🚨💸 “Tariff Tumult: Bitcoin‘s $84K Tightrope” 🤹♂️💥

As the world teeters on the precipice of President Donald Trump’s “Liberation Day” tariffs, bitcoin stands resolute, its price a tantalizing $84,609 – a veritable tightrope walk between the chasm of bearish despair and the mountaintop of bullish jubilation 🌆. Market capitalization, that grand symphony conductor, orchestrates a whopping $1.67 trillion, while 24-hour trading volume thunders along at $19.84 billion, with intraday price swings performing a dizzying dance between $81,188 and $85,438 🕺.

Bitcoin: A Tale of Two Sentiments

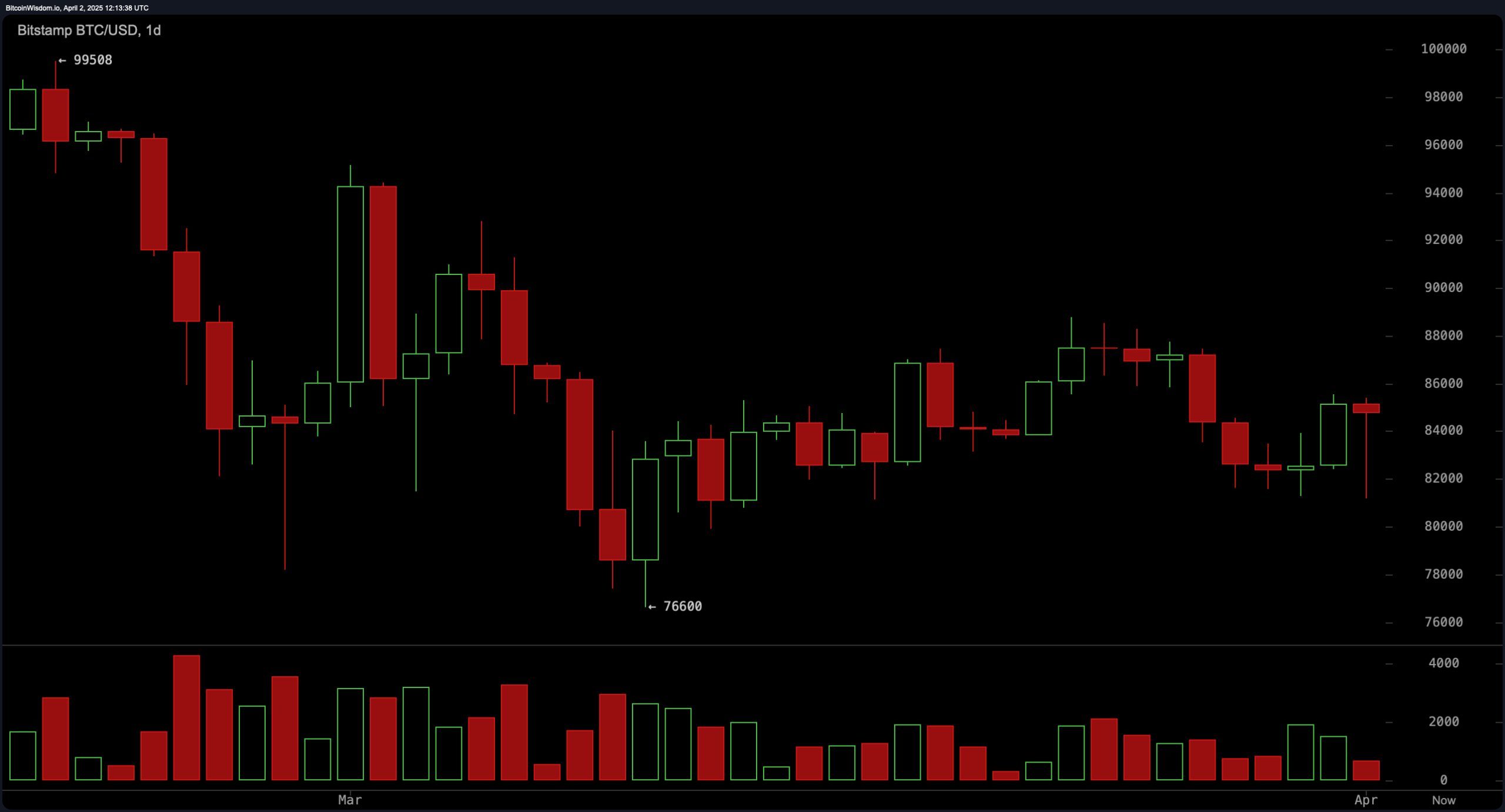

Behold! The daily chart, a canvas of indecision, where bitcoin meanders within a vast consolidation band, leaving traders in a state of befuddlement 🤔. The $76,600 to $99,500 range, a veritable Rubicon, separates the bulls from the bears, with support clinging tenaciously to the $80,000 mark and resistance rebuffing advances near $95,000. And yet, despite this sideways waltz and a slight decline in volume, the bias whispers sweet nothings of neutrality, with a hint of bullish coquetry 😉. A potential entry zone beckons, like a siren’s song, around $80,000–$82,000, especially if those tantalizing bullish reversal patterns materialize, while short-term profits might be plucked, like ripe fruit, at $88,000–$90,000 🍉.

Now, dear reader, let us descend into the 4-hour chart, a realm of mild bearishness, where bitcoin’s precipitous decline to $81,188 was swiftly followed by a resilient bounce, trading between $84,500 and $85,000 – a veritable game of market ping-pong 🏓. The structure, a lower high and lower low pattern, whispers bearish sweet nothings, yet recent price stabilization hints at possible upside, like a playful sprite 🧚♀️. A breakout above $85,500, particularly if buttressed by strong volume, could herald a reversal, but beware, dear trader, for wicks and false breakouts near $85,000 may signal market hesitation and liquidity traps – a siren’s warning 🚨.

And, finally, we find ourselves in the hourly timeframe, a realm of textbook liquidity sweeps, where a sharp drop was followed by a gradual recovery – a typical pattern used to shake out the leveraged and the timid 🙅♂️. Volume spikes during the decline and a slower recovery ascent imply a stop-hunt event, while the current formation of higher lows suggests a nascent bullish trend, like the first tender shoots of spring 🌱. Scalp-long opportunities may be viable on a successful retest of the $84,000 support, with targets near $86,000–$86,500, though divergences in the relative strength index (RSI) or volume could indicate weakening momentum, a faint whisper of caution 🗣️.

