Bitcoin, in a dramatic reenactment of Icarus but with far less elegance, nosedived to a tragic low of $81,629 this past Saturday. Investors collectively wrung their hands—some metaphorically, some literally—as the broader crypto market saw its valuation shed 2.14%, leaving us all wondering if HODLing is still supposed to work or if we’ve simply been pranked by the gods of volatility.

Panic and Grapes of Wrath—Crypto Style 🍇

Crypto markets, always one Reddit thread away from pure chaos, have spiraled into turbulence yet again. The top-ten cryptocurrencies, each boasting a market cap bigger than most countries’ GDPs, now find themselves humbly sinking along with Bitcoin. Ethereum, that smug altcoin darling, lost a smug (and not-so-insignificant) 3.2%, while XRP, doing its best ripple imitation, slid 2.5% without so much as sending a postcard in apology.

BNB fell 2.5% in unison—as though choreographed—but Solana, aspiring to steal the show, flopped by a dramatic 3.6%. Dogecoin, however, sashayed onto the stage with a Shakespearean-level tragedy, losing a whopping 6%. And Bitcoin itself? Oh, a sneaky retreat to $81,629 before inching up to a completely thrilling $82,612. Truly riveting financial drama for those of us with patience thinner than Ethereum gas fees.

The market capitalization of Bitcoin has slimmed down to $1.63 trillion—a fitness plan none of us asked for—though $17.92 billion in global trading volume over the last day provides some consolation, assuming one finds solace in meaningless metrics. Week-over-week, Bitcoin’s decline against the U.S. dollar now sits at 2.3%, a number fondly referred to around crypto circles as “meh.”

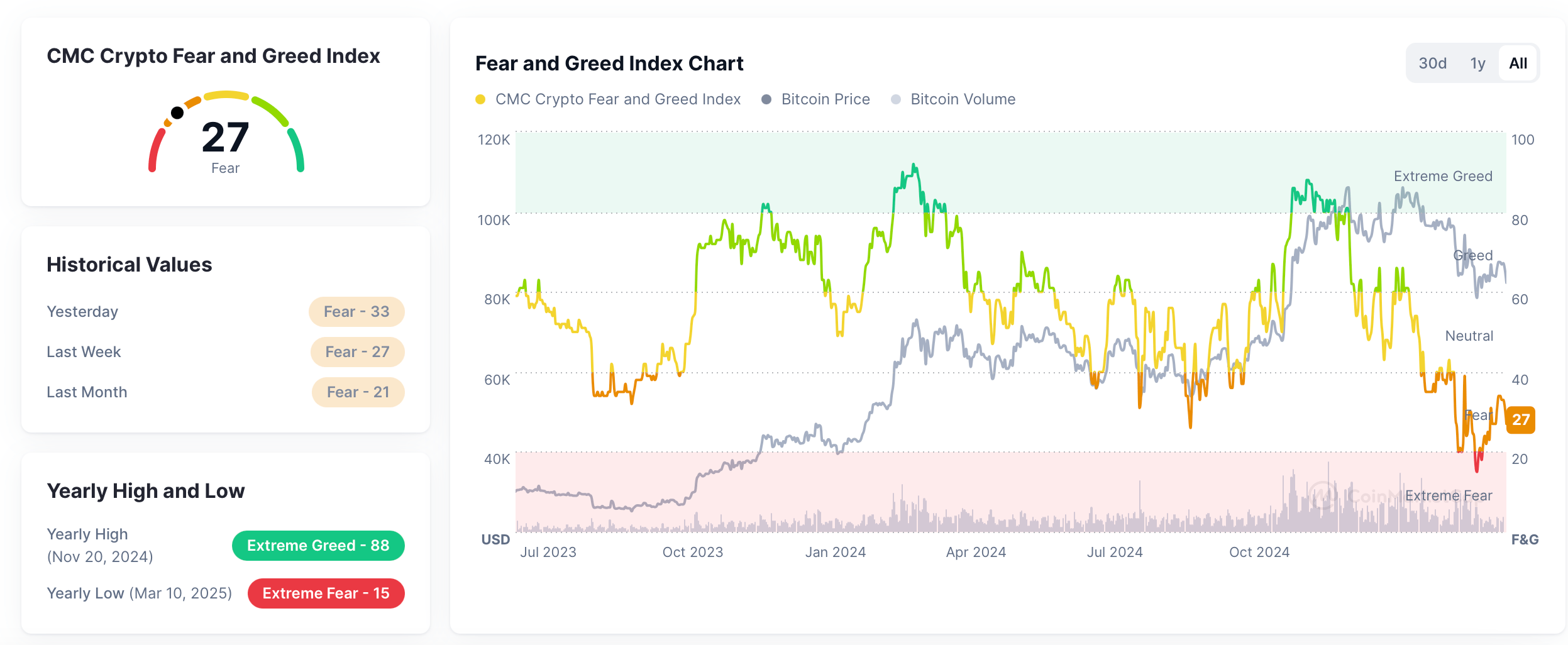

Speculators whisper that the $75,000–$70,000 range is where Bitcoin might test its self-control next, assuming market sentiment continues to wallow in existential crisis. The CFGI remains firmly parked in the “fear” category, and in the last 24 hours, $347.26 million worth of positions, dreams, and probably a few yachts were liquidated. Coinglass has identified 139,263 traders who learned the true meaning of “pain,” with $78.78 million wiped from bitcoin long positions alone. Ethereum, not one to be left out of the misery, saw $72.37 million in long contracts erased as well.

As for the broader sector? Let’s just say enthusiasm is quieter than a trading floor during Christmas. Crypto ETFs, particularly Bitcoin-focused ones, saw outflows this past Friday, abruptly ending what was apparently a wildly exciting streak of ten days of inflows. Ho ho ho, Merry Cryptmas, everybody. 🎄

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- MrBeast Becomes the Youngest Self-Made Billionaire in History

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- EA FC 25 LaLiga TOTS: Release Date LEAKED! + Predictions!

- ATHENA: Blood Twins Hero Tier List (May 2025)

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

2025-03-30 00:29