What to Know:

- According to the mystical risk reversals, ETH calls are pricier than BTC calls on Deribit—something fishy is afoot.

- ETH CME futures have gained faster than your grandma’s gossip in open interest—trust me, that’s quick.

- Premiums and funding rates for ether futures are higher, indicating traders are more bullish on ETH than on dull old BTC.

It seems the high rollers—those shadowy kings of finances—are increasingly favoring ether over bitcoin. A remarkable market twist, or perhaps just another day in the circus of crypto.

Bitcoin, that old warhorse, recently flirted with record highs beyond $110,000, basking in macroeconomic sunshine and a constant flow into spot ETFs, like a superstar basking under stage lights. It has gained over 16% this year—truly the poster child for resilience, or stubbornness.

Meanwhile, ether has, to everyone’s surprise, tumbled 20%, despite Ethereum maintaining its throne in DeFi and tokenization kingdoms. Oh, the irony! A rollercoaster, indeed.

Yet, don’t despair for the blue coin—the tide might turn soon, as an indicator suggests a bullish crush on ETH is blooming.

Options Say ETH Is the ‘Better Buy’—Apparently

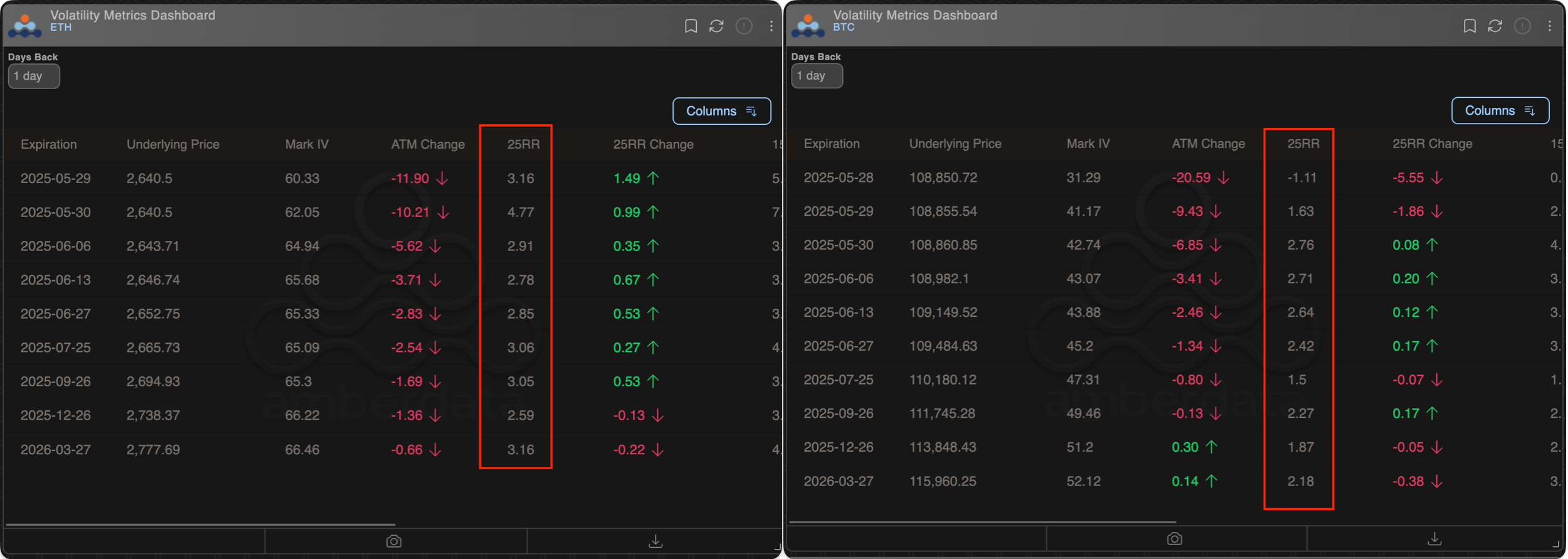

Options listed on Deribit reveal a stronger bullish sentiment for ether than for bitcoin—because who doesn’t love a good gamble?

Options are those fancy contracts that grant the right to buy but not the obligation—like a flirtation with financial fate. Calls show hope; puts, fear.

