Dearest reader, as of the 24th day of June, in the year 2025, Bitcoin finds itself resting—if such a thing may be said of so fidgety a creature—at $105,138, boasting a market capitalization that would make even Sir Walter gasp: $2.09 trillion. It has, in the past day alone, traipsed merrily through a trading volume of $52.63 billion, its price ricocheting between $100,177 and $105,927 with the flair of a fortune-seeking debutante at her first ball. Pray, is this a comeback of substance, or merely a flirtation with hope? 🧐

Bitcoin

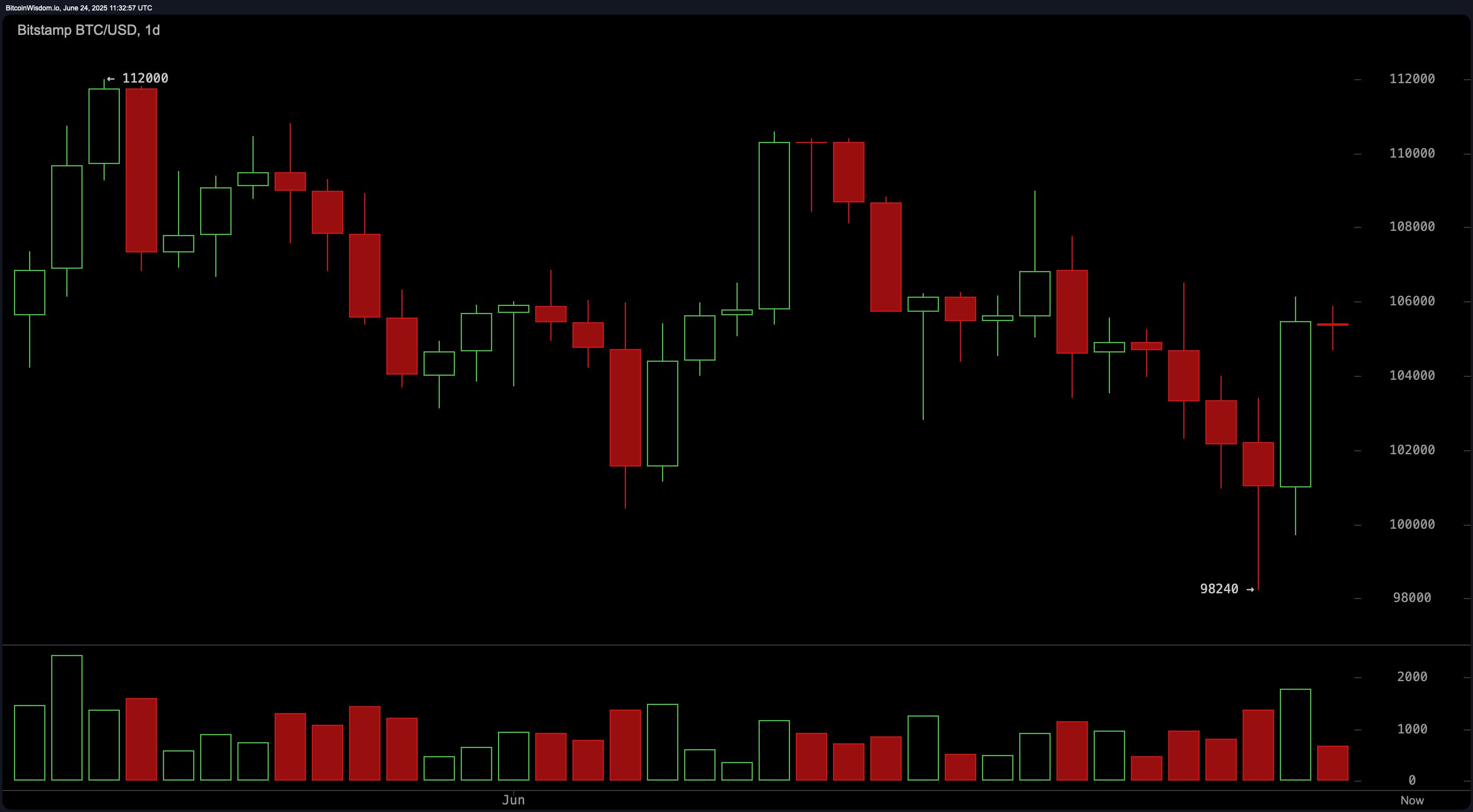

Upon the daily chart, bitcoin appears to have concluded its most dramatic swoon—from the heady heights of $112,000 down to a pitiable nadir near $98,240—with all the melodrama of a Regency heiress denied a fourth dance. The presence of a bullish reversal candle (as the traders call it), swaddled in voluminous buying interest, implies that buyers have ceased wringing their hands and started loosening their purse strings—though perhaps with the caution of one eye upon the chaperones. Support is holding fast at $98,000, while resistance hovers between $106,000 and $108,000, behind which the market’s would-be suitors gather, awaiting their chance to waltz. To maintain its advantageous posture, Bitcoin must remain above $104,000—failure to do so would be most improper indeed.

