-chain is one key step in.

RWAs are shifting from theoretical blockchain to practical tokenized asset implementation in traditional and decentralized finance. The focus is now on enabling real utility through better collateral mobility, new financial products, and more efficient workflows. By improving interoperability and identity frameworks, tokenization is expected to democratize illiquid assets and enhance financial efficiency. For additional recordings of the informational sessions, do visit STM TV on YouTube—because who doesn’t love a good show?

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates. But do take it with a pinch of salt, darling!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Basketball Zero Boombox & Music ID Codes – Roblox

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- Come and See

2025-05-21 19:21