- SUI, a mere fledgling in the vast aviary of crypto, has somehow amassed a stablecoin supply that, like a plump dowager’s jewels, exceeds $1 billion. One almost suspects sleight of hand.

- Is this period of…shall we say, ‘restraint,’ merely the overture to a grand, explosive aria? A pregnant pause before the diva shatters glass?🤔

Sui’s [SUI], a name that hints at both Swiss neutrality and a certain je ne sais quoi, has seen its stablecoin supply balloon past the $1 billion mark. A gaudy display, one might say. It suggests, with a vulgar lack of subtlety, that hordes of capital are lurking in the shadows, ready to pounce with the grace of a caffeinated grasshopper.

According to AMBCrypto, a source of such unimpeachable accuracy that one almost suspects it of being human, this “dry powder,” as they so poetically term it, doesn’t materialize ex nihilo. No, dear reader, such a swelling of stablecoins supposedly heralds a bacchanal of DeFi activity, liquidity provision, and the deployment of leverage. One shudders at the thought.

With momentum building like a poorly constructed house of cards, the conditions appear, dare I say, ripe for SUI to outpace the broader market’s inevitable and utterly predictable repricing. The suspense is almost unbearable!

Should this “capital rotation” intensify, like a particularly virulent strain of influenza, and on-chain velocity reach breakneck speeds, then a shot at a new all-time high might not be, as they say, “too far off.” One can only hope it doesn’t involve too much glitter.

SUI’s Growing…Edge? In the Cutthroat World of L1 Market Contention

Time and again, AMBCrypto, that oracle of the crypto realm, has deigned to spotlight SUI’s “rising dominance” in the L1 space. A dominance so subtle, so nuanced, that one almost misses it. Nevertheless, it continues to “post impressive numbers” across various “critical on-chain metrics.”

From the depths of liquidity to the frothy heights of user participation and the murky depths of DEX volumes, SUI is giving “serious competition” to those dreary, old-fashioned blockchains that once held a “near-monopolistic control” over network fundamentals. The audacity!

Now, armed with over a billion dollars in stablecoins – a sum that would make Croesus blush – SUI is “loading up even more dry powder.” The metaphor is becoming tiresome, but the implications are clear: a “heated showdown” in the L1 space is nigh. Get your popcorn ready.🍿

As the chart above so helpfully illustrates, USDC, that paragon of stability (allegedly), dominates the stablecoin landscape on SUI with a staggering 70.55% share. These stablecoins aren’t merely “inert reserves,” mind you. Oh no. They are, rather, “capital in waiting.” Like debutantes at a ball, poised to waltz into the arms of the highest bidder.

The 13.54% weekly “jump” in SUI’s stablecoin market supposedly signals a “risk-off pivot.” But fear not! When the market inevitably shifts back to a “risk-on” environment, that “sidelined liquidity” could spring to life. Like a sleeper agent activated by a coded message.

Thus, “igniting” swaps, LP inflows, and leveraged positioning. With such liquidity “primed for activation,” SUI looks poised to “challenge the $4 resistance.” A challenge so daring, so audacious, that one can scarcely believe it.

Consequently, “opening the floodgates” to price discovery and placing a “fresh all-time high” firmly within striking distance. One hopes they have a good aim.🎯

Gaining Ground on…Real-World Utility? And Investor ROI? 🤔

Two “core pillars” underpin any investment of conviction: “Utility-driven fundamentals” and “asymmetric upside potential.” Jargon, pure jargon! But SUI, we are told, is “firing on both fronts.” A feat of pyrotechnics, no doubt.

Ecosystem developers are “actively scaling real-world applications,” while capital allocators are “taking notice — and profits.” One can only imagine the scenes of jubilation and champagne-soaked revelry.🥂