Currently, both BTC and ETH’s 25-delta risk reversals are positive, meaning traders favor calls—buying promises of future gains. But dear reader, ETH’s options are more expensive than BTC’s—traders are more enthusiastic about ETH, as if it’s the new chocolate cake at the party.

CME Futures: The Institutional Curtain Rises

The notional open interest for CME bitcoin futures—a fancy way of saying the total money involved—has soared about 70% since April’s crash, standing over $17 billion. A big show, indeed.

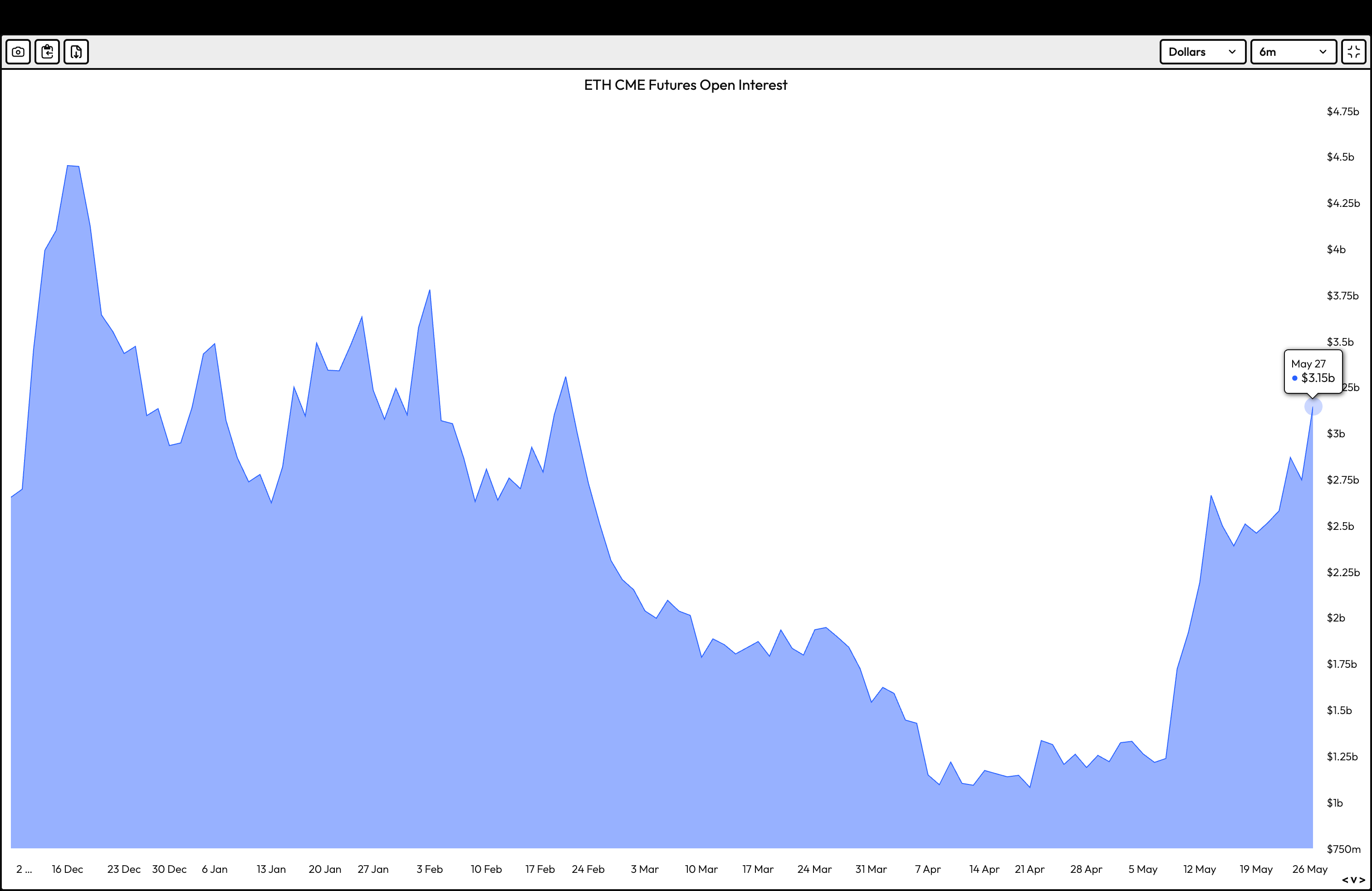

Yet, for the past week, it’s stopped climbing, like a politician dodging questions. Meanwhile, ether’s open interest skyrocketed by 186%, hitting $3.15 billion, with a sprint over the past fortnight. Clearly, the big money is turning its gaze to ether—perhaps tired of the old crowd?