Oscillator readings, those fickle messengers, offer a mixed bag, like a jester’s wild card 🤡. The relative strength index, stochastic, commodity channel index, average directional index, and awesome oscillator all hover around mid-range thresholds, a neutrality that’s almost… well, boring 😴. Notably, momentum flashes a sell signal at −1,550, while the moving average convergence divergence (MACD) reflects a buy signal at −896, reinforcing the market’s indecision and potential for a breakout in either direction – a thrilling game of market chicken 🐓.

The broader moving average picture, a somber landscape, skews bearish, like a Russian winter ❄️. Both exponential moving averages and simple moving averages, across 20-day to 200-day intervals, predominantly suggest a sell bias, with only the exponential moving average (10), at $84,443, whispering sweet nothings of a buy. This alignment signals that while short-term momentum may support minor rallies, the longer-term outlook still faces resistance from prevailing bearish trends, a constant, nagging doubt 🤔.

Bull Verdict: A Glass Half Full 🥂

If bitcoin continues to defy gravity above the $84,000 level, with increasing volume and a successful breach of the $85,500 resistance, a short-term rally toward $88,000–$90,000 is plausible, like a sunrise over the horizon 🌅. The minor uptrend visible on the hourly chart and a buy signal from the moving average convergence divergence (MACD) add weight to the bullish case, a hopeful heart beating in the darkness ❤️.

Bear Verdict: A Glass Half Empty ☹️

Should bitcoin falter, slipping below the $81,188 support level, downside pressure could accelerate, like a runaway stagecoach 🐴. The predominance of sell signals across both exponential moving averages and simple moving averages, along with a bearish momentum reading, points to a fragile market structure, a house of cards in the wind 💨. A break below key support may trigger a deeper correction toward the $80,000 demand zone, or even test the $76,600 lower boundary, a bleak, barren landscape 🌀.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Lottery apologizes after thousands mistakenly told they won millions

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Umamusume: Pretty Derby Support Card Tier List [Release]

- J.K. Rowling isn’t as involved in the Harry Potter series from HBO Max as fans might have expected. The author has clarified what she is doing

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-04-02 16:01