My dear reader, brace yourself, for today sees a staggering $14.21 billion in Bitcoin (BTC) and Ethereum (ETH) options on the brink of expiring. Quite the spectacle, wouldn’t you agree?

Market pundits are positively buzzing with anticipation, as this splendid event could very well dictate the short-term trajectory of our beloved cryptocurrencies through sheer contract volume and their rather impressive notional value.

$14.21 Billion Bitcoin and Ethereum Options: A Dashing Disarray

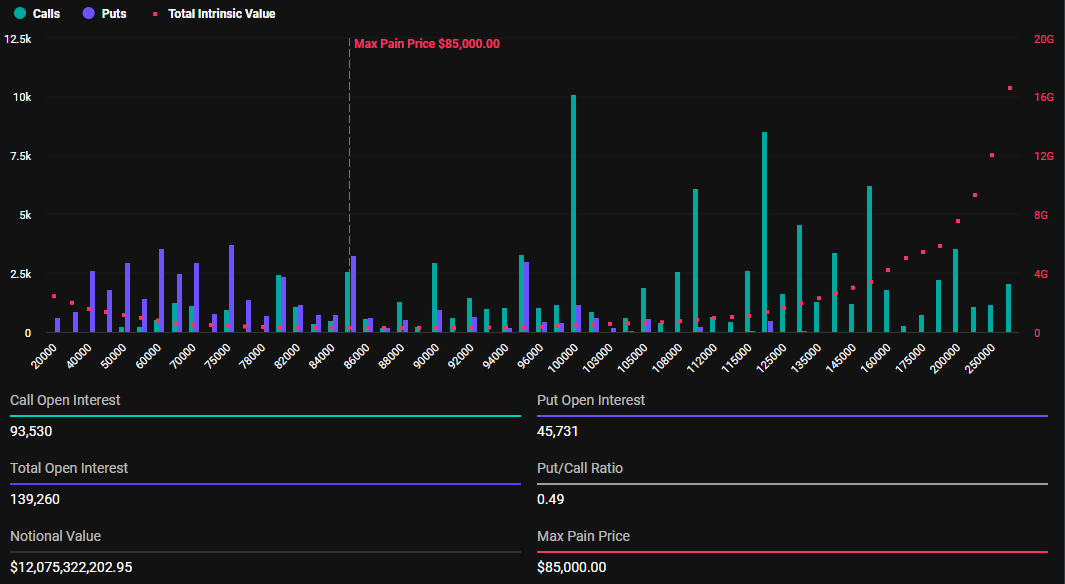

Today’s expiring BTC options flaunt a notional value of $12.075 billion, with a delightful assortment of 139,260 contracts. The put-to-call ratio sits at a rather cheery 0.49, implying that the optimists (those pesky buyers of options) are rather outnumbering the pessimists (sellers). Ah, the drama!

Ah, but do take note: the maximum pain point dances at $85,000. This is the threshold where our dear crypto holders shall experience the most delightful agony. Isn’t that just charming?

