- Bitcoin: teetering just beneath a ridiculous short liquidation cluster. Drama much?

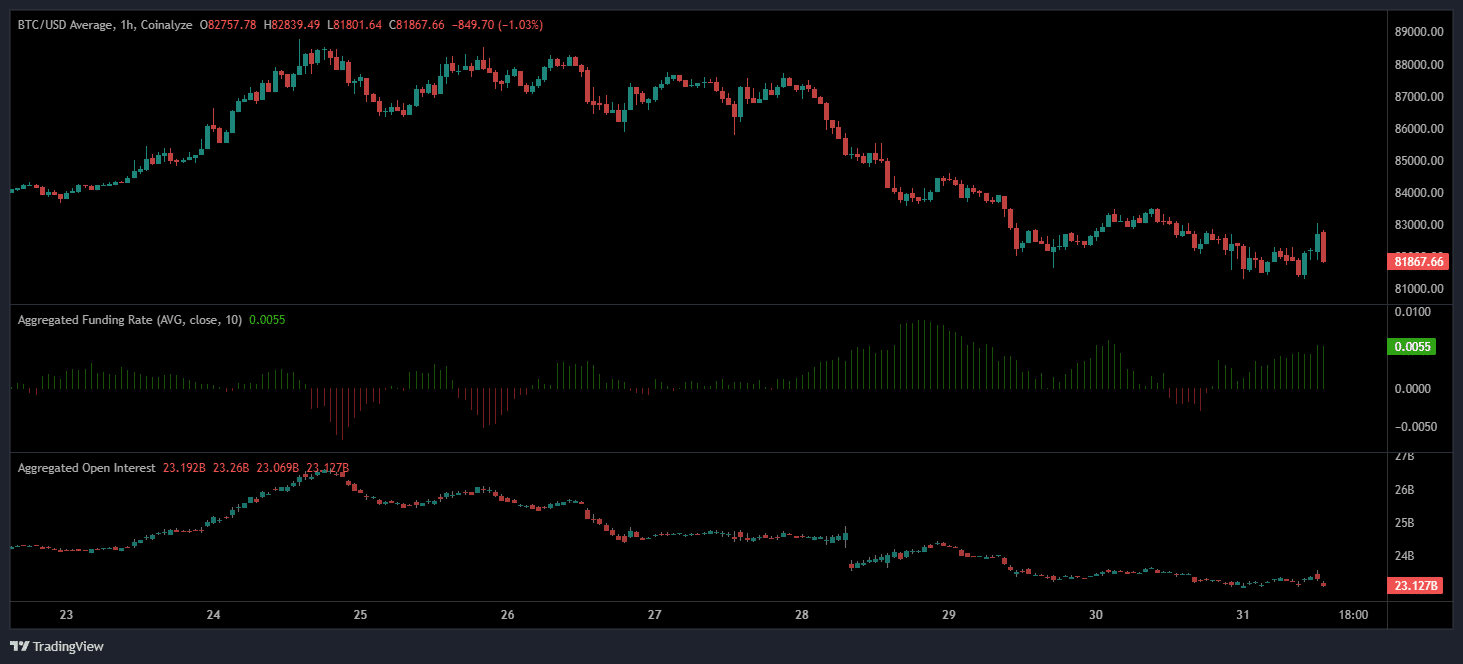

- 9% Open Interest drop in a week. Traders either ran for the hills or got obliterated. 🚪💨

Alright, Bitcoin [BTC]. It’s doing its thing again—flirting with “critical thresholds.” Oh, how suspenseful. Price is shimmying up to some dense short liquidation zones. Exciting, right? Sure. If you’re into charts and numbers. Me? I’ll be over here having a sandwich. 🍞🧀