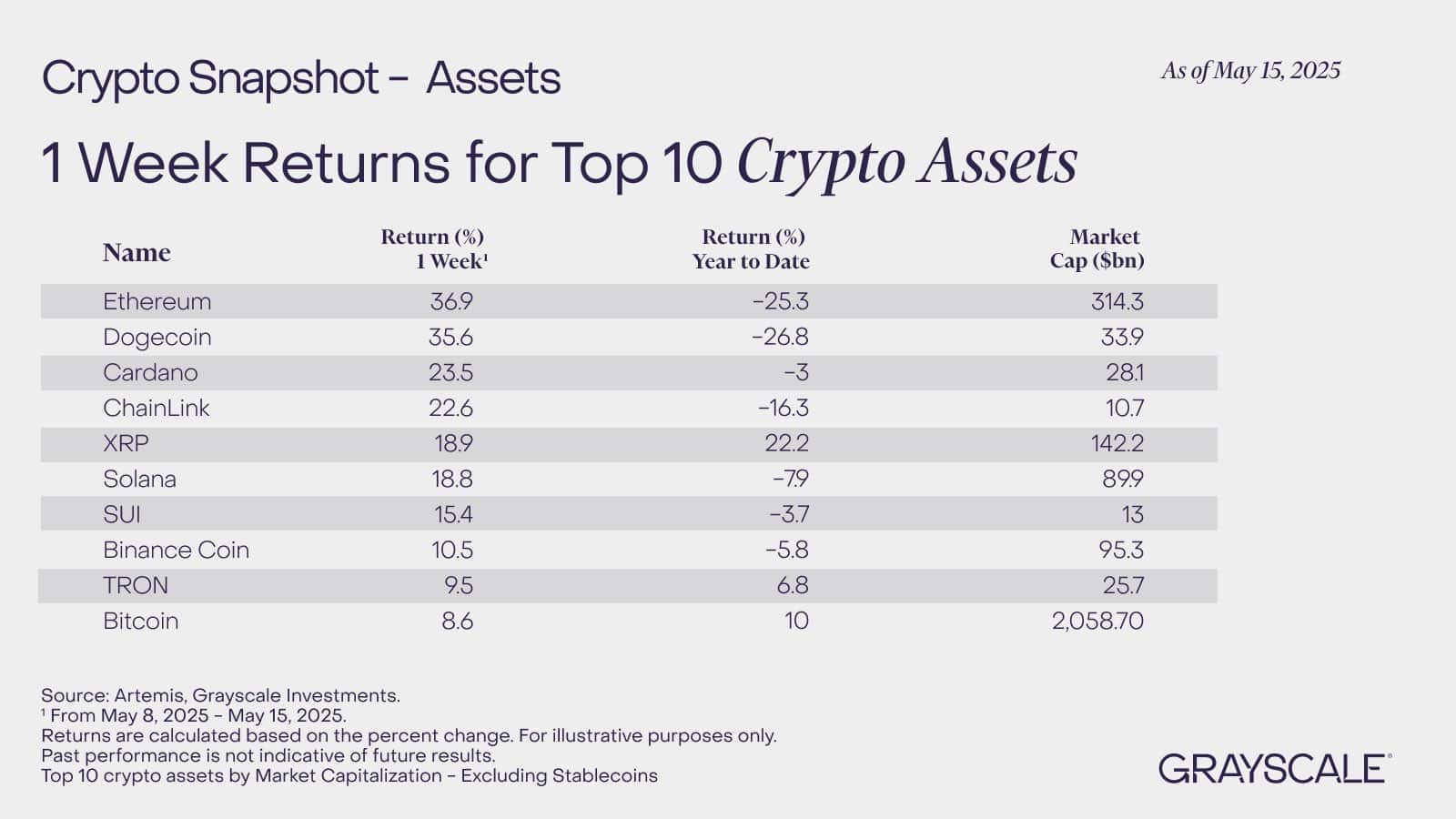

According to Grayscale’s latest “snapshot,” SUI ranked in the top 10 crypto assets by weekly returns, notching an “impressive” 15.4% gain between the 8th and 15th of May. A truly staggering achievement, akin to winning a particularly gaudy lottery.

That “return profile” outpaced such stalwarts as TRX, BNB, and even BTC. While “narrowing the gap” with Solana [SOL] – a “notable feat” in a landscape so saturated it’s practically drowning. One can almost hear the faint cries for help.

What’s more, this wasn’t some random stroke of luck. Oh no. The performance coincided with Bitcoin [BTC] reaching a “local high” at $105,755, triggering a “wave of rotational capital” into the murky depths of “high-beta alt L1s.” A veritable feeding frenzy!

Coupled with “strong sidelined liquidity,” “tactical capital rotation,” “solid on-chain utility,” and “bullish ROI signals,” SUI’s recent pullback looks more like a “healthy consolidation” than a “breakdown.” Unless, of course, it isn’t.

Long story short: This “dip” feels more like a quick breather than a catastrophic collapse. Keep your eyes on SUI – that $5 all-time high might be closer than you think. Though, personally, I wouldn’t bet the family jewels on it. 😉

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- KPop Demon Hunters: Real Ages Revealed?!

2025-05-17 13:18