Well now, in the digital bazaar where folks trade shiny coins like children exchanging marbles, we find ourselves knee-deep in a dust storm up ahead. Bitcoin‘s hotfooting it around with a price tag of BTC $115,846, and it seems to be doing the cha-cha with a volatility rate of 2.6%—that’s fancy talk for “hold on to your hats!”

Now, cast your eyes to the horizon where a whopping $12 billion worth of BTC options is set to hit the floor on the 25th of July, and I reckon the sellers are waking up in a new world of pain, down by 2.71% as our beleaguered hero limps back to $115,000. Alas! Daily trading volumes, however, are puffing themselves up like a rooster at dawn, strutting around with a figure of $94 billion!

And if that ain’t enough to get your heart racing, they say a cool billion in liquidations splattered across the market on July 24. Altcoins? They seem to be taking a little breather—might be the shock of it all. With $15 billion in Bitcoin and Ethereum options lining up to expire, it’s a regular circus of uncertainty!

🚨 Options Expiry Alert 🚨

Tomorrow, over $15.4B in BTC and ETH options are set to expire on Deribit. $BTC: $12.66B notional | Put/Call: 0.88 | Max Pain: $112K $ETH: $2.75B notional | Put/Call: 0.87 | Max Pain: $2,800

Last month’s H1 expiry hit $17B. This week’s is not far…

— Deribit (@DeribitOfficial) July 24, 2025

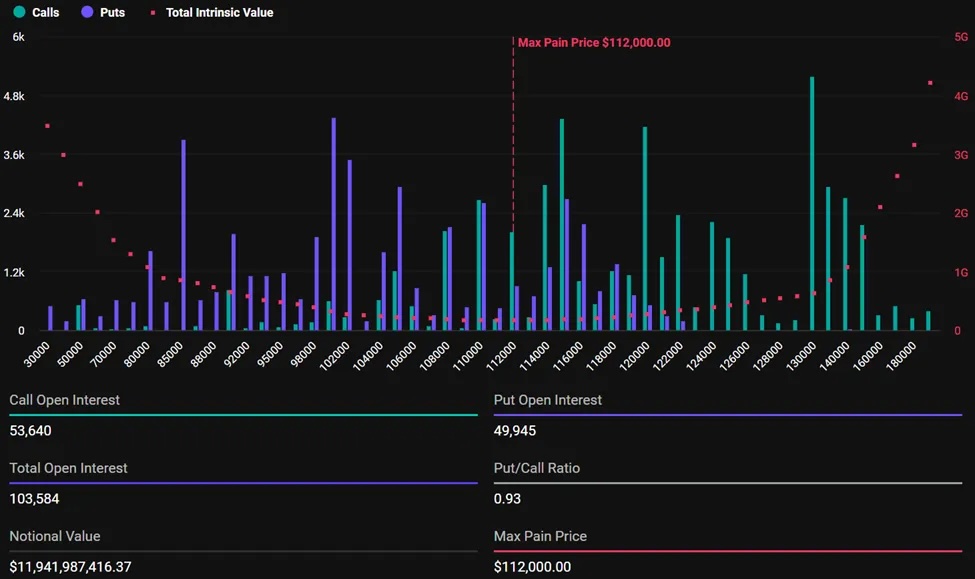

103,584 Bitcoin Options Contracts Expire As BTC Price Dives

Gather ’round, ye traders and market watchers! With a mighty $11.94 billion in Bitcoin options ready to go belly up today, we find ourselves in a situation where 103,584 contracts are like a herd of skittish cattle, according to the fine folks at Deribit. The Put/Call Ratio (PCR) gives off a slightly bullish whiff, sitting at 0.93, meaning the optimists are trying to tiptoe past the pessimists. Yonder lies uncharted territory!

Bitcoin options expiry | Source: Deribit

Now, the maximum pain point for today’s festivities is pinned at $112,000, which, if history’s any teacher, means a lot of sweaty brows and perhaps a few tears down the line.

As fate would have it, our gallant BTC has already faced the pangs of selling pressure earlier today, slipping down to $115,000 as it catches its breath. Rumor has it, good ol’ Mike Novogratz’s Galaxy Digital let loose about 30,000 BTC recently, fresh from the pockets of those whale chaps. The futures open interest is strutting about with a 7% boost, now resting at $88.54 billion.

Meanwhile, another platitude-filled platform named Greeks.live paints a gloomy picture, with traders entrenched in bearish sentiments, gripping their puts like a lifeline.

Community Daily Digest

Published: 2025-07-24

Overall Market Sentiment

The group shows a predominantly bearish sentiment with traders holding put positions despite significant losses. Most traders are focused on potential downward moves, with key…

— Greeks.live (@GreeksLive) July 24, 2025

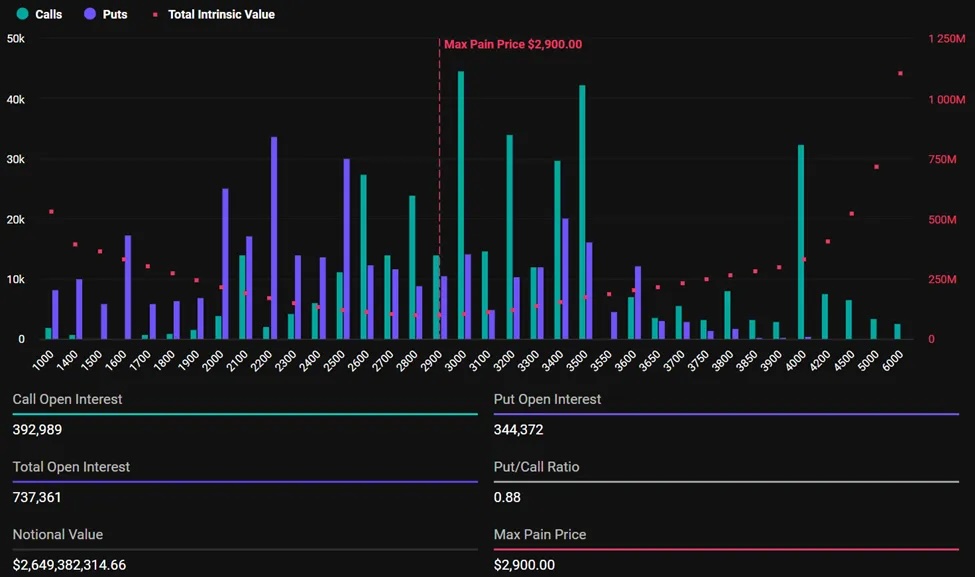

$2.5 Billion of Ethereum Options to Expire Today

Turning our gaze toward the charming Ethereum, we find options contracts amassing to a mighty $2.65 billion. With a grand total of 737,361 call options taking center stage, it seems they are the favored children today, while the put-to-call ratio winks at 0.88, hinting at bullish vibes all around. The maximum pain point? A dainty $2,900.

Ethereum Options Expiry | Source: Deribit

This week’s expiration seems like a shadow of last week’s notable $5.76 billion, closing out the $14.59 billion in total monthly options as we tiptoe into the twilight of July.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to watch the South Park Donald Trump PSA free online

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- 50 Goal Sound ID Codes for Blue Lock Rivals

2025-07-25 20:45