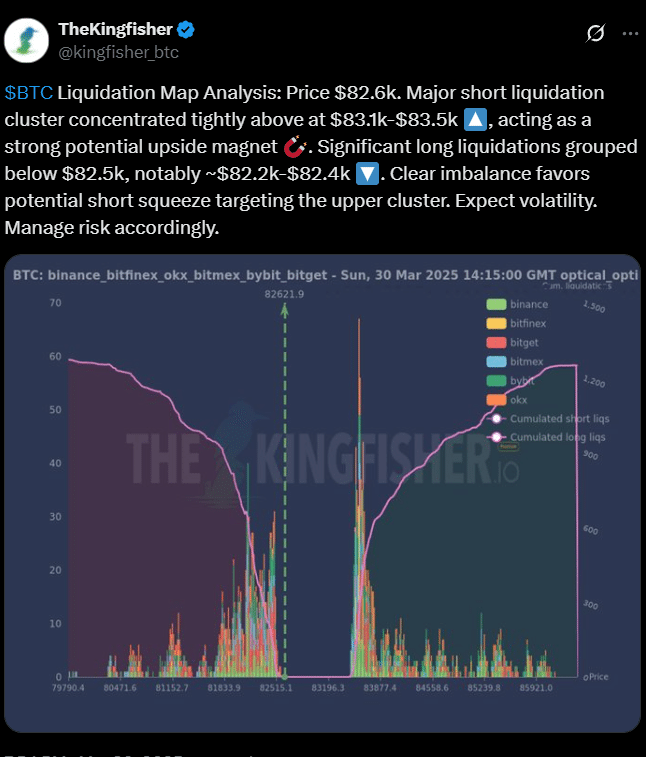

On 30 March, some crypto guru, TheKingfisher—I mean, is this a person or a fishing show?—puts Bitcoin at $82,621.9. Did they measure this with a ruler? Whatever. Apparently, Bitcoin is stuck like a pickle between “opposing liquidation zones.” Sounds fancy, but basically, it’s like a tug-of-war with money.

At press time (love that phrase, “press time,” so official), short positions cluster somewhere between $83,100 and $83,500. And down below $82,400? Long liquidations stretching like a bad yoga move. Compression, people! It’s a tight squeeze! Just like my pants after Thanksgiving dinner. 🦃

A squeeze waiting to happen?

Let me tell you something. You zoom into this chart structure, and you see imbalance. Oh, great. Imbalance. Just what I need in my life.

Short positions here—just a smidge above spot at 0.6–1.1%. Longs? They’re all over the map. It’s chaos. Total chaos. If this “upper boundary” is breached, there’s a chance bulls could run wild. Yeah, like a herd at a theme park on Free Ice Cream Day. 🍦(But only if!!)