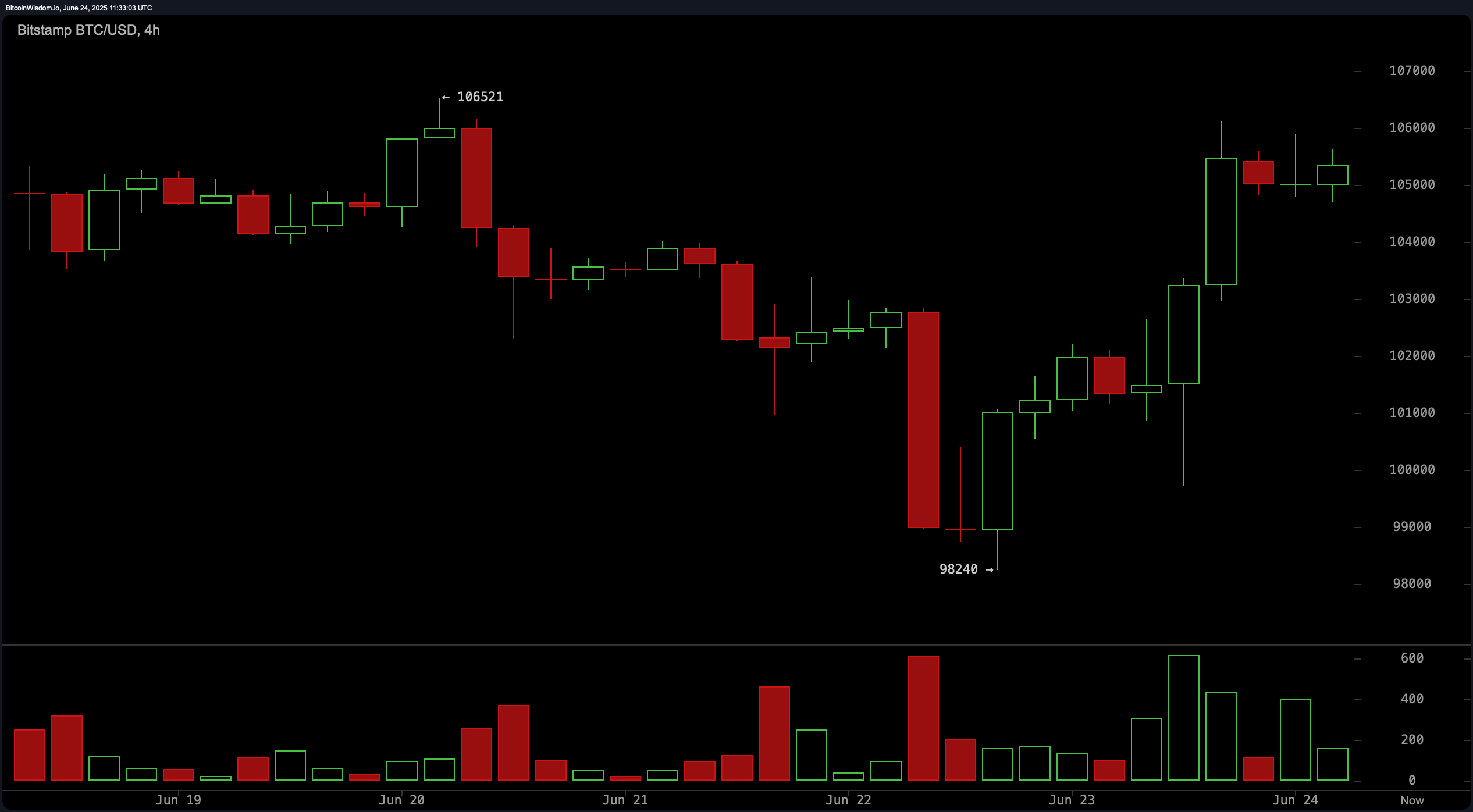

Turning to the four-hour chart, one cannot help but note bitcoin’s V-shaped recovery—a formation loudly celebrated by all who crave scandalous reversals of fortune. Having plunged to $98,240, our asset surged anew, the volume bars blushing a becoming shade of green. However, it presently finds itself breathless beneath $106,000 resistance. Should it break vaingloriously above $106,500, particularly if accompanied by a boisterous upturn in volume, the road to $108,000 or greater riches may open. One suspects the market’s more audacious participants have assembled outfits suitable for an extended rally. 💃

