- Well, it seems a Bitcoin accumulation address decided to go shopping just when the market was in a bit of a pickle.

- The charts, those notoriously fickle creatures, are hinting at a jaunt into the $90,000 zone.

Bitcoin [BTC], bless its digital little heart, has managed to cling on to a price threshold as if it were a toddler gripping a teddy bear during a thunderstorm. This little feat suggests that a market rally could be just around the corner, sporting a top hat and a flourish, ready to entertain.

However, this past week saw our beloved crypto experience a slight hiccup—down 3.81%, now trading at $81,016. According to AMBCrypto, it seems the institutional types have been buying in droves, perhaps triggered by a fleeting sense of optimism, which may well launch an upward trajectory for our hero.

Will Bitcoin fancy an extra $13,000 for the road?

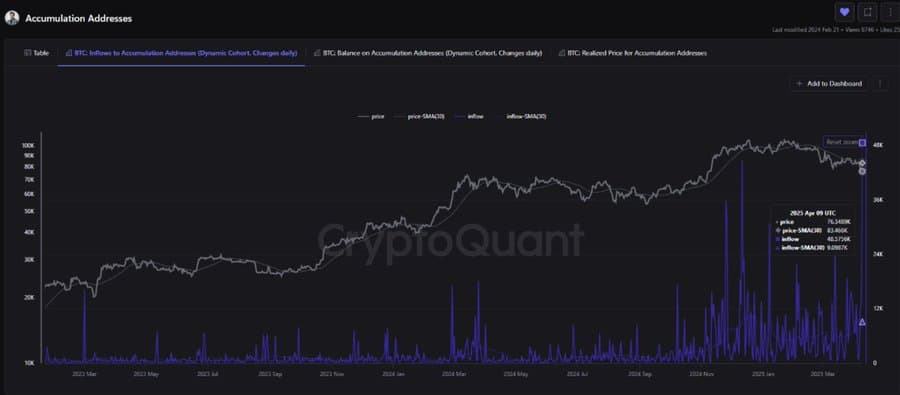

According to a particularly sensational report from CryptoQuant, a Bitcoin accumulation address, notorious for its strategic purchasing prowess, has recently pulled the trigger on its second-largest buying spree of the past three years. Sounds dramatic, doesn’t it?

After Bitcoin took a dip into the $76,000 realm, this curious address nabbed 48,575 BTC, approximately $3.6 billion worth! And guess what? It’s the largest single-day spectacle since that thrilling February 1st, 2022, adventure when 95,000 BTC strutted its stuff onto the scene—both times, folks, a dazzling $3.6 billion. What are the odds?

Now, a purchase of such grand proportions from a whale typically raises an eyebrow and whispers that a rally may be making its entrance. Who doesn’t like a little confidence boost, after all? More buying activity could very well be on the horizon, and who wouldn’t want a front-row seat?

Further analysis—because why stop at one?—shows that should a rally spring to life, Bitcoin might just roam freely till it hits that tantalizing $94,500 mark, where selling pressure could rain on its parade. If this rally comes to pass, BTC could treat itself to a $13,480 uplift. A proper jolly-good flourish, if you ask me.

Other markets are buzzing with excitement!

The institutional and derivative traders, bless their optimistic little souls, have been placing bets as if the stock market were a raucous casino, all in the hope of Bitcoin scaling up the heights. After all, who doesn’t enjoy a flutter?