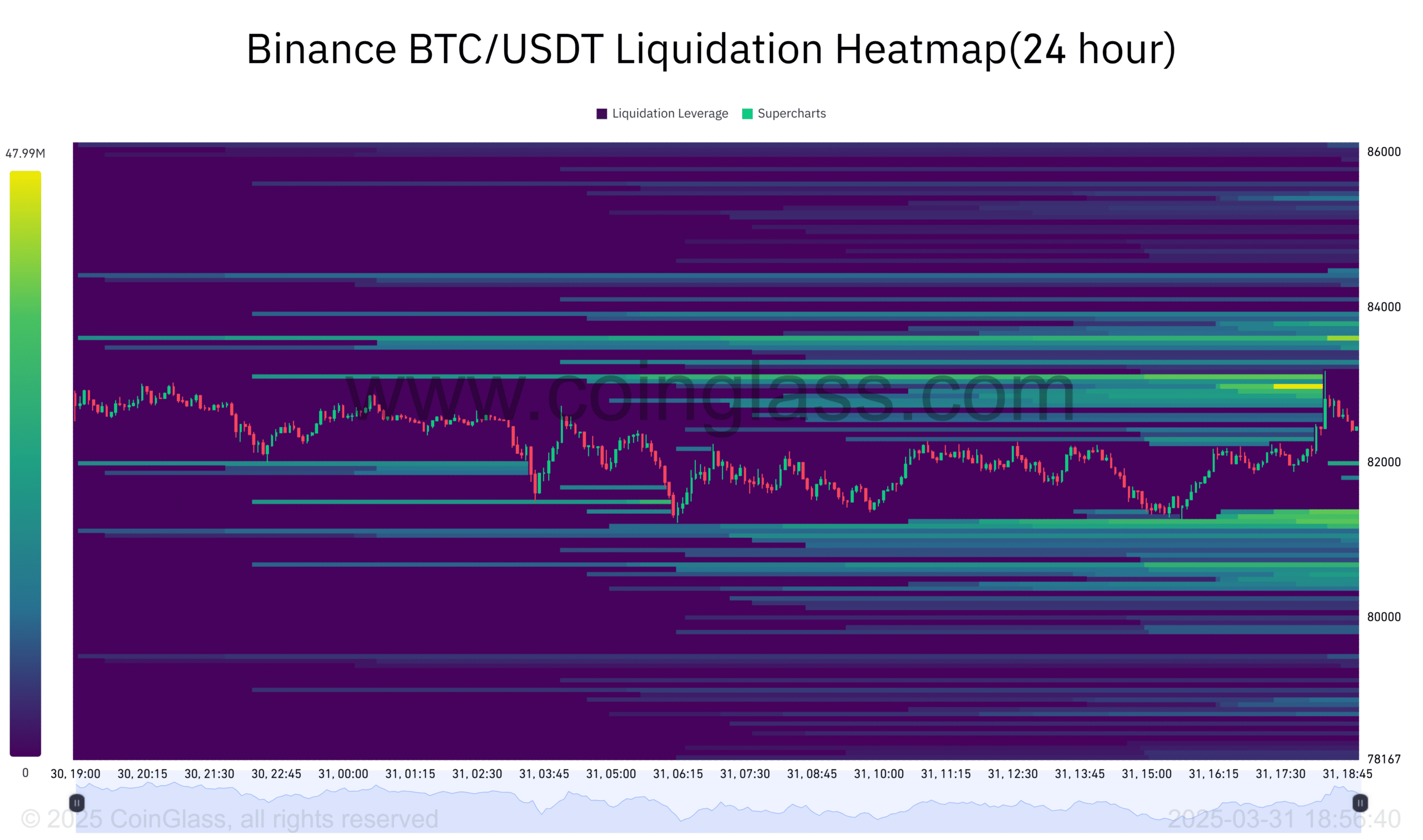

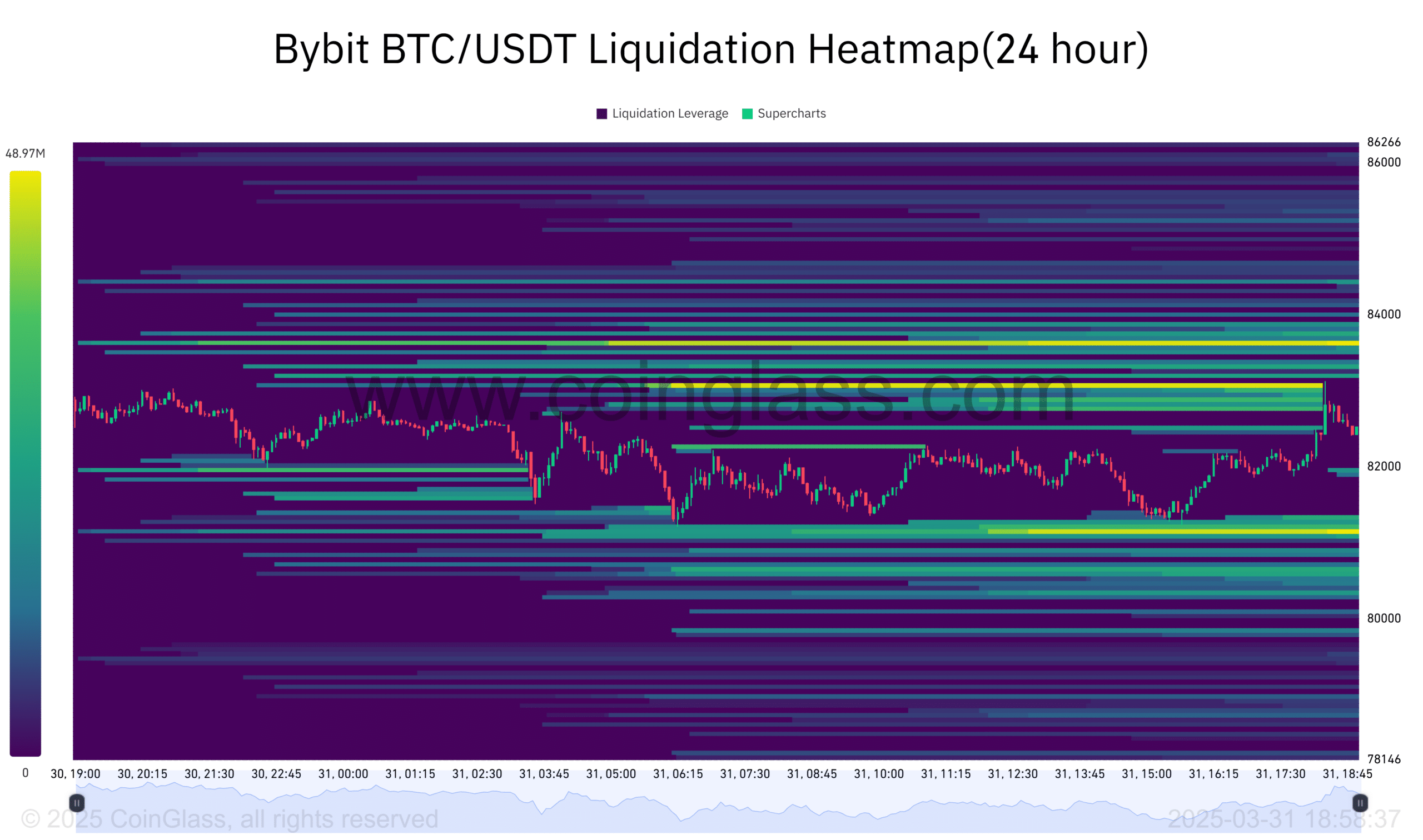

Trading platforms are also in this opera of madness. Take Binance and Bybit. These platforms have the “most concentrated” short positions. Said with a straight face, too. The nerve! If prices go up, those short positions are toast. Pop! Like bubble wrap, but with bigger financial consequences.

Need proof of this madness? Behold the heatmap!

Seriously, these charts—they’re like the Rorschach tests of finance. “Do you see an upward spiral or a downward demise?” Who knows?!

And Coinglass shows Bitcoin went from $80,673 to $83,618 on 31 March. Wow. Big whoop. Maybe someone had an itchy trading finger? (Could happen. Fed up with bad wifi and—boom! Trade clicked!)

A surge… or just the start?

Let’s layer in another chart (because no article is complete without a pile of these, obviously). Bybit threw down some numbers, too. A heatmap recorded a peak session at $83,642. Liquidation leverage hit $48.98M. Translation: people bet big, lost big, and cried into their keyboards. 💻😭

Apparently, short positions are stacked here. Well, good luck to them. Everyone’s got a dream, right?