Futures Premiums: Ether’s Gold Rush

Their high premiums say it all: optimism is in the air, and everyone’s apparently betting on ETH’s future glow.

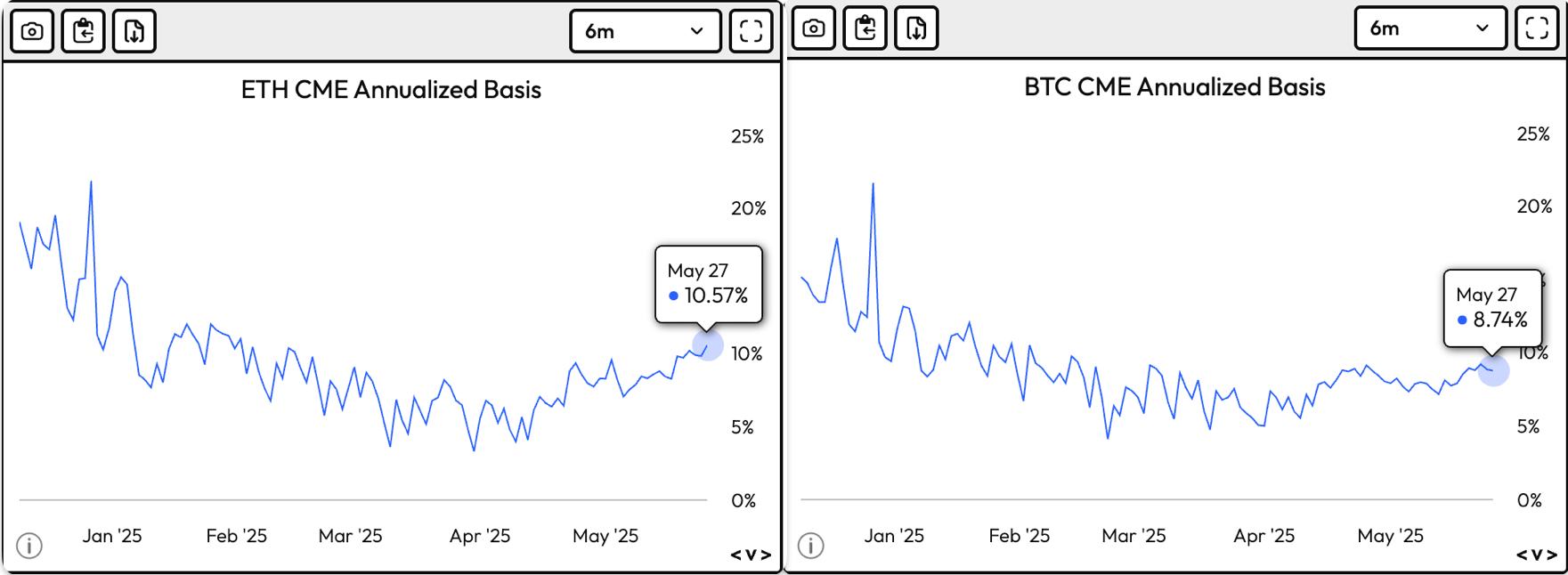

One-month ether futures boast an annualized premium of 10.5%, the highest since January—probably enough to make your eyes pop. Bitcoin futures aren’t far behind at 8.74%. Looks like the traders’ heart beats faster for ETH these days.

Yes, these elevated premiums hint at bullishness—probably the traders’ subtle way of saying, “Hey, ETH is the real thing now.” Still, we know how fickle markets are—today’s optimism might just be tomorrow’s punchline.

And in offshore exchanges, funding rates for ETH hover near 8%, while BTC keeps below 5%—because apparently, ETH is the favorite child showing off in the playground of markets.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lottery apologizes after thousands mistakenly told they won millions

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-28 15:39