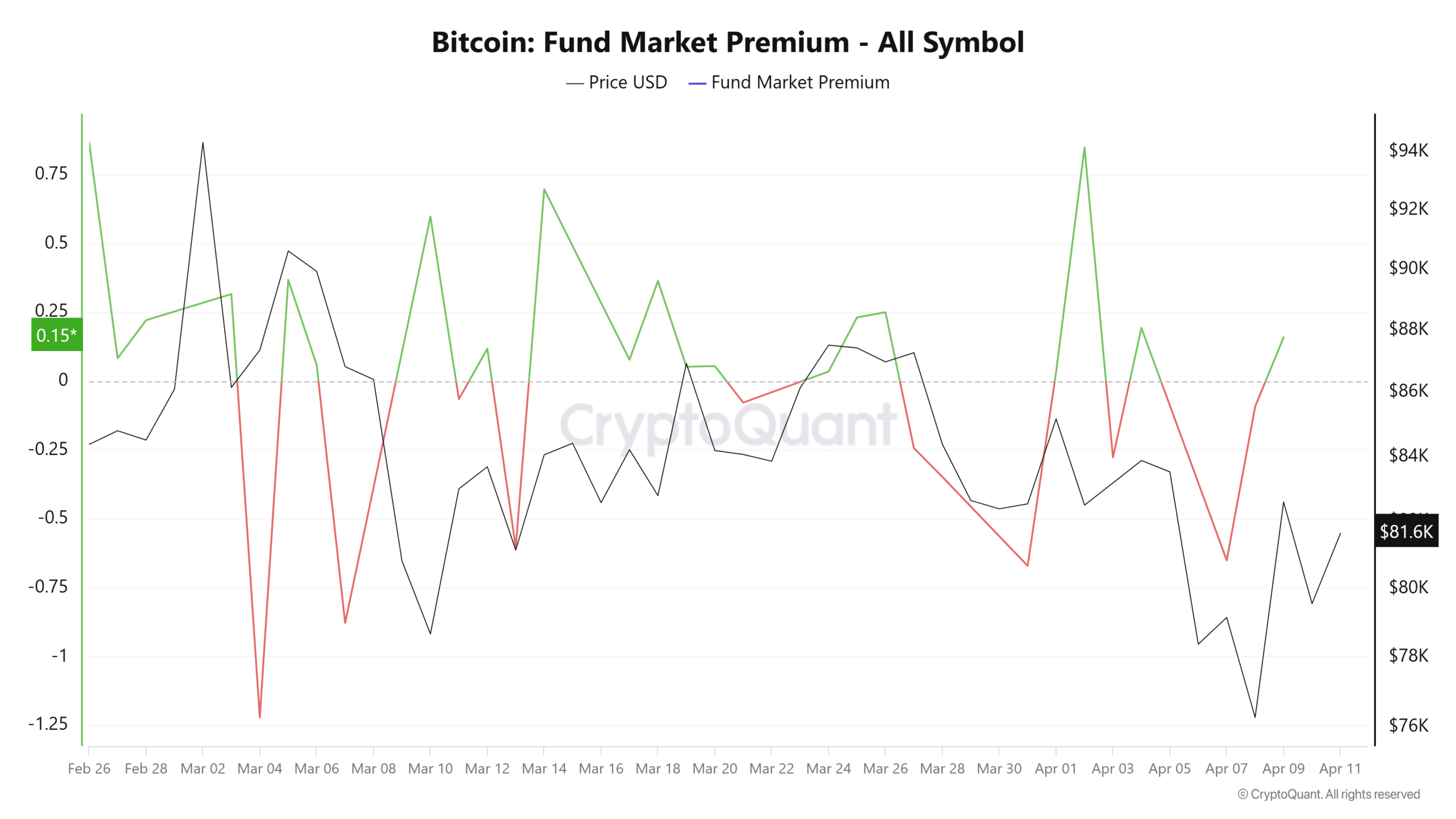

At this very moment, the fund market premium has been playing the role of the of cheerleader on the sidelines, waving its pom-poms of buying activity!

The institutional investor narrative, quite the mouthful, is gauged by the price difference between Bitcoin on institutional platforms and its retail cousins (think Binance). At present, this difference is as pleasant as a sunny day with a reading of 0.15, signaling a net buying spree. Huzzah!

Meanwhile, it seems the happiness of the derivatives market is a contagion, with buyers overtaking sellers over the last 24 hours. Yes, you heard right: after a day ruled by the sale-mongers, our buyers have returned, and the charts glimmer in glorious green, boasting a Taker Buy/Sell Ratio of 1.09. What a charming picture!

The miners have found their hats

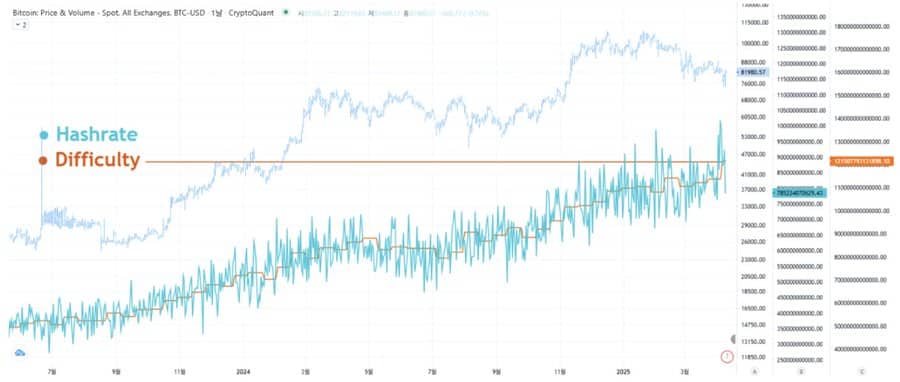

Despite Bitcoin having a bit of a tumble from its dizzying heights above $109,000, our plucky miners have maintained a steady growth in hashrate. Very commendable, I must say!

Hashrate, that lovely term, pertains to the total computing power miners use to process and secure every transaction on a proof-of-work blockchain. An increasing hashrate implies a greater security blanket for our digital darling, much to investors’ delight.

According to the insightful Mr. Ki Young Ju, Bitcoin’s hashrate could be the secret door to a spectacular rally leading to a market capitalization of $5 trillion—up from its current $1.6 trillion. Imagine that! A threefold bonanza, sending the asset soaring to a staggering $243,000 on the charts. Breathtaking, isn’t it?

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lottery apologizes after thousands mistakenly told they won millions

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-04-11 18:28