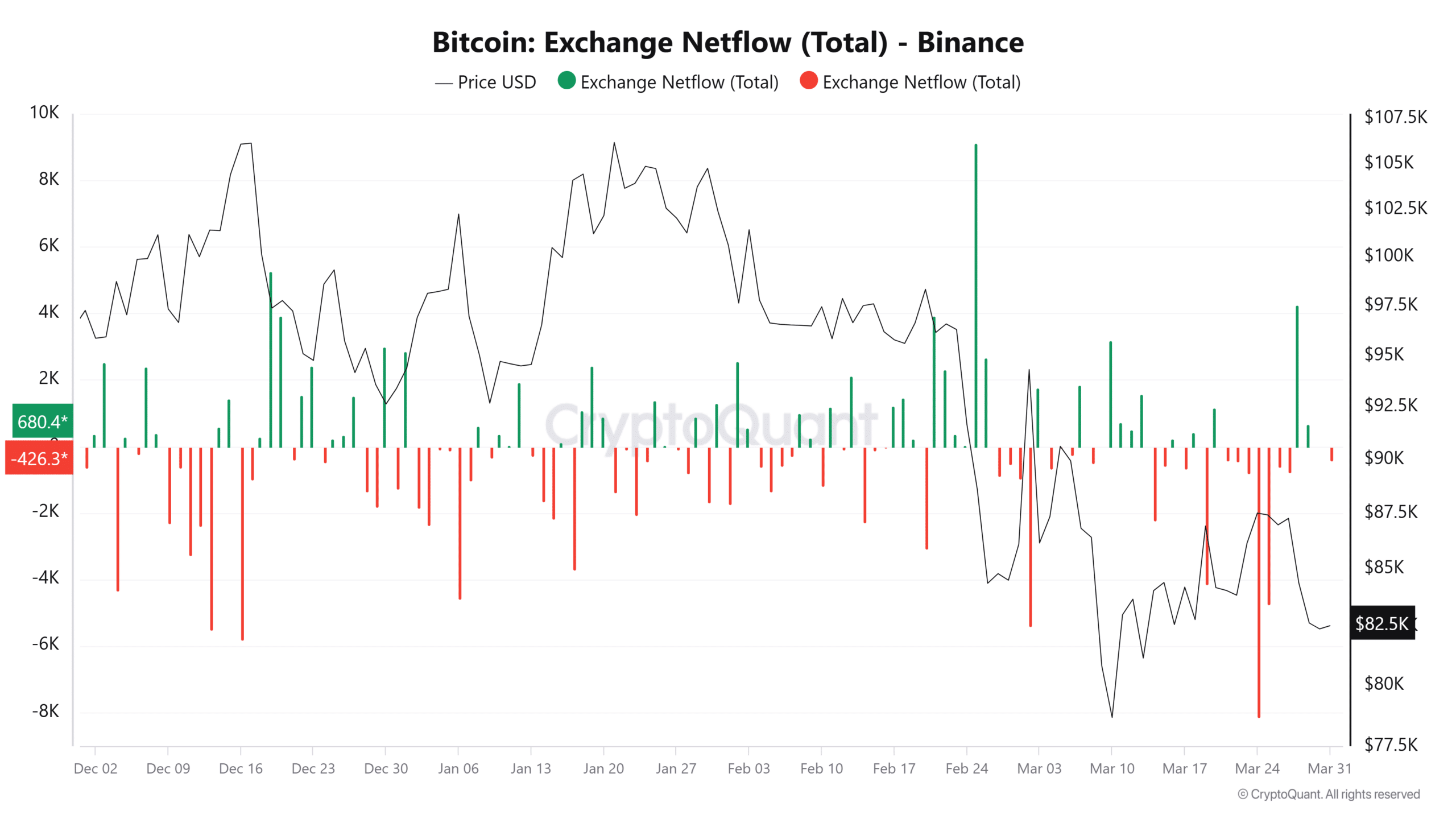

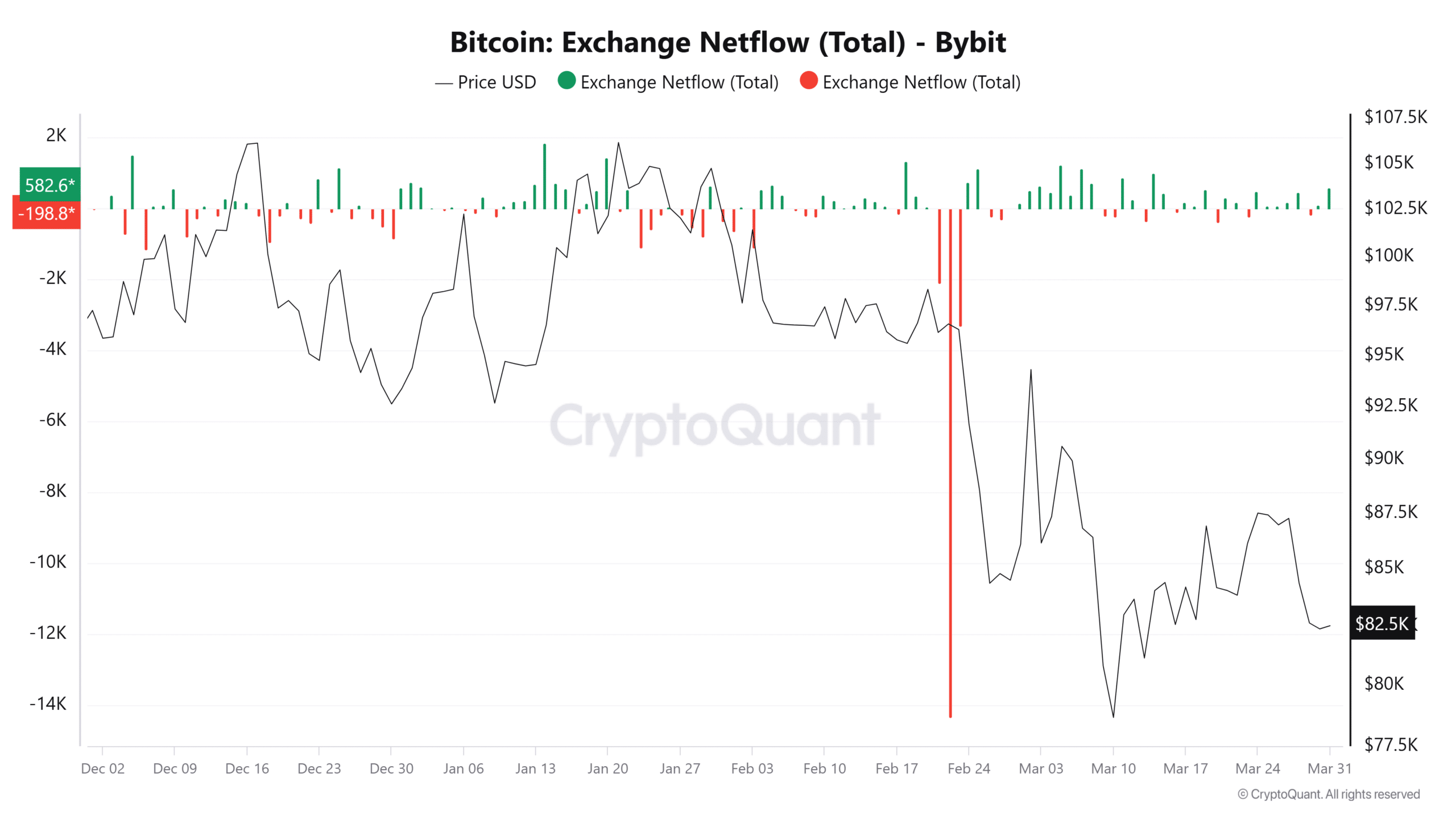

Oh, and here’s a bonus nugget: Bitcoin outflows have been reigning supreme at Binance and Bybit since February, says CryptoQuant. Translation: money’s leaving, people are skeptical, and the whole vibe screams, “I’m outta here!” 🚶♂️💨

Even when 4,258 BTC flowed in on 28 March, people kept their bags packed. Obviously, no one’s committing here like a bad Tinder match.

Look back to see forward

Now, stepping back a little (because apparently, hindsight is 20/20). Bitcoin peaked at $106,164 in January, and since then? It’s like rolling downhill in a shopping cart. 22% down by March. Bravo. 🎢