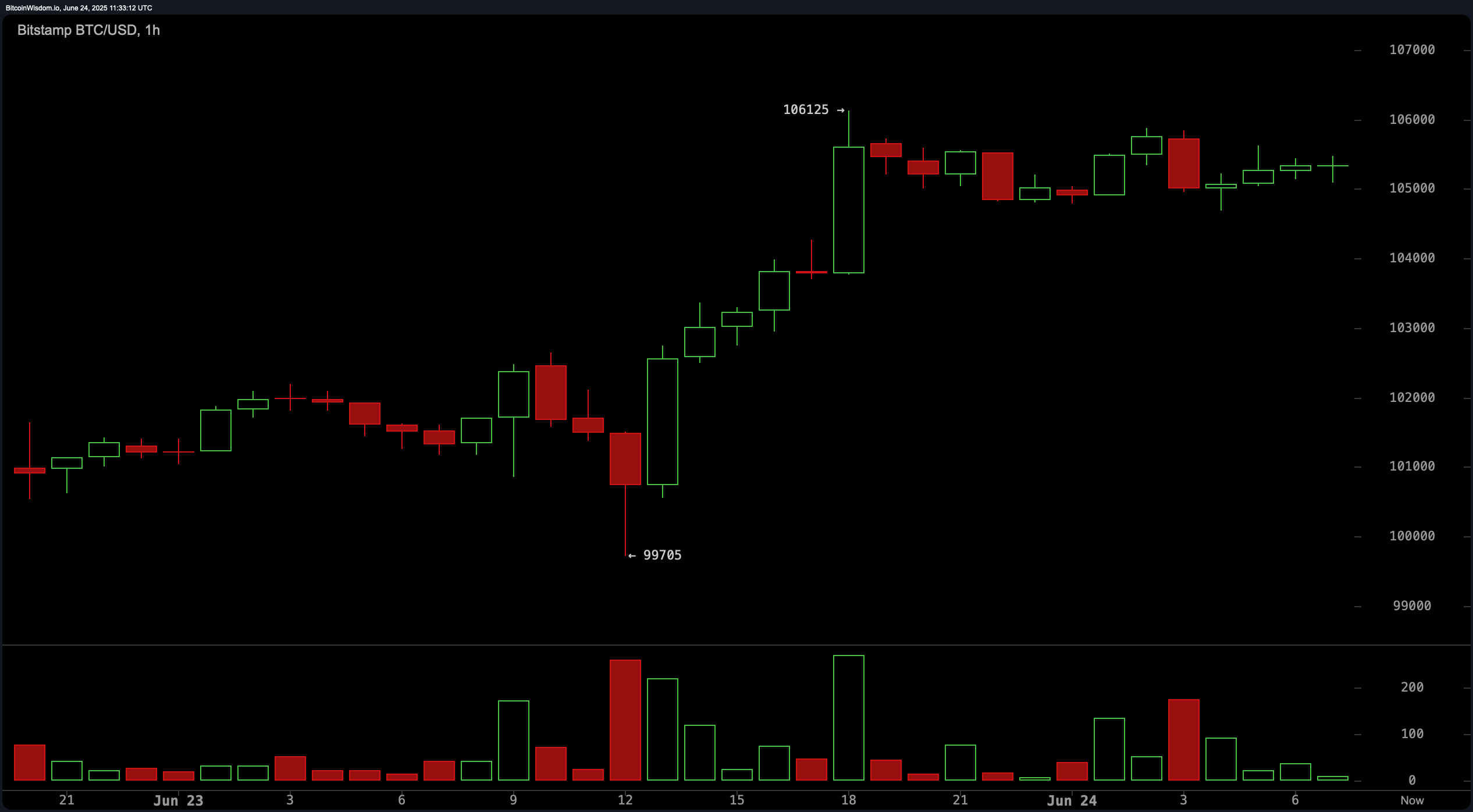

On the hourly chart—a brisk and, some might say, impetuous timeframe—bitcoin is seen ascending from $99,705 like an elopement in a well-heeled carriage, strings of higher highs and higher lows in tow. The price consolidates between $105,000 and $106,000, perhaps composing a bullish flag, though with volume waning like a dinner party past midnight. A most eligible dip to $104,500–$105,000 may serve as an opportunity for daring suitors wishing to enter for the long haul. The general consensus is bullish, albeit tinged with the wariness of a mother sent to chaperone by candlelight. 🕯️

Technical indicators, those formidable aunts of the trading world, offer a report laden with mixed signals, yet tending slightly toward optimism, perhaps after a sherry or two. The oscillators—RSI (52), Stochastic (47), CCI (3), ADX (18)—seem to have settled into a state of respectable neutrality, neither gossiping nor indeed declaring a verdict. The awesome oscillator at -2,816 offers no invitation to dance. Yet, the momentum indicator at -24 flutters its fan towards the buyers, while the MACD (–276) lingers in chilly opposition. One can imagine the room is evenly divided; some pray for a proposal, others are ready to bolt at the first sign of scandal.

To the moving averages (MAs), whose judgments are attended with gravity: all the exponential moving averages (from the 10-period at $104,482 to the stately 200-period at $93,803) incline toward bullishness. The simple moving averages, meanwhile, present a dish of mixed fortune — with only the 30-period ($105,674) donning the black armband of bearish sentiment, while the rest (notably the 50-period at $105,296 and the ample 200-period at $96,017) maintain bullish airs. This convergence of fortuitous signals suggests enhancement of Bitcoin’s character, should it behave properly above resistance lines. 💼

Bull Verdict:

Should Bitcoin conduct itself with sufficient aplomb above $104,000, and sweep past the $106,500 resistance in a burst of enthusiasm, the drawing room gossip will all be of $108,000 and even greater elopements. With moving averages fluffing its reputation and technical patterns lining up their dance cards, only an utter lack of decorum could derail this upward promenade. 🦚

Bear Verdict:

However, if Bitcoin’s recent good graces falter, and it is rebuffed by those formidable resistance matrons between $106,500 and $108,000, expect a rapid retreat, possibly scurrying back towards $102,500, or, in the very worst sort of Regency disgrace, $98,000. With MACD tittering warnings and oscillators dodging engagements, the market stands precariously upon a parlour knife’s edge. Mind your funds; scandal is but a candle’s flicker away! 🕵️♂️

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Jump Stars Assemble Meta Unit Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- League of Legends: T1’s Lackluster Performance in LCK 2025 Against Hanwha Life Esports

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Sony Doesn’t Sound Too Concerned About Switch 2, Even After A Record-Breaking Debut

2025-06-24 15:57