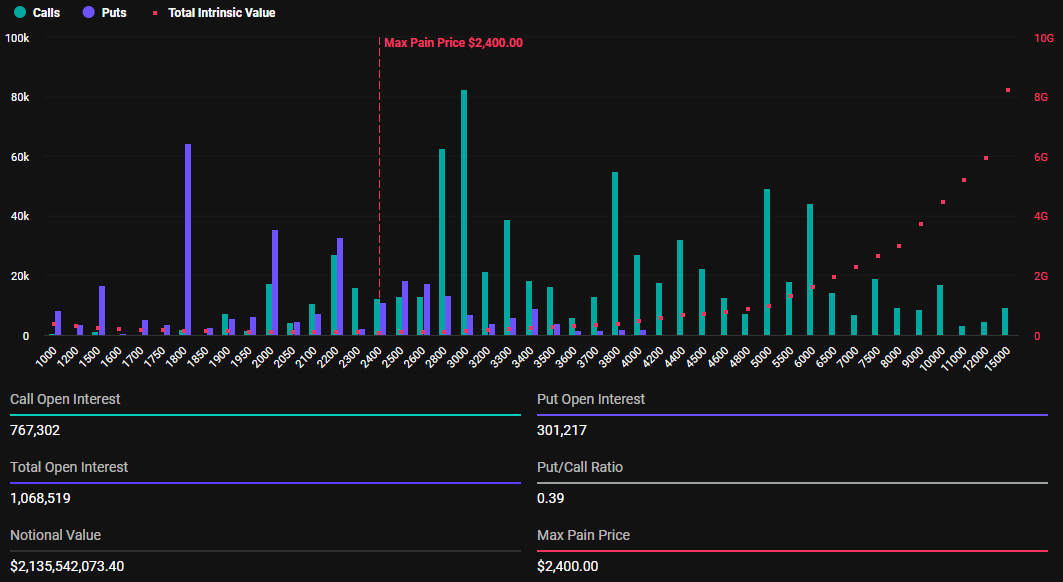

In addition to the Bitcoin hullabaloo, we have a staggering 1,068,519 Ethereum options contracts ready to take their final bows today, with a notional value of $2.135 billion, a put-to-call ratio of 0.39, and a maximum pain point of $2,400. Why, it’s enough to make one’s head spin!

The volume of today’s fascinating expiring options overshadowed last week’s dismal figures, with BeInCrypto’s reports revealing a mere 21,596 BTC and 133,447 ETH options expired last week. How quaint! Their notional values of $1.826 billion and $264.46 million are merely whispers compared to today’s crescendo.

This delightful change in momentum heralds the arrival of quarterly options expiry, gracing us on this last Friday of March. Deribit’s impeccable timing aligns with the venerable traditions of our financial forebears, ensuring traders have a reliably sprightly schedule.

In markets worldwide, expiration dates for options contracts are routinely set at the week’s end—Fridays, no less! A tradition worth upholding, as it standardizes the jolly old timing and smooths out settlement processes like a fine silk handkerchief.

Deribit, in their infinite wisdom, adopted this grand practice to help poor souls transitioning from the world of TradFi to the dazzling cryptocurrency arena, ensuring liquidity and market panache peak at a time when one might indulge in a cheeky cocktail.

“Tomorrow is not just any Friday; it promises to be one of the colossal expiries of the year! Over $14 billion in BTC and ETH options are set to expire at 08:00 UTC. What’s your prediction for Q1’s grand finale?” mused Deribit in a Thursday post. Ah, how delightful!

Implied Volatility: A Hair-Raising Prelude to Quarterly Madness

Indeed, this astronomical options expiry wraps up the first quarter (Q1) in a rather flamboyant fashion. Deribit’s analysts observe the implied volatility (IV) curves of BTC and ETH, revealing market expectations swirling like champagne bubbles.

Bitcoin’s curve, positively bursting with optimism, indicates a powerful bias towards higher prices (an upside skew), while Ethereum’s flatter curve suggests a less zealous directional bias, albeit still hinting at elevated volatility. Quite the raucous week ahead!

“Chart 1 – $BTC: Bitcoin is showcasing a remarkable upside skew, with calls priced far beyond their put counterparts. Chart 2 – $ETH: A flatter curve indeed, yet the volume remains commendably elevated! Both markets signal a promising anticipation of movement post-expiry,” noted the astute minds at Deribit.

It appears both Bitcoin and Ethereum markets are positively brimming with expectations for movement either into or after this thrilling expiry. On a side note, analysts at Greeks.live offer a rather grim view of Bitcoin’s future, some might say, rather depressingly cautious.

They forecast a potential retest of lower price levels of $84,000 to $85,000, which is simply picturesque for those fond of volatility, as Bitcoin hovers around $85,960 today. What a delightful chess game!

Ah, but fret not! Some traders note that Bitcoin is currently ensconced in a snug trading pattern, leading to limited volatility unless we see a dramatic breakout—a dashing sight to behold!

“Key resistance levels that are the talk of the town sit at $88,400 where significant selling was observed, while the potential support level at $77,000 has been dubbed the ‘definite bottom’ by some, how absolutely quaint,” the analysts opined with a flourish.

The good folks at Greeks.live have also noted that implied volatility is experiencing a rather delightful squeeze due to the quarterly ado, revealing tantalizing opportunities for traders with a nose for profit—or perhaps just flair for the dramatic!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- You Won’t Believe Denzel Washington Starred in a Forgotten ‘Die Hard’ Sequel

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

2025-03-28 09:51