Bitcoin’s Vanity Fair: A Tale of Resistance, Wild Whales & Wistful Wishes

In the grand theatre of cryptocurrency, our dear Bitcoin—ever the showstopper—has stumbled upon a resistance so formidable, even a Hollywood star would bow. A cryptic scholar of the digital arts, Justin Bennett, with 115,600 followers hanging on his every word—presumably not just for fashion tips—whispers that our beloved coin might be crafting a bearish flag. Oh, the drama! It’s predicted to tumble more than 7%, which, in the universe of speculations, is about as precise as my cat’s mood swings.

Bear flag patterns—those delightful technical signals—are like the clingy ex who consolidates upward only to dash your hopes, all while hiding a downward move behind a smokescreen of charts and candles. Truly, a masterstroke of subtlety, much like my own social engagements.

“Here’s a different perspective of BTC with the same conclusion: April trend line break plus failure to hold $106,600 plus a potential bear flag below resistance. $97,000-$98,000 is the objective. $106,600-$106,800 is my invalidation. Simple.”

Yet, amidst this melodrama, our analyst reminds us that perhaps if the stock market—those overgrown playgrounds for Wall Street wizards—continues its bullish romp, Bitcoin might just cling to its six-figure dreams. Naturally, the bond between stocks and coins could prove both a blessing and a curse.

“The big wildcard with any bearish crypto stance is the US stock market. Without a pullback there, you have to wonder if we’ll get a further pullback here. Time will tell.”

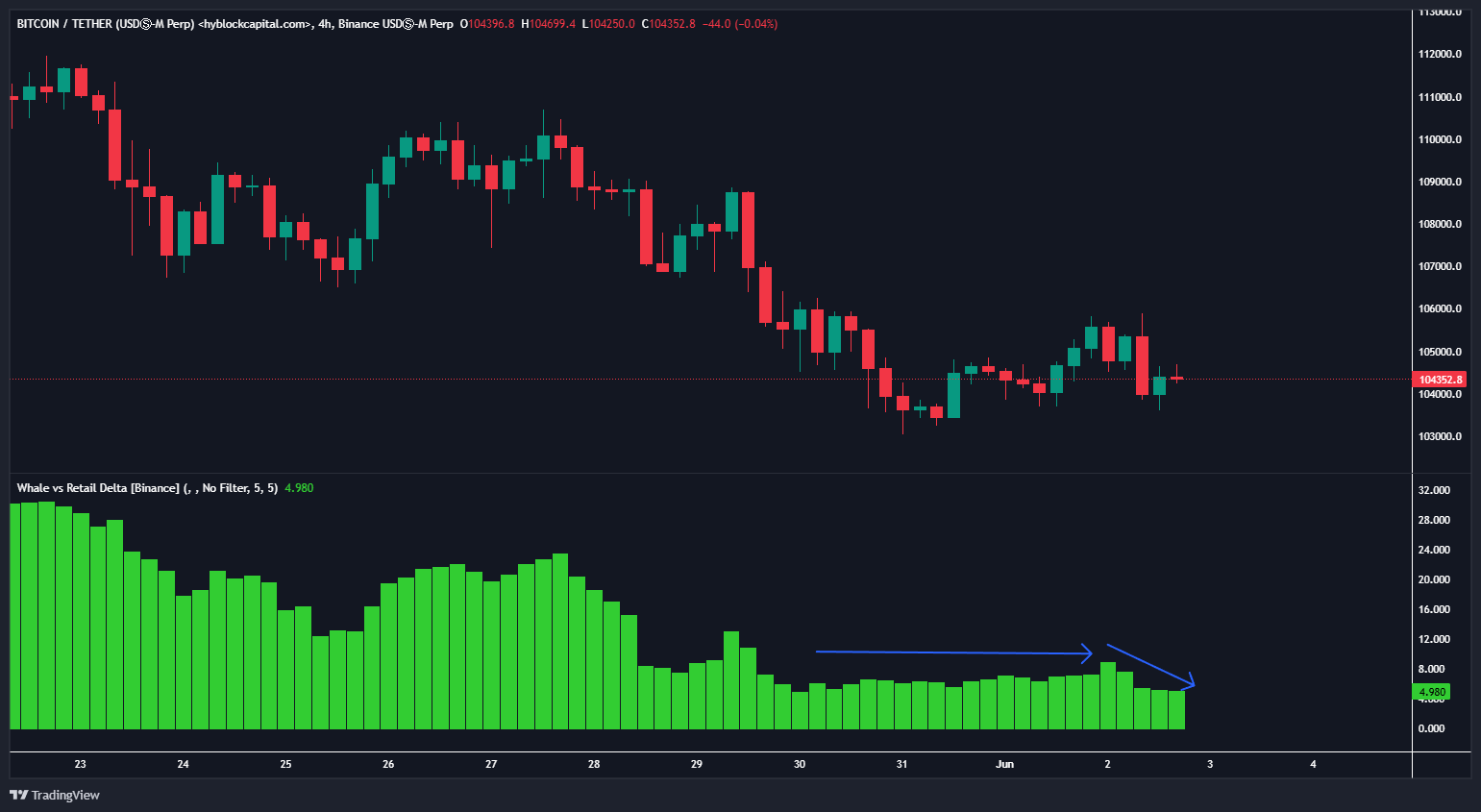

Adding a dash of intrigue, our prophet points to the whale versus retail delta indicator, that fabulous gauge comparing the ambitions of whales and wallet-wielding commoners. When whales—those mysterious deep-pocketed titans—boost their shorts, chaos may follow.

The downward trend in this indicator suggests whales are once more sharpening their short swords, readying to slay Bitcoin’s hopes—how charming.

“Not a great sign for Bitcoin. The Hyblock Capital whale versus retail delta was trending sideways to slightly higher, but is back to trending lower again. Translation: whales are once again increasing their BTC short exposure versus retail.”

As I pen this, Bitcoin lounges at the modest sum of $105,069, having lost a mere 1.2% in a day’s whims—truly a stable (or amusingly unstable) world we inhabit.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- How to watch the South Park Donald Trump PSA free online

2025-06-05 17:41