What to know:

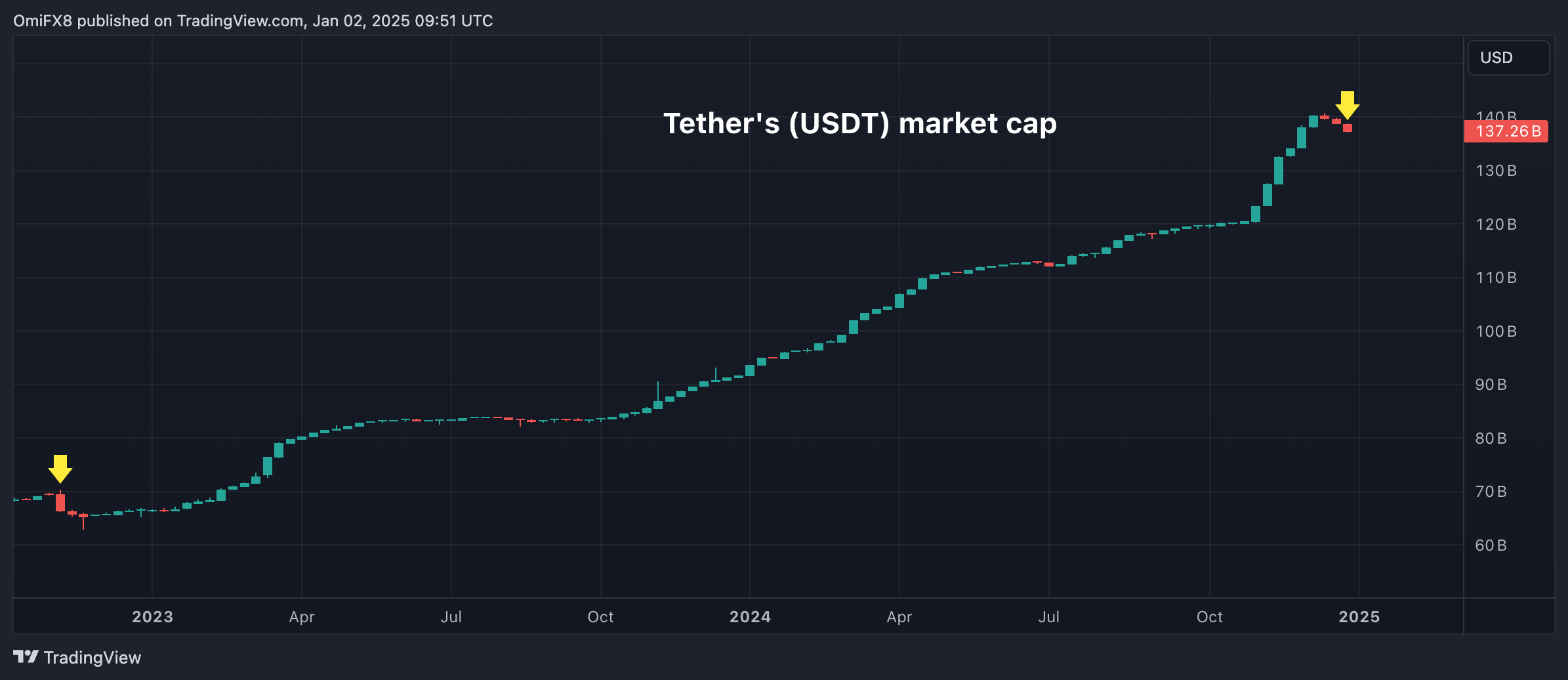

- The market cap of Tether’s USDT slid almost 1.1% this week.

- Several European exchanges and Coinbase have removed USDT on MiCA compliance concerns.

- The delisting has a limited impact on USDT’s dominance and the broader market.

As a seasoned crypto investor with a decade of experience navigating the volatile digital asset landscape, I’ve learned to stay calm amidst market turbulence and keep a keen eye on regulatory changes. The recent decline in Tether’s USDT market cap, though concerning, is not entirely surprising given the evolving MiCA regulations in Europe.

