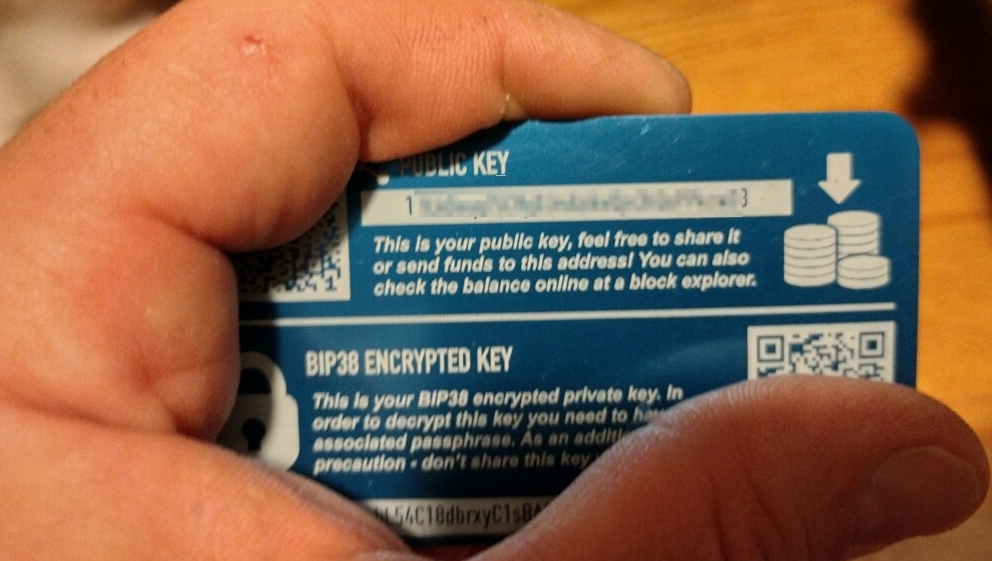

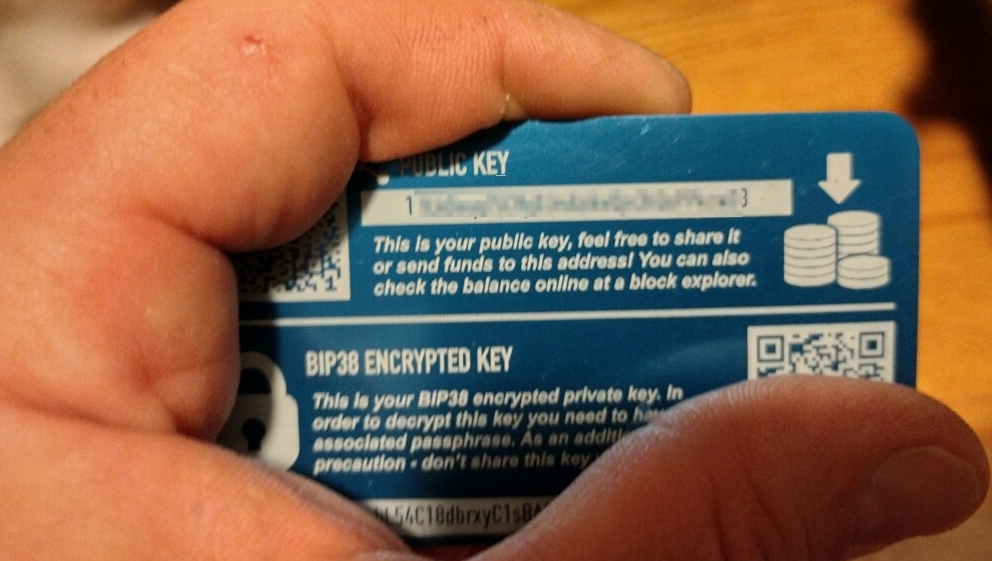

In June, a sailing companion (who happens to be an aerospace engineer) inquired if I could examine a relative’s “bitcoin.” He sent me a picture of a plastic bitcoin wallet, with the private key only partially visible. It appeared that the family friend had received this card as some kind of promotional item at a conference and had kept it tucked away ever since.