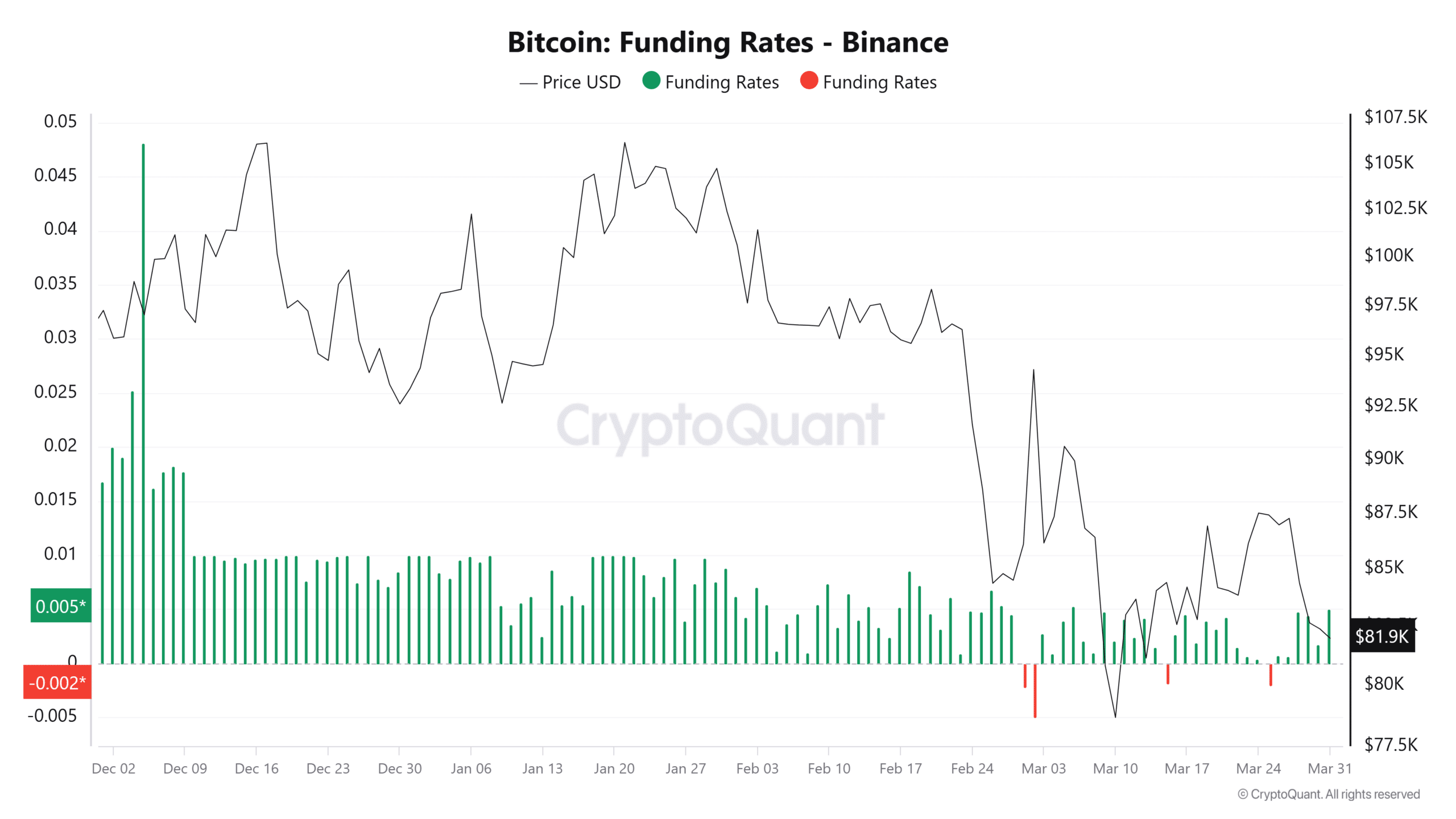

Let’s not forget funding rates. Between 24–28 March, they were negative, which means short sentiment dominated. But now, they’re flipping positive… Oh, the drama! Rates going back and forth like a bad sitcom marriage. 📉📈

And then there’s Open Interest. Last week of March? Dropped like my Wi-Fi connection during Netflix. It went from $25.39 billion to $23.12 billion. A steep drop on 28 March screams, “Liquidations ahoy!” Pirates in a financial storm, people. 🏴☠️

Shorts keep piling up, outweighing longs by 1.5–2x. And someone somewhere is betting on a 60–65% chance of upward volatility. Sure. Why not? I mean, we can all dream. But I still wouldn’t bet my pastrami sandwich on it. 🥪

Here’s the bottom line, folks. Either Bitcoin breaks $83,100 and takes the scenic route to $83,877 or—it doesn’t. Big shocker, right? Will it rise? Will it tank? Do these funding rates go negative again? Take your bets. Take your TUMS. But remember, Bitcoin doesn’t care. It’s Bitcoin. It just does its thing. 🤷♂️

Read More

- Best Crosshair Codes for Fragpunk

- How to Get Seal of Pilgrim in AI Limit

- Lucky Offense Tier List & Reroll Guide

- Wuthering Waves: How to Unlock the Reyes Ruins

- Enigma Of Sepia Tier List & Reroll Guide

- Are We Actually Witnessing a Crunch Time for ADA? 😲📈

- TenZ rips into Valorant’s “Power Rangers” meta and calls for CS2-inspired changes

- Final Fantasy Pixel Remaster: The Trials of Resurrection and Sleeping Bags

- Shocking NFT Sales Surge! But Where Did Everyone Go? 🤔💸

- Lost Records Bloom & Rage Walkthrough – All Dialogue Options & Puzzle Solutions

2025-04-01 11:09