In my early days of investing, I remember the challenges posed by lack of regulatory clarity, which often led to uncertainty and instability. However, as we move forward, it seems that regulators are stepping up their game, albeit at a slower pace than the crypto market itself. The MiCA regulations, while complex, aim to protect investors and foster a secure environment for digital assets.

The delisting of USDT from several European exchanges due to these compliance concerns might seem alarming at first glance. However, upon closer examination, it becomes clear that the EU is not the largest player in the global crypto market. Most trading volume occurs in Asia and the United States, which suggests that this development may have a limited impact on USDT’s dominance.

That being said, I can’t help but chuckle at the thought of shorting the EU – a prospect as elusive as trying to catch a unicorn in the digital wild west of cryptocurrencies! But remember, the crypto market is like a rollercoaster ride – it goes up, it goes down, and sometimes it even takes unexpected loops. The key is to hold on tight, enjoy the ride, and always have a good sense of humor about it!

This week, the value of Tether’s USDT, a well-known stablecoin pegged to the U.S. dollar, has dropped significantly compared to the past two years. This sudden change has raised worries about potential market instability.

This week, USDT’s market capitalization experienced its steepest drop of over 1% since the FTX exchange crash in November 2022, falling to approximately $137.24 billion. The decline is according to data from TradingView and represents the most substantial decrease since the incident involving the FTX exchange. Earlier in mid-December, USDT reached a record high of $140.72 billion.

The fall is occurring because several crypto exchanges based in the European Union (EU) and Coinbase have chosen to stop supporting USDT, due to compliance concerns with the EU’s MiCA regulations which officially came into force on December 30th, despite stablecoin rules having been implemented six months prior.

The law mandates that entities offering or trading Asset-Referenced Tokens (ARTs) or Electronic Money Tokens (EMTs) within the union must possess a MiCA license. ARTs are cryptocurrencies designed to keep their value stable by linking to another asset such as gold, other crypto tokens, a mix of both, or even multiple official currencies. ERTs, on the other hand, refer to a single national currency, similar to USDT.

Traders located within the European Union can continue to keep their USDT in personal, non-custodial wallets, however, they are prohibited from trading this digital asset on centralized exchanges that comply with MiCA regulations.

USDT serves as an entry point into the world of digital currencies, being widely utilized by investors for funding direct cryptocurrency transactions and derivative trades. Consequently, its recent removals from certain platforms and decline in worth have ignited discussions on potential widespread downturns within the crypto market on various online platforms.

In a recent post on platform X, Karen Tang, who leads APAC partnerships at Orderly Network – a Web3 liquidity layer operating without restrictions – expressed that the worries might not be validated and any potential negative consequences would likely only affect the eurozone at most.

According to Tang’s statement, the restriction of access to @Tether_to in the EU due to MiCa regulation won’t undermine the dominance of USDT (Tether). This is because the majority of crypto trading volume takes place in Asia and the United States. He further added that this move will only slow down the EU’s digital asset innovation, which is already hindered by complex overregulation. If he could short the EU, he would do so.

According to crypto expert Bitblaze, it’s Asia that holds a significant portion of Tether’s trading volume, suggesting that potential delistings in Europe due to MiCA regulations may have less of an overall effect.

USDT, the biggest stablecoin, boasts a market capitalization of $138.5 billion and a daily trading volume of around $44 billion. Remarkably, approximately 80% of this trading activity happens in Asia. Consequently, the delisting from European exchanges is unlikely to cause significant disruption,” Bitblaze stated on X.

In an effort to maintain compliance with the MiCA regulations, Tether has decided to invest in firms such as StablR and Quantoz Payments.

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- What was the biggest anime of 2024? The popularity of some titles and lack of interest in others may surprise you

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- Deep Rock Galactic: The Synergy of Drillers and Scouts – Can They Cover Each Other’s Backs?

- Sonic 3 Just Did An Extremely Rare Thing At The Box Office

- Final Fantasy 1: The MP Mystery Unraveled – Spell Slots Explained

- Influencer dies from cardiac arrest while getting tattoo on hospital operating table

- Smite’s New Gods: Balancing Act or Just a Rush Job?

- Twitch CEO explains why they sometimes get bans wrong

2025-01-02 13:44