In this instance, I occasionally feel like an imposter, with self-doubt sitting on my shoulder, subtly affirming me. Despite having four years of experience in the business, followed by another two years experimenting in my personal account, I haven’t accumulated enough credibility in the crypto world to confidently exclaim, “Oh, wow! I recall these.” Admittedly, I’m new to this. To avoid overpromising, I made a clear disclaimer and swiftly moved on to another topic.

At my home, I delved into the picture with the focused resolve reminiscent of Quincy M.E., even though comparing my task to forensic examination might be a stretch since no suspicious activities were involved. How did these old wallets function? If the key is directly printed on the card, how can that ensure security? I was familiar with BIP39, but what exactly is BIP38?

Education took place subsequently. I later examined the Bitcoin blockchain and observed that precisely one bitcoin was transferred to this address approximately nine and a half years ago, when a single Bitcoin cost roughly $325. Since then, no further action has been recorded. Regarding the hidden BIP38 “private” key, it can only be decrypted with a specific passphrase. Oh dear, I wonder if the family friend remembered to save the passphrase for a decade, now potentially possessing a Post-it® note worth $100,000?

—

This week, we went to watch a performance with a new set of friends. I proposed covering the ticket costs using cryptocurrency. “Create a Phantom wallet, keep the seed phrase safe, and provide me with your Ethereum address. I can pay you in either ether or USDC, whichever you prefer.

I observed every single expression. Laughing, rolling my eyes, it’s hard to believe, let me think about this, why not, alright! I’m still expecting that Ethereum wallet information, but I have full faith this will materialize. Another “scheme,” after a decade.

In 2025, Bitcoin is widely recognized and easily accessible, making it a popular choice among digital assets for those considering investment. However, there are other options such as ETH (Ethereum) or USDC (USD Coin) that might be worth considering too.

ETH and USDC serve different purposes in the crypto market. ETH is a blockchain platform used to build decentralized applications (dApps), making it more than just a store of value like Bitcoin. USDC, on the other hand, is a stablecoin, meaning its value is tied to the U.S. dollar, providing price stability that some investors may find appealing.

While Bitcoin’s scarcity and growing demand are expected to drive its value up over time, diversifying your portfolio with assets like ETH or USDC can help mitigate risk and offer exposure to different sectors of the crypto market.

A significant number of people struggle to grasp Ethereum, smart contract platform blockchains, stablecoins, and the concept that they depend on various other blockchains, requiring payment of fees in ETH, SOL, or numerous other cryptocurrencies. For those who plan to allocate around 5% of their investment efforts and resources towards crypto (the “5%ers”), understanding these concepts may prove crucial for unlocking the next significant insight.

A more effective route to reach that destination is by allocating a few “learning funds” (different from “investment funds”) within the blockchain network and then maneuver them. I wish my friends would utilize their newly acquired USDC, deposit some into AAVE, transfer some to Solana, and make purchases on Uniswap.

In this research, an investor’s faith in a specific platform could be strengthened significantly. Alternatively, it may reinforce the belief that choosing successful investments is challenging, especially in a year projected for rapid expansion. Notably, XRP, XLM, and HBAR were found at the top of the 2024 rankings in the CoinDesk 20 Index, an outcome that was unlikely to be predicted. We anticipate that investors and financial advisors will opt for a diversified market return over the prospect of individual selection gains.

Individuals who owned the bitcoin stored in a plastic wallet did not seem to be drawn into active supporters of bitcoin, but interestingly enough, they made a wise decision by keeping their wallets and the necessary password in a drawer for a decade. Nowadays, I’m making every effort to encourage people to use a digital wallet and gain some blockchain knowledge. (However, if they choose not to, I can still provide theater tickets using traditional currency.)

As a seasoned crypto investor, I’d like to express my personal perspective on the current market trends. Please remember that these opinions don’t necessarily align with CoinDesk, Inc., its owners, or affiliates. In my view, the volatile nature of cryptocurrencies presents both challenges and opportunities for those willing to navigate this dynamic landscape.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